| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

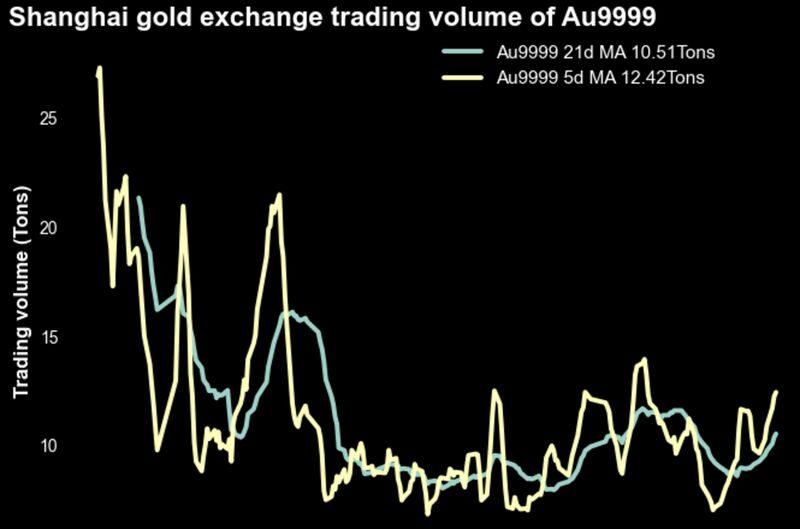

Hugo Pascal, Chief Investment Officer at InProved, recently highlighted the growing popularity of the gold physical proxy contract AU9999 on the Shanghai Gold Exchange (SGE). In a LinkedIn post, Hugo noted that the trailing 5-day volume for AU9999 has reached a 10-week high of 12.42 tons. This surge in activity reflects increasing interest in physical gold trading and underscores the contract’s significance in the global gold market.

Let’s dive into what the AU9999 contract is, why it matters, and what the recent volume trends tell us about the state of the gold market.

AU9999 is a physical gold trading contract on the Shanghai Gold Exchange, China’s premier marketplace for gold and other precious metals. This contract represents 99.99% pure gold and is one of the most liquid and widely traded instruments on the exchange.

Unlike futures contracts, AU9999 is a physical proxy, meaning it reflects the spot price of gold and is directly linked to physical delivery. This makes it an appealing choice for investors looking to trade gold with minimal speculative risk and a direct tie to the metal itself.

The Shanghai Gold Exchange (SGE) is one of the largest and most influential gold trading platforms in the world. As China is both the largest consumer and producer of gold globally, the SGE serves as a key benchmark for physical gold pricing and trading activity.

The exchange’s structure, which emphasizes physical delivery and transparent pricing, sets it apart from Western gold markets like COMEX. By focusing on physical contracts like AU9999, the SGE reflects real demand and supply dynamics, making it an important barometer for the global gold market.

The trailing 5-day volume of AU9999 hitting 12.42 tons—a 10-week high—indicates growing activity in the physical gold market. Several factors could be driving this surge:

1. Increased Domestic Demand in China

China’s demand for physical gold is rising, driven by its status as a traditional store of value and a hedge against economic uncertainty. This is particularly relevant given China’s recent economic recovery efforts and the yuan’s fluctuating value, which may have spurred increased buying.

2. Global Economic Uncertainty

Rising inflation, geopolitical risks, and concerns about the global economy continue to push investors toward gold as a safe-haven asset. The AU9999 contract, with its direct link to physical gold, is a preferred vehicle for those looking to hedge against such uncertainties.

3. Seasonal Trends

Gold demand often increases in China ahead of significant festivals and events, such as the Lunar New Year. This seasonal boost may contribute to the heightened trading volumes seen in AU9999.

4. Competitive Advantage of Physical Contracts

Compared to paper-based gold trading, AU9999 offers a direct tie to physical gold, making it attractive to investors prioritizing asset-backed security. The surge in volume highlights growing confidence in the physical gold market’s transparency and stability.

The increase in AU9999 trading activity on the SGE has broader implications:

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

For investors, the growing momentum of contracts like AU9999 offers a valuable perspective on the dynamics of the gold market. As geopolitical uncertainties and economic challenges persist, the demand for physical gold remains a critical indicator of market sentiment.

Stay updated on the latest developments in gold and precious metals by following Hugo Pascal on LinkedIn and exploring expert insights on InProved’s article section.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions