| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

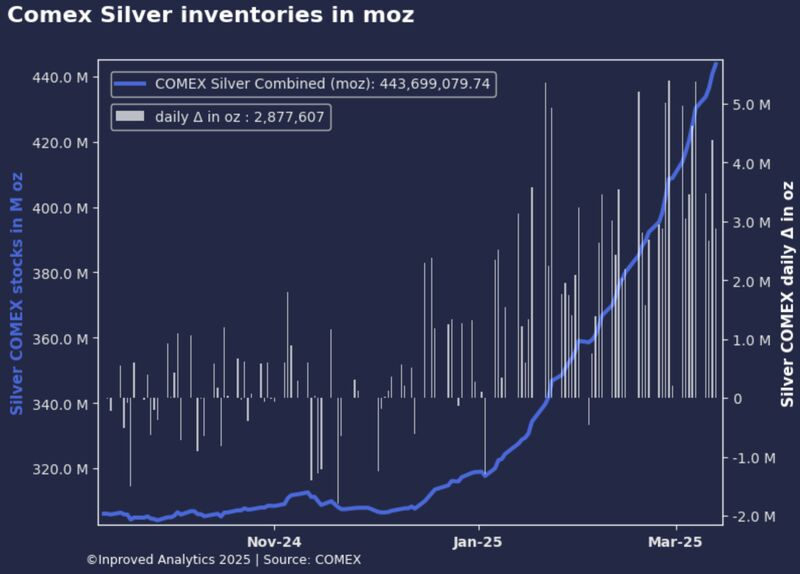

Silver is witnessing an extraordinary moment, with physical inflows to COMEX vaults hitting new all-time highs while speculative bets on the Shanghai Futures Exchange (SHFE) surge to their highest levels in months. Hugo Pascal, Chief Investment Officer at InProved, has been closely monitoring these developments, and the numbers paint a picture of a market gripped by both physical demand and speculative fervor.

On Thursday alone, silver inventories at COMEX vaults surged by another 2.9 million ounces (90 tons), bringing total stockpiles to a staggering 443.7 million ounces. Month-to-date (MTD), inflows have now surpassed 1,088 tons. The day prior, COMEX saw a 4.4 million-ounce (137-ton) inflow, pushing inventories to 440.8 million ounces. Despite these inflows, the market remains laser-focused on the $35 level, where a significant call wall represents a major psychological and technical resistance point.

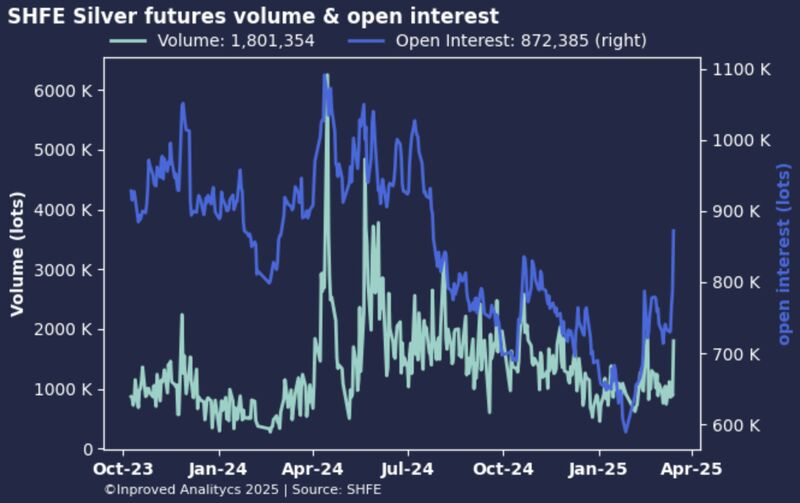

Meanwhile, in China, trading activity on the SHFE is reaching levels not seen in nearly a year. Open interest skyrocketed by 10.75% in a single session, hitting an 8-month high of 872,000 contracts (13,086 tons). Volume exploded, with 1.8 million contracts changing hands, as bullish bets continued to dominate. The Put/Call (P/C) ratio has dropped to 0.58, signaling that traders are aggressively favoring upside exposure. The most traded strike price—¥8,500/kg (equivalent to $36.50/oz on COMEX)—has remained the focal point for seven consecutive days, with more than 100,000 contracts exchanged. More notably, interest is now building around the ¥9,000/kg ($38.70/oz) strike, suggesting traders are betting on silver pushing even higher.

However, as bullish positioning intensifies, silver inventories in Shanghai continue to dwindle. Vault holdings in China have declined by another 47 tons this week, hitting a four-month low at 1,180 tons (37.9 million ounces). The continued outflows indicate that physical silver availability in China is tightening, even as speculation ramps up.

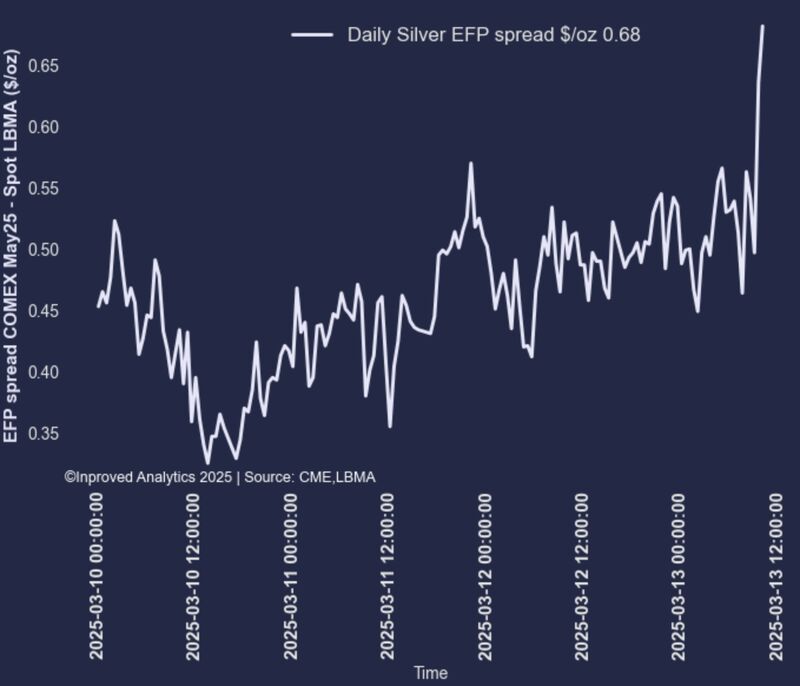

The divergence between physical availability and speculative positioning is mirrored in the Exchange for Physical (EFP) spread, which is widening again at $0.68/oz for May 2025 contracts. This indicates growing dislocations between futures and spot markets, a trend that often precedes supply constraints or heightened volatility.

Several key factors are fueling this latest surge in silver activity:

First, the relentless inflows into COMEX vaults suggest that New York remains the preferred destination for physical silver. With over 1,088 tons added this month alone, the continued stockpiling raises questions about whether institutions are preparing for an upcoming delivery squeeze or simply repositioning supply to align with futures market activity. Unlike previous episodes of large COMEX inflows that were tied to ETF redemptions, the current surge appears to be more structural—indicating that physical silver is being accumulated rather than dumped back into circulation.

Second, the risk reversal skew on COMEX May 2025 silver has jumped to 3.8 from 2.8 the previous day, meaning call options have become significantly more expensive relative to puts. This reinforces the idea that traders are paying a premium to bet on higher silver prices. At the same time, the put wall at $31 suggests that downside hedging remains strong, creating a critical support level in case of any corrections.

Third, in China, the silver market is experiencing an unprecedented wave of bullish speculation. The sheer magnitude of open interest and trading volume on the SHFE suggests that institutional players are aggressively building positions. The ¥8,500/kg ($36.50/oz) strike has dominated trading for a full week, while fresh interest in the ¥9,000/kg ($38.70/oz) strike signals that traders believe silver’s rally is far from over.

Fourth, the ongoing decline in Shanghai’s silver inventories underscores a fundamental issue—physical silver availability in China is shrinking. Whether this is driven by industrial demand, investment accumulation, or shifts in global supply chains, the trend is unmistakable. If silver continues to flow out of Shanghai while bullish positioning builds, it could create the conditions for a short-term price squeeze.

With silver flirting with key technical levels, the $35 call wall on COMEX May 2025 futures remains a crucial barrier. The combination of record-high vault inflows, aggressive bullish bets on SHFE, and declining inventories in China suggests that silver is at a make-or-break moment.

If silver can break above $35, it could trigger a cascade of buying from momentum traders and force options market makers to hedge further, creating a potential price surge. However, if it struggles to breach this level, we may see some consolidation before the next move.

Hugo Pascal’s analysis highlights a market that is running at full throttle—physical supply is shifting, speculative money is pouring in, and technical indicators are flashing bullish signals. Whether silver makes a decisive break past $35 or takes a breather first, the sheer volume of activity suggests that the next few weeks will be anything but quiet in the silver market.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions