| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

Silver is in motion—physically and in market sentiment. Hugo Pascal, Chief Investment Officer at InProved, has been tracking an unprecedented shift in silver inventories, with COMEX vaults reaching a new all-time high while London and Shanghai stockpiles continue to shrink.

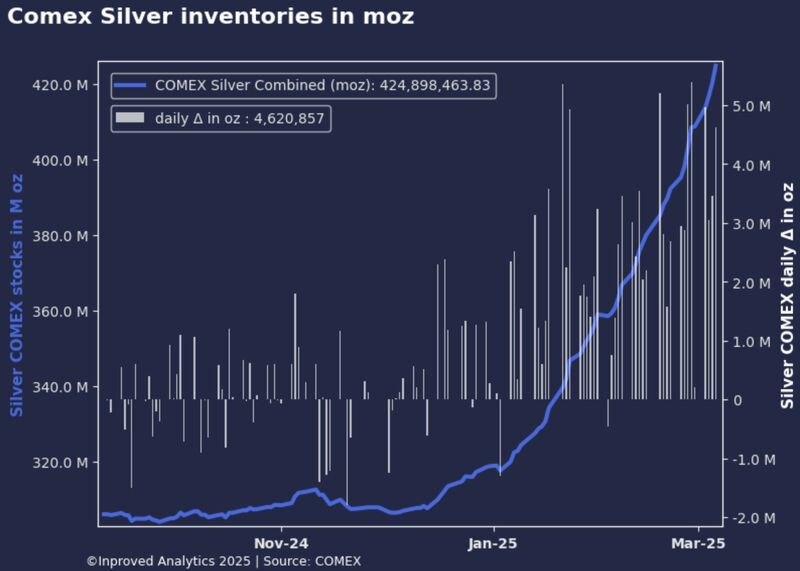

On Thursday, March 6th, silver inventories in COMEX vaults surged by 4.6 million ounces (143 tons), bringing total holdings to 425 million ounces. Month-to-date (MTD), inflows have now reached 500 tons. This continues a trend from the previous day, where COMEX inventories rose by 3.5 million ounces (109 tons), taking total stockpiles to 420.3 million ounces. This rapid accumulation raises critical questions about whether this is a response to anticipated delivery demand or a broader structural shift in silver distribution.

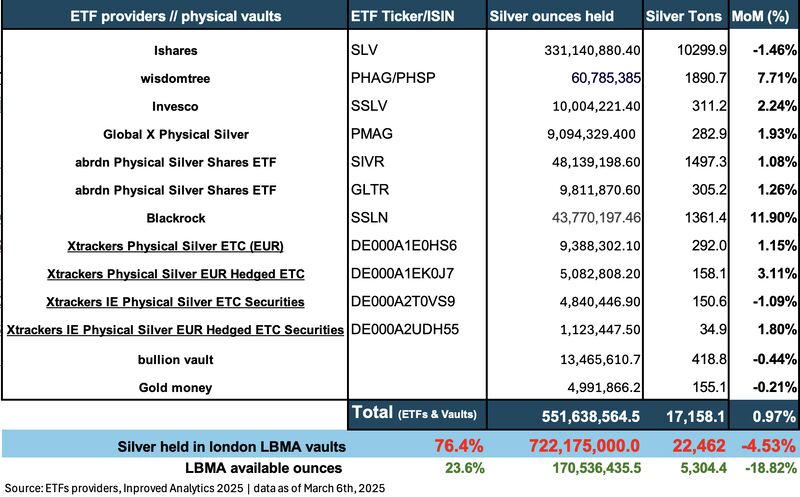

Meanwhile, in London, the latest LBMA data shows a 4.53% decline in total silver holdings for the month—a drop of 1,066 tons. More strikingly, the availability of silver in London has shrunk by 18.8% in the same period, with just 5,304 tons of non-allocated silver remaining. However, ETF-held silver in London has increased to 76.4% of total vault holdings, up from 72.2% last month, indicating that more silver is being locked away in long-term investment vehicles.

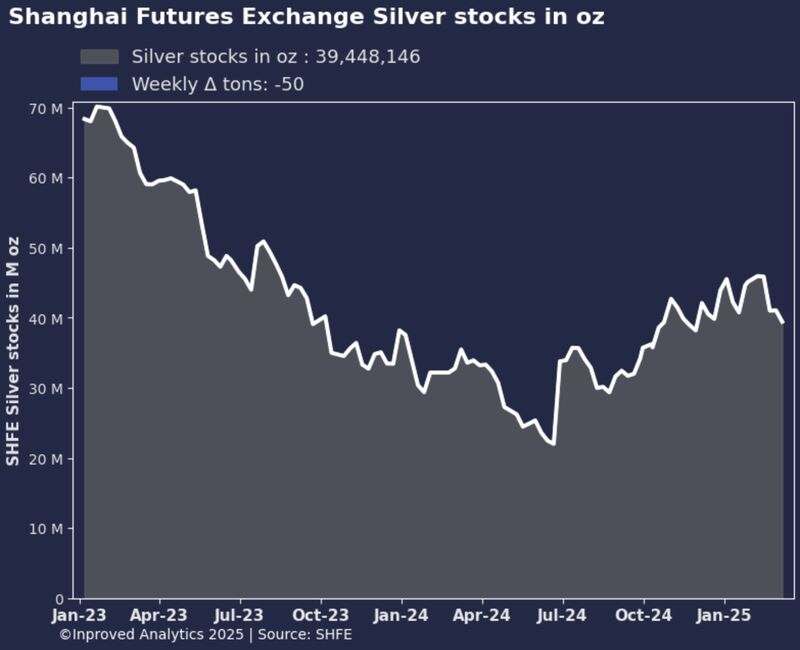

Shanghai is also seeing its silver inventories dwindle. Vault stocks in China have hit a three-month low at 1,227 tons (39.5 million ounces), with a week-over-week decline of 50 tons. The outflows from Shanghai suggest that silver demand in Asia remains strong, potentially for industrial or private investment purposes, and that locally available supply is tightening.

Against this backdrop, silver’s technical positioning on the COMEX May 2025 contract is signaling potential volatility. The 68.2% retracement zone between $32.53 and $33.73 indicates that silver is trading within a crucial support-resistance band. The 25-delta risk reversal skew at 2.9 suggests a strong bullish tilt, meaning that traders are paying a premium for call options over puts.

Additionally, the call wall at $35 represents a significant psychological and technical barrier, where a concentration of call options could create resistance unless fresh momentum pushes prices higher.

The surge in COMEX silver inventories could be attributed to several key factors. First, the upcoming delivery cycle may be prompting increased metal deposits to meet contract obligations. COMEX, unlike many other futures exchanges, offers physical settlement, and when delivery demand spikes, inventories tend to rise in anticipation.

Second, the decline in LBMA and Shanghai vault stocks suggests that silver is being redistributed. The sharp drop in available silver in London—an 18.8% reduction in just one month—signals tightening supply, even as ETF-held silver rises. This shift implies that more institutional investors are taking physical positions rather than keeping silver available for immediate liquidity.

Shanghai’s declining inventories further reinforce the idea that silver’s physical market is under stress. China has long been a major consumer of silver, both for industrial applications and as an investment hedge. The consistent withdrawals from Shanghai vaults, even amid higher COMEX inflows, suggest that Asian demand remains strong, potentially driven by factors such as solar panel production and increasing silver usage in electronics manufacturing.

The decline in LBMA silver holdings is particularly important because London has traditionally been one of the largest storage hubs for physical silver. Over the past few months, its inventory levels have been shrinking, and the fact that available silver has dropped nearly 20% in a month signals that the market may be shifting away from London as a primary liquidity center.

The increase in ETF-held silver in London means that more of the remaining metal is being allocated to long-term holdings rather than being readily available for physical trading or delivery. This trend could have long-term implications for the market, as it reduces the amount of freely circulating silver that can be used to meet industrial or investment demand.

The steady decline in Shanghai silver inventories raises another important question—are these outflows being driven by rising demand in China, or is silver simply moving to other global vaults?

China has been one of the world’s biggest silver consumers, particularly for industrial applications such as solar panels and semiconductors. If the drawdowns from Shanghai vaults are due to industrial consumption, it could indicate strong demand that may not be immediately visible in futures pricing. On the other hand, if silver is being relocated to COMEX, it may suggest a preference for U.S.-based inventories due to shifting trade flows or arbitrage opportunities.

The key takeaway from these developments is that silver’s physical market is undergoing significant redistribution. COMEX inventories continue to swell, while London and Shanghai are seeing consistent outflows. This divergence suggests that silver is shifting toward where futures activity is strongest — New York — while supply tightens elsewhere.

From a price perspective, silver’s near-term movement will likely be dictated by whether it can hold the $32.53-$33.73 technical zone. The elevated risk reversal skew of 2.9 signals that options traders are leaning bullish, which could set the stage for further upside. However, the call wall at $35 represents a formidable resistance level that will require strong buying pressure to overcome.

If the trend of declining availability in LBMA vaults and Shanghai continues, it could lead to a supply squeeze that eventually puts upward pressure on prices. On the other hand, if COMEX continues to absorb silver at this rate, it may provide enough short-term liquidity to keep price spikes in check—at least until broader market demand forces a reassessment.

Hugo Pascal’s analysis highlights a silver market in flux, with physical and paper markets pulling in different directions. Whether this shift leads to a structural revaluation of silver remains to be seen, but the signs of tightening availability in major global hubs suggest that silver’s long-term fundamentals are strengthening.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions