| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

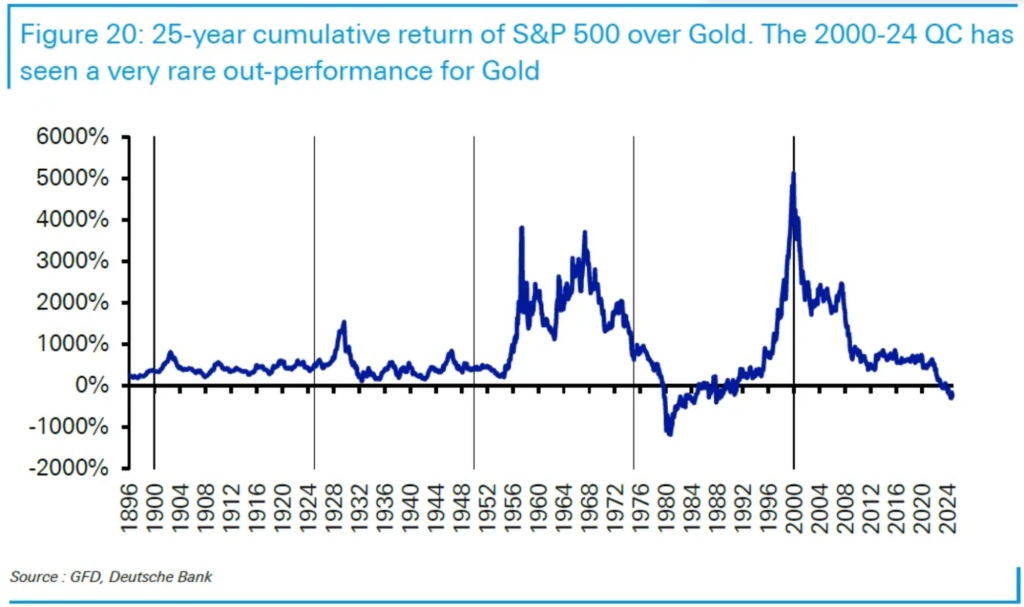

Starting the millennium with stocks at historic highs has ultimately meant a less impressive quarter-century for equities than it may have initially seemed. Gold, however, has outpaced other asset classes:

This isn’t merely due to a favorable starting point. Analyst Reid’s examination of the historical ratio between the S&P 500 and gold prices (essentially calculating the S&P’s value in terms of gold rather than dollars) highlights a clear trend. Over the past 25 years, gold has shown steady growth. The only historical parallel to this is 1980, a period when inflation surged following the end of the Bretton Woods gold standard, driving this ratio to a record low. This point was a key indicator that the financial framework was shifting, and soon after, global finance flourished under a Federal Reserve committed to controlling inflation:

This dominance by gold might seem surprising given the strong stock performance of the last 15 years. Reid’s historical data on central bank balance sheets helps to clarify the conditions that have favored gold. For example, the Bank of England’s balance sheet data stretches back to 1697, and since 2000, it has expanded at a previously unimaginable rate. The same trend is visible with the Federal Reserve, which has seen a similar expansion since its founding in 1915:

But it hasn’t been just aggressive monetary policy. Fiscal policy has also veered into uncharted territory. At the beginning of 2000, the US, under the Clinton administration, had successfully balanced its budget with plans to reduce national debt entirely. This did not materialize, however. Today, US government debt as a percentage of GDP is nearing levels last seen in the 1940s wartime economy and is expected to increase further:

The influence of the US Treasury and bond market extends globally, yet this trend is widespread. At the turn of the century, global debt stood at a little over twice the global GDP; today, it exceeds triple GDP.

While some may find it excessive to hear ongoing warnings about financial instability, there are underlying reasons for concern. Viewed from 25 years ago, these figures would have been alarming, likely leading to grave predictions.

In addition to surging global debt and extensive monetary expansion, one of the most transformative developments has been China’s rise. By the year 2000, Deng Xiaoping’s economic reforms had been in place for nearly a decade, but the Chinese growth model was only beginning to gain momentum. China’s entry into the WTO would further catalyze this growth, as seen in its GDP rise relative to the US economy since 1980:

Remarkably, China has continued to grow even as global trade, a central driver of the 1990s, has plateaued since the 2008 financial crisis. The collapse of the Berlin Wall had previously fueled international trade, which, while not reversing, now shows signs of stagnation—possibly facing additional constraints under new trade policies, such as tariffs introduced during Trump’s presidency.

With hindsight, gold has proven to be a more successful investment since 2000. Investors who were hopeful at the turn of the millennium have been met with challenges, as stock growth has largely relied on expanding government debt and accommodative monetary policy. As we approach another phase where leaders strive to reform the global economic model, we can only hope that the next 25 years will again yield positive results.

Strong dollar pressures gold, raising its price for global buyers US inflation data strengthens case for a Fed rate cut next month Gold continued a four-day decline, pressured by a strengthening dollar, even as recent US inflation data supported the prospect of a Federal Reserve rate cut next month.

Following a 1% drop in the prior session that brought gold prices to an eight-week low, the metal held steady. The US dollar index surged to a two-year high amid expectations that President-elect Donald Trump’s administration will stimulate economic growth and corporate earnings. A stronger dollar generally makes dollar-denominated commodities, such as gold, pricier for international buyers.

US consumer price data on Wednesday aligned with expectations in headline terms, although the annualized three-month core inflation rate rose. The data pointed toward a potential rate cut by the Fed in mid-December, with traders in the swaps market putting the likelihood above 80%. Lower interest rates often favor gold, as it is a non-yielding asset.

Gold has fallen over 7% since hitting a record high on October 31, with losses accelerating after Trump’s victory. Despite recent declines, gold prices remain about 25% higher this year, bolstered by the Fed’s easing policy, central bank gold acquisitions, and heightened geopolitical and economic uncertainty that has spurred demand for safe-haven assets.

As of 8:25 a.m. in Singapore, spot gold held steady at $2,574.55 per ounce. The Bloomberg Dollar Spot Index remained stable after reaching its highest level since 2022 on Wednesday. Meanwhile, silver edged higher, palladium was unchanged, and platinum saw a slight decline.

About Us

Information

Individual Solutions

Commercial Solutions