| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

Gold has been putting on quite the performance lately, and if recent market movements are any indication, it might just be gearing up for an encore. Hugo Pascal, Chief Investment Officer at InProved, has been tracking the latest developments, and the signals coming from the COMEX and global spot markets suggest that gold is setting the stage for some high-stakes action.

First, let’s talk about the key technical levels shaping the April 2025 COMEX gold contract. Prices are hovering within the critical 68.2% retracement zone, ranging from $2,915 to $2,975. This Fibonacci level is often a battleground—if gold can break through the upper boundary, it could send prices soaring as momentum buyers pile in. But if it falters, we could see a period of consolidation or even a pullback. Meanwhile, the 25-delta risk reversal skew sits at 0.8, signaling a slight preference for calls over puts, but not an overwhelming one. The market, it seems, is tilting bullish—but cautiously.

What’s particularly fascinating is the put wall at $2,750. A put wall at this level suggests that a significant number of traders have hedged downside risk here, making it a psychological and technical support zone. If gold does dip, it will have to work hard to push through this level, as put buyers may either unwind their positions or force market makers to hedge in ways that stabilize prices. In other words, gold has a cushion—and a fairly thick one.

But technicals alone don’t tell the full story. The real drama is unfolding in the physical and derivatives markets. China has been bidding aggressively for precious metals during the Asian morning session on February 14, pushing spot gold to $2,932/oz. This is no small detail—Chinese buying often sets the tone for the rest of the trading day, and sustained interest from the region suggests robust demand. When China steps into the market with conviction, it often signals either capital flight hedging or anticipation of further price appreciation. Neither scenario bodes well for gold bears.

Another key development is the resurgence of Exchange for Physical (EFP) spreads, with gold’s EFP jumping to $30/oz. Rising EFP spreads typically indicate a tightening of physical supply, making it more expensive to convert futures contracts into physical gold. This trend suggests that demand for deliverable gold remains strong, which could further pressure prices higher.

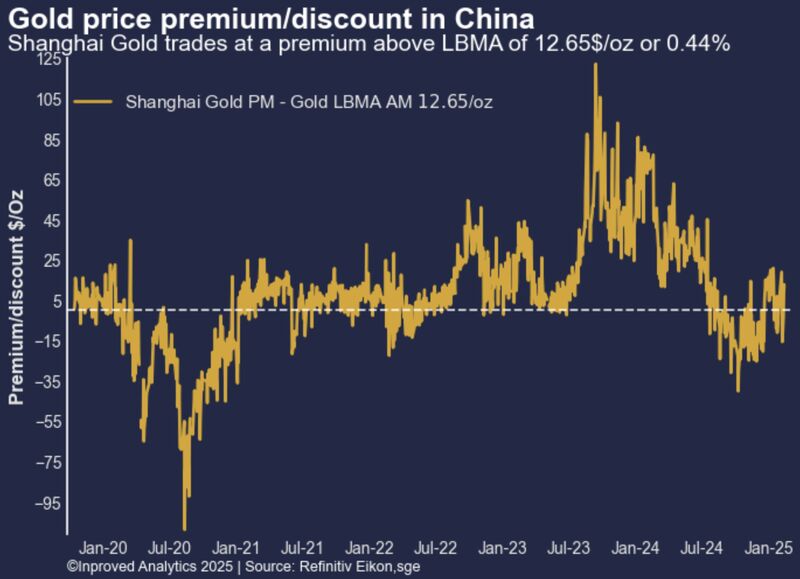

Adding another layer to the story, gold premiums remain in positive territory, closing on February 13 at $12.65/oz, or 0.44% above the LBMA benchmark. A sustained premium on physical gold is often a sign of constrained supply or strong physical demand—both of which reinforce the broader bullish case.

So, what does all this mean for gold next week, next month, and for the first half of 2025?

In the immediate term, the battle at $2,975 will be critical. If gold manages to clear this level, it could be off to the races, especially with China bidding and EFP spreads widening. Conversely, if the rally stalls here, we may see some short-term consolidation as traders reassess positioning.

Over the next month, the combination of rising EFP spreads and continued premiums suggests that physical gold demand remains firm. If this trend holds, it could provide a steady floor for prices, preventing any deep pullbacks. Moreover, the put wall at $2,750 acts as a safety net, further limiting downside risk.

For the first half of the year, gold is looking increasingly well-positioned. Central banks remain net buyers, inflation remains sticky, and geopolitical risks are as unpredictable as ever. If demand from China persists and supply tightens further, we could see gold not just testing new highs, but potentially setting the stage for a more structural rally.

Hugo Pascal’s insights highlight a gold market at a pivotal juncture. The confluence of technical levels, physical demand, and derivative positioning suggests that the metal’s next move could be substantial. Whether gold makes a decisive break above $2,975 or takes a breather first, the coming weeks will be crucial in determining the trajectory of what is shaping up to be an exceptionally interesting year for the yellow metal.

About Us

Information

Individual Solutions

Commercial Solutions