| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

Gold markets are sending mixed signals, with demand for physical gold rising in some areas while seasonal trends slow activity in others. Hugo Pascal, Chief Investment Officer at InProved, has been closely monitoring these shifts, and the latest data points to an evolving landscape for the yellow metal.

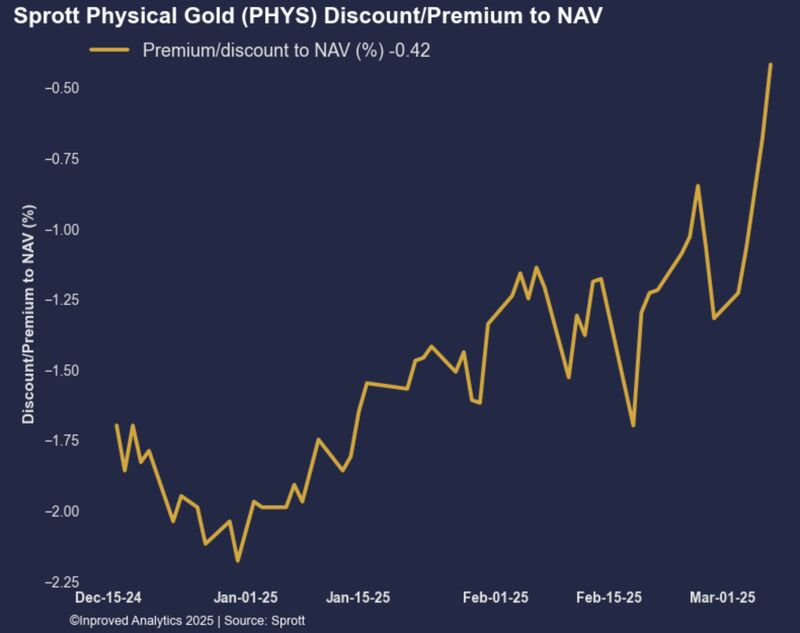

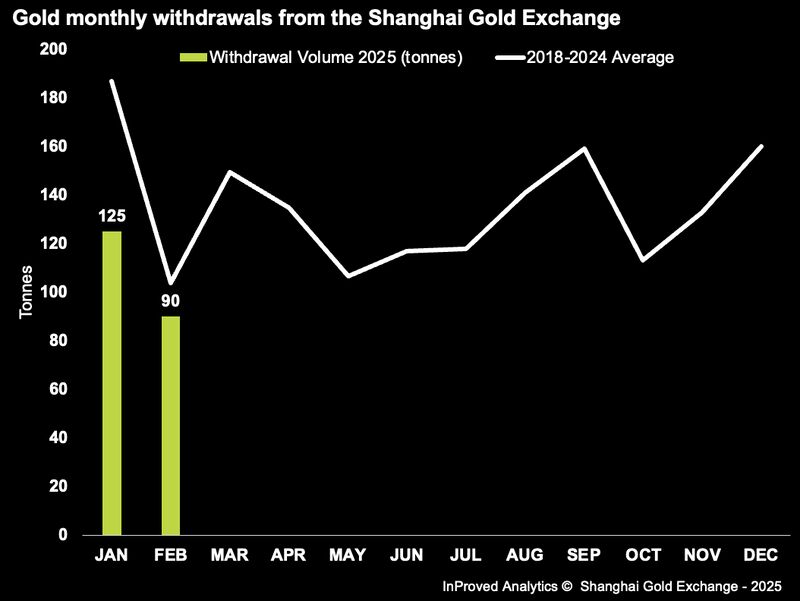

The Sprott Physical Gold Trust (PHYS) discount has continued to shrink, now standing at just -0.42% as of March 7, 2025. This is a significant development, as narrowing discounts in gold trusts often indicate growing investor interest in physical gold, rather than just paper gold exposure through ETFs or futures. Meanwhile, withdrawals from the Shanghai Gold Exchange (SGE) totaled 90 tonnes in February, down 28% from the previous month. While this may seem like a bearish indicator at first glance, the decline aligns with seasonal trends, as post-Lunar New Year demand for gold in China typically slows during this period.

At the same time, gold’s technical positioning on the COMEX April 2025 contract is reaching a critical juncture. The 68.2% retracement zone between $2,897 and $2,955 suggests that gold is trading within a key area where past price action has seen reversals or acceleration. The 25-delta risk reversal skew at 0.2 indicates a fairly neutral balance between calls and puts, suggesting that options traders have not yet taken a strong directional stance. However, a significant put wall at $2,700 implies that downside protection is being built at this level, which could act as a firm support zone if gold were to experience a pullback.

The Sprott Physical Gold Trust (PHYS) differs from traditional gold ETFs in a crucial way—it holds allocated, fully redeemable physical gold rather than relying on financial derivatives or unallocated bullion. This makes PHYS a preferred vehicle for investors who want exposure to physical gold while maintaining the liquidity benefits of an exchange-traded instrument.

The narrowing of PHYS’s discount to just -0.42% suggests that investors are increasingly favoring physical gold over paper gold, a trend that often emerges in times of economic uncertainty or when inflation concerns persist. Historically, when PHYS moves closer to, or even trades at a premium, it reflects rising confidence in gold as a long-term store of value.

This growing demand for physical gold contrasts with the recent slowdown in withdrawals from the Shanghai Gold Exchange. While February’s 90-tonne withdrawal was 28% lower than in January, the decline follows a predictable seasonal pattern. Lunar New Year celebrations in China typically lead to a surge in gold buying during January, followed by a natural cooling-off period in February. Given this seasonal trend, the drop in withdrawals is less about weakening demand and more about expected market behavior.

However, if March’s withdrawal figures continue to decline at a steeper rate, it could indicate a broader shift in China’s gold appetite, especially if economic conditions tighten or government policy changes impact gold purchasing behavior.

Gold’s current positioning on the COMEX April 2025 contract suggests that the market is at an inflection point. Trading within the 68.2% retracement zone between $2,897 and $2,955, gold is testing a level that has historically acted as a springboard for price reversals or breakouts. If gold manages to hold above this range and push higher, it could indicate that the market is preparing for another leg up.

The 25-delta risk reversal skew at 0.2 suggests that there is no extreme imbalance in call or put options demand, meaning traders are not aggressively favoring one direction over the other. However, the put wall at $2,700 remains a key level to watch—if prices were to decline toward this level, the presence of strong put positioning could lead to market maker hedging activity, which often results in price stabilization or even a reversal.

The diverging trends between PHYS and the SGE suggest that while global physical demand remains strong, regional factors are influencing short-term movements. The narrowing PHYS discount implies growing investor interest in gold as a safe-haven asset, a sign that institutional and retail investors outside of China are accumulating physical gold.

Meanwhile, the decline in SGE withdrawals, while seasonally expected, raises the question of whether Chinese demand will rebound in the coming months. China has historically been a key driver of global gold prices, and if demand slows beyond seasonal norms, it could dampen bullish momentum in the gold market. However, with ongoing economic uncertainty and potential monetary policy shifts, it would not be surprising to see Chinese demand return as the year progresses.

From a technical perspective, gold’s immediate future will likely be decided by whether it can hold its position above $2,900 and push toward $2,955, or whether it retraces back toward the $2,700 put wall. If PHYS continues to see a shrinking discount and SGE withdrawals pick up again in March, it could provide the fuel needed for another gold rally.

Hugo Pascal’s analysis underscores the importance of watching both institutional and regional demand trends when evaluating gold’s next move. The market is at a key inflection point, and how these dynamics evolve in the coming weeks could determine whether gold continues its march higher or pauses for a period of consolidation. Either way, the metal remains firmly in focus as a critical asset in a world grappling with inflation, currency devaluation, and shifting economic conditions.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions