| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

Silver markets are heating up across both Western and Eastern trading hubs—but for very different reasons. As physical silver continues to flood into COMEX vaults at record pace, activity on the Shanghai Futures Exchange (SHFE) is being driven by speculative positioning and paper risk-taking. This East-West divergence is rapidly defining the structure of the global silver market, and could shape price action in the weeks ahead.

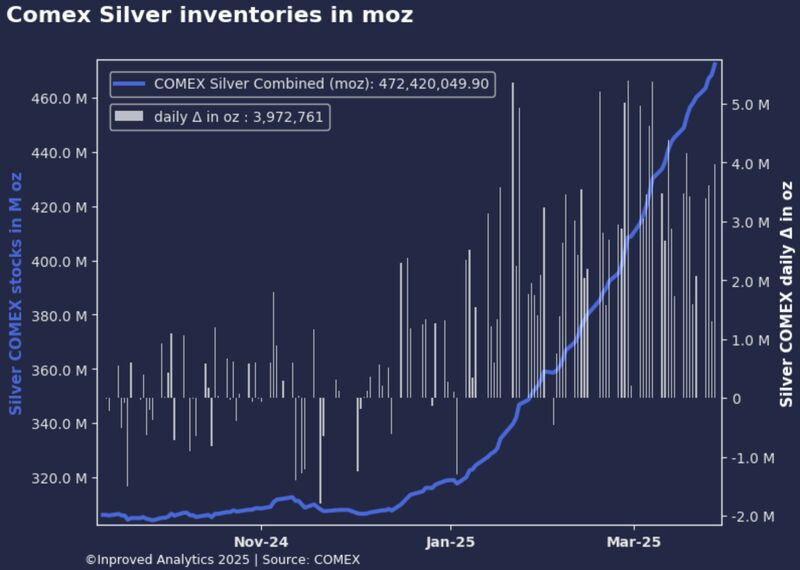

The New York-based COMEX vaults are being restocked at a historic rate. On Thursday, inventories rose by 4 million ounces (124 tons), pushing the total to 472.4 million ounces. This follows a 3.6 million-ounce (112 ton) build earlier in the week, taking month-to-date inflows to 1,979 tons (63.6 million ounces). In just one month, COMEX has absorbed the equivalent of nearly 6% of total global silver production—an extraordinary pace.

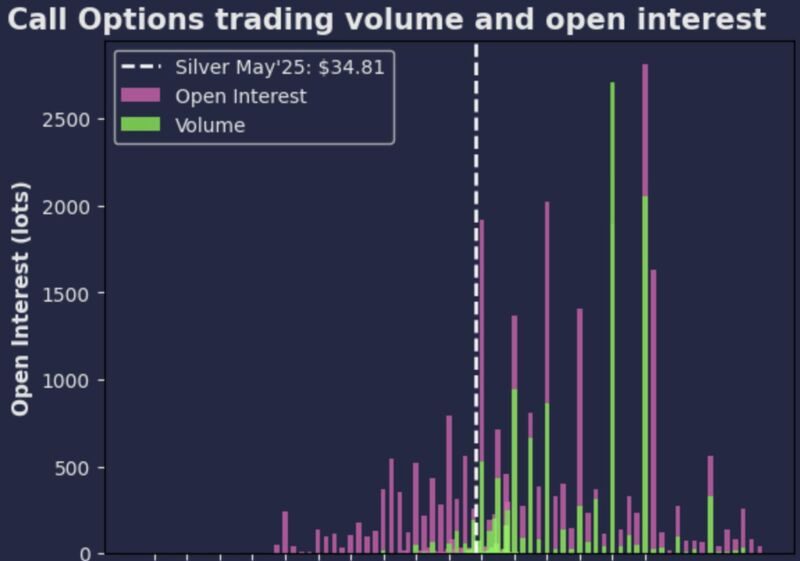

These inflows coincide with increased bullish interest in the options market. The most traded strikes on Friday, March 28th, were $39 and $40 call options, both expiring in just 26 days. The heavy traffic at these far-out strikes suggests market participants are betting on continued price upside before the May 2025 contract expires.

On the technical front, COMEX May ‘25 silver is sitting within a critical range—the 68.2% retracement zone between $33.68 and $34.76. The 25-delta risk reversal skew stands at 1.3, while the 90-day skew (Jul ’25) has surged to 3.3, a strong signal that upside options are commanding a premium. The put wall at $31 remains firm support, and the widening EFP (Exchange for Physical) spread at $0.93/oz underscores growing dislocation between paper and physical pricing. This usually suggests tightness in spot availability or delivery constraints.

In parallel, the Sprott Physical Silver Trust (PSLV) has seen its Net Asset Value hit $6 billion, now holding 182.1 million ounces of physical silver. As the second-largest exchange-listed silver fund globally, PSLV’s growing size confirms investor appetite for physically-backed exposure, beyond just futures speculation.

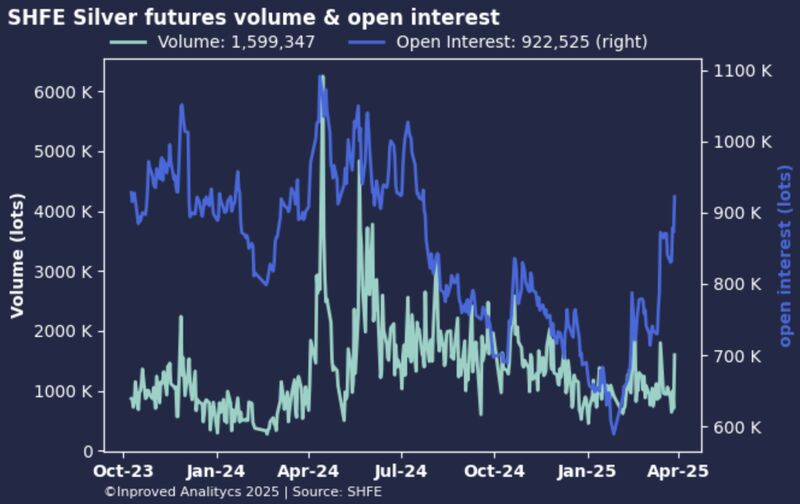

On the other side of the world, silver sentiment is red-hot—but for very different reasons. Open interest on the SHFE jumped to 922,525 contracts, the highest level in eight months, totaling 13,840 tons in paper exposure. Volume has surged in tandem, with 1.8 million contracts traded in a single session, a clear indication that Chinese speculators are re-entering the silver trade with force.

The Put/Call volume ratio has fallen to 0.66, showing clear preference for bullish bets. The most traded strike on SHFE remains ¥8,500/kg (equivalent to $36.50/oz on COMEX)—now the dominant contract for seven straight days, trading over 100,000 contracts on Friday alone. What’s more, open interest is beginning to build around the ¥9,000/kg ($38.70/oz) strike, indicating rising expectations for a larger breakout.

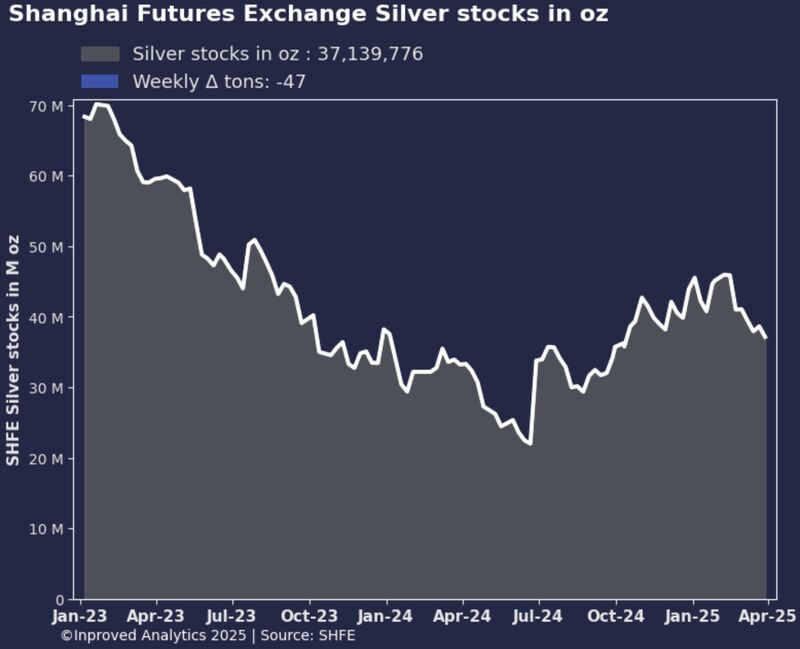

However, while speculative appetite increases, Shanghai vaults are being quietly drained. Weekly withdrawals have reduced total holdings to 1,155 tons (37.1 million ounces)—the lowest in six months. This depletion of physical inventory, combined with soaring open interest, creates a leverage imbalance that could magnify price reactions in the near term.

What’s remarkable about silver’s current trajectory is the divergence in how the East and West are expressing bullish conviction.

In the West (COMEX), the approach is physical and institutional. Vaults are swelling, options traders are targeting high strikes like $39 and $40, and trusts like PSLV are absorbing real ounces. The rising EFP spread reflects friction in sourcing physical metal, and institutions appear to be preparing either for delivery or increased long-term demand.

In the East (SHFE), the play is aggressive, speculative, and paper-based. Traders are piling into far-out call options, trading volume is spiking, and yet, physical inventories are dropping. The imbalance here suggests that any further upside in price could be met with either a physical squeeze—or a sharp unwind if sentiment turns.

As Hugo Pascal observes, silver is becoming a globally bifurcated market. COMEX represents the build-up of institutional conviction and physical delivery readiness. SHFE, meanwhile, reflects the raw optimism and risk appetite of a speculative surge.

The ultimate direction of price may depend on which force breaks first: does the physical tightness in Shanghai fuel a scramble for metal, or does the COMEX build-up signal a looming delivery rush?

For now, both are aligned in one key message: silver is back in play, and the market is bracing for something big.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions