| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

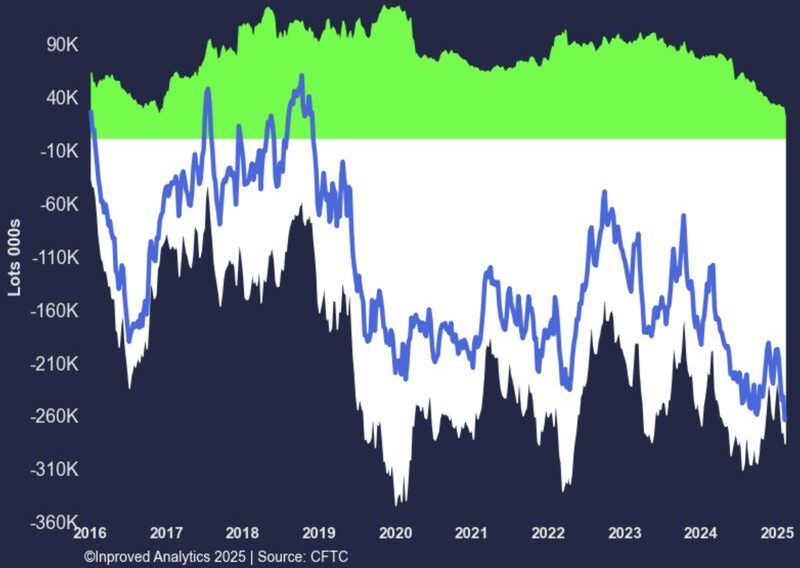

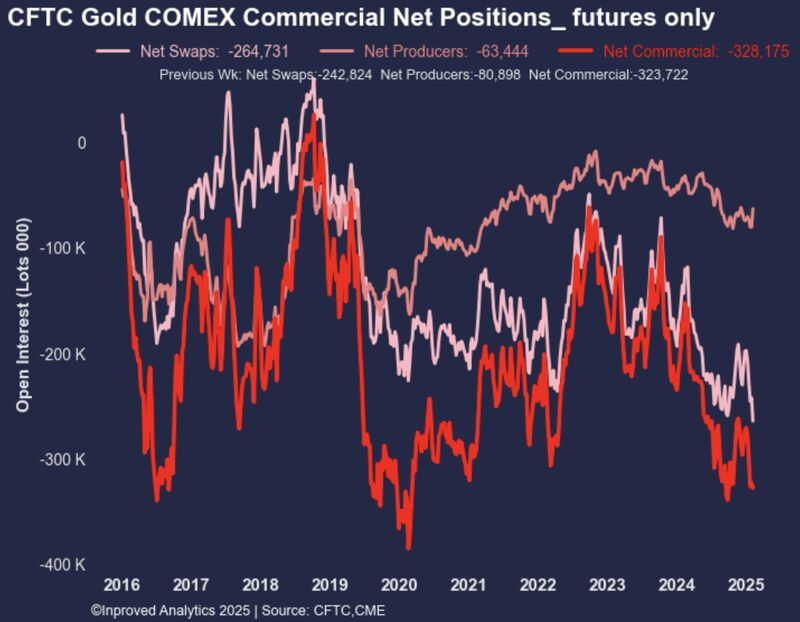

In the world of gold trading, few moments stand out as historic. Yet, this week, the market witnessed one. Swap dealers in gold have reached an unprecedented level of short positioning, holding a net of -264,731 contracts—equivalent to a staggering -26.5 million ounces or 823.5 tons. As Hugo Pascal, Chief Investment Officer at InProved, pointed out in his latest analysis, this massive buildup of short positions is not just a statistical anomaly; it is a signal that something significant is unfolding in the gold market.

This past week alone, swap dealers added another 21,900 contracts to their short positions, increasing their exposure by an additional 2.2 million ounces. Meanwhile, managed money—largely hedge funds and institutional traders—trimmed their long positions by 1,000 contracts, a relatively modest move in comparison. The most striking shift, however, came from gold producers. In the largest reduction of short positions in five years, producers cut 17,500 contracts, indicating that those closest to the supply side of the market may be anticipating a shift in price dynamics.

To understand the magnitude of these moves, it’s important to grasp the role of swap dealers. These market participants, often large financial institutions, act as intermediaries in the gold futures market, facilitating trades for hedge funds, miners, and other market players. Typically, swap dealers maintain a balance between long and short positions to hedge risk. However, when their net short position balloons to this extent, it signals aggressive positioning—whether as a hedge against rising volatility or as a sign that they are bracing for a potential correction in gold prices.

The timing of this buildup is telling. Gold has been trading near multi-month highs, with strong safe-haven demand driven by geopolitical uncertainty, inflation concerns, and shifting central bank policies. In recent weeks, gold prices have pushed toward key resistance levels, and it appears swap dealers are betting that the rally has reached its limits. This surge in short positioning suggests an expectation of downward pressure on gold, possibly triggered by profit-taking from long positions or a stronger dollar that could dampen demand for the metal.

Yet, while swap dealers are going aggressively short, gold producers are doing the opposite. The significant reduction in producer short positions—the largest in five years—suggests that mining companies, which typically hedge their future production to lock in prices, are now comfortable reducing their hedges. This could be interpreted as a signal that producers believe gold prices have more room to run or, at the very least, are unlikely to drop significantly in the near term. If producers expected a major price correction, they would be increasing their hedges, not unwinding them.

The divergence between swap dealers and producers creates a fascinating standoff in the gold market. One side is positioning for a downturn, while the other is easing back on protective measures, potentially anticipating higher prices. Add to this the fact that managed money only marginally cut their long exposure, and the picture becomes even more complex. Hedge funds, typically quick to react to market shifts, are not aggressively exiting their positions, which suggests they may not share the same bearish outlook as the swap dealers.

Looking ahead, the consequences of this historic short positioning could be profound. If gold prices hold firm despite the wave of short contracts, a short squeeze could emerge, forcing swap dealers to buy back positions at higher prices and fueling another leg up in the gold rally. Conversely, if their bet proves correct and gold faces selling pressure, we could see a sharp pullback before the market stabilizes.

Hugo Pascal’s analysis highlights a moment in gold’s trading history that could define market movements in the weeks ahead. With swap dealers at their most short on record, producers making their largest hedge cut in years, and hedge funds only slightly reducing their bullish exposure, the market is setting up for a decisive move. Whether gold’s rally continues or meets resistance, one thing is certain: the coming weeks will be anything but quiet in the gold market.

About Us

Information

Individual Solutions

Commercial Solutions