| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

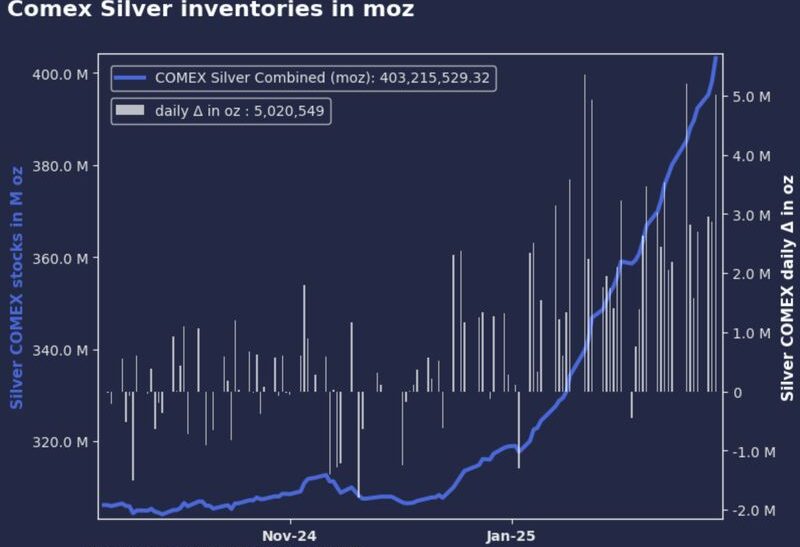

Silver is making headlines again, but this time it’s not just about price movements—it’s about where the metal is going. Hugo Pascal, Chief Investment Officer at InProved, has been tracking a significant development: silver continues to flow into COMEX vaults at a rapid pace ahead of the March delivery contract.

In just two days, COMEX inventories surged by over 10 million ounces. On Wednesday, an inflow of 5 million ounces (156 tons) brought total stockpiles to 403.2 million ounces, followed by another 5.4 million ounces (168 tons) on Thursday, pushing total holdings to 408.6 million ounces. For the month-to-date (MTD), inflows have now reached an astonishing 1,541 tons—one of the most significant buildups in recent months.

These inflows come at a crucial moment for the silver market. The London Bullion Market Association (LBMA) vault data is set to be released soon, and with COMEX silver inventories swelling, the data could reveal key shifts in global silver distribution.

At the same time, silver’s technical positioning on the COMEX May 2025 contract is reaching a critical juncture. The 68.2% retracement zone, sitting between $31.72 and $32.82, suggests that silver is at a major support level. If it holds, the market could be setting up for a move higher. However, all eyes are on the $32 level—this is a “must-hold” area, as a break below could trigger further downside. Meanwhile, the options market is signaling bullish interest, with the 25-delta risk reversal skew at 2.3, indicating a strong preference for calls over puts. Traders are also targeting the $35 level, where a large concentration of call options suggests significant resistance ahead.

The surge in silver inventories at COMEX is likely tied to multiple factors, but the timing suggests that traders and institutions are preparing for March contract deliveries. Silver contracts on COMEX, unlike many other futures, offer physical delivery, and when demand spikes for actual metal, inventories must be built up to meet obligations.

This buildup could also reflect a broader shift in the silver market. While COMEX inventories are rising, LBMA vaults have been seeing consistent declines in recent months. The upcoming LBMA data release will reveal whether this trend is continuing. If LBMA inventories shrink while COMEX stockpiles grow, it could indicate that silver is shifting from the London market to New York, potentially due to differing regional demand dynamics.

A similar pattern was observed in March 2020, during the height of the COVID-19 crisis, when logistical challenges created a divergence between COMEX and LBMA silver inventories. Back then, silver demand spiked as investors rushed to secure physical metal, causing extreme volatility in the futures market. While the current situation isn’t identical, the large inflows into COMEX suggest that something significant is brewing.

Silver’s immediate price action will depend on whether the $32 level holds. If it does, the buildup in COMEX inventories could be a sign that physical demand is strengthening, supporting a push toward $35. The options market, with a bullish risk reversal skew of 2.3, suggests that traders are positioning for higher prices, reinforcing the idea that silver could see upward momentum in the near term.

However, if silver fails to hold above $32, the market could experience additional volatility. While the long-term fundamentals for silver remain strong—driven by industrial demand in solar panels, electronics, and green energy technologies—short-term price action will be dictated by the balance of futures positioning and physical supply movements.

Hugo Pascal’s insights into COMEX silver flows highlight a market in transition. With deliveries approaching, the surge in inventories is a key indicator of what traders and institutions are preparing for. If history is any guide, such movements often precede significant price developments, making the next few weeks crucial for silver investors.

Whether this is a temporary repositioning or a sign of larger structural shifts in the silver market remains to be seen. But one thing is clear: silver is on the move, and the market is watching closely.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions