| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

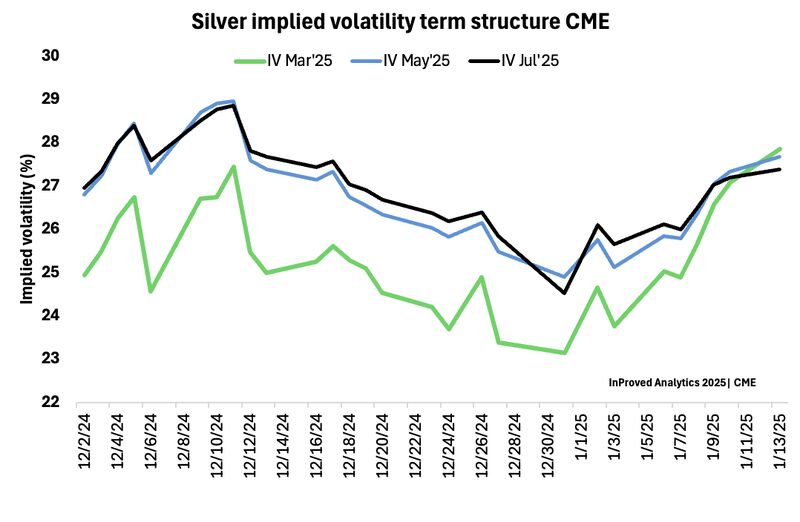

Hugo Pascal, Chief Investment Officer at InProved, recently highlighted mounting short-term stress in the silver market. His LinkedIn post noted that the volatility term structure has flipped into backwardation, and the Exchange for Physical (EFP) spread stands at $0.97/oz. These developments reflect heightened tensions in the silver market and offer insights into trader sentiment and market dynamics.

In this article, we’ll explore why short-term stress persists in the silver market, what backwardation in the volatility term structure means, and the significance of the EFP spread.

The silver market is experiencing short-term stress due to several overlapping factors, including:

1. Tight Physical Supply:

Supply constraints, whether from lower mining output or logistical challenges, are a recurring issue in the silver market. Tight supply can create pressure, especially when combined with sustained industrial demand for silver in applications like electronics and solar energy.

2. Speculative Activity:

Short-term traders speculating on silver price movements can amplify market volatility. Increased trading volumes in futures and options markets often lead to larger price swings.

3. Geopolitical and Economic Uncertainty:

Broader macroeconomic instability, such as inflation concerns or currency fluctuations, adds to the stress, as silver is both an industrial metal and a safe-haven asset. These dual roles make it highly sensitive to external factors.

4. Imbalanced Demand:

Rising industrial demand for silver coincides with short-term investor repositioning, creating temporary mismatches in supply and demand dynamics.

Volatility Term Structure

The volatility term structure measures implied volatility in options contracts over different time horizons. Under normal market conditions, the term structure is in contango, meaning longer-dated options have higher implied volatility than short-term options. This reflects uncertainty about the distant future.

Backwardation in Volatility

When the term structure flips into backwardation, short-term implied volatility exceeds long-term implied volatility. This phenomenon often signals heightened market stress or expectations of near-term price disruptions.

Exchange for Physical (EFP)

The EFP is a mechanism that allows traders to exchange futures contracts for physical metal. The EFP spread reflects the cost difference between a silver futures contract and the spot price of physical silver.

EFP Spread at $0.97/oz

An elevated EFP spread, like the current $0.97/oz, indicates increased costs or difficulty in converting futures positions into physical silver. This may signal:

1. Physical Supply Constraints: A higher spread suggests tightness in the physical silver market, as traders face challenges sourcing the metal to fulfill contracts.

2. Strong Demand for Physical Silver: Industrial or investor-driven demand for physical silver can widen the EFP spread, reflecting competition for limited supply.

3. Market Stress Indicator: A large EFP spread often coincides with broader market stress, as it points to inefficiencies or mismatches between paper and physical markets.

The combination of backwardation in the volatility term structure and a high EFP spread paints a picture of a market under strain. Here’s what this could mean for silver prices:

1. Short-Term Volatility: The backwardation in implied volatility suggests traders expect significant price fluctuations in the near term, driven by tight supply or speculative activity.

2. Potential Price Support: A high EFP spread indicates physical silver demand is outpacing supply, which could support higher prices if this trend persists.

3. Opportunities for Traders: For speculative traders, heightened volatility presents opportunities for short-term gains. However, it also increases risks, requiring careful risk management.

Hugo Pascal’s analysis highlights critical stress signals in the silver market, including backwardation in the volatility term structure and an elevated EFP spread. These indicators reflect a market grappling with short-term uncertainty, driven by tight supply, speculative activity, and rising demand for physical silver.

For investors and traders, understanding these dynamics is essential. Whether navigating short-term volatility or positioning for long-term trends, keeping a close eye on market stress signals like backwardation and EFP spreads can provide valuable insights.

To stay informed about the latest developments in the silver market and beyond, follow Hugo Pascal on LinkedIn and explore InProved’s expert analysis for actionable perspectives.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions