| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

Silver is beginning to stir in ways that can’t be ignored. The market, which has been oscillating between quiet accumulation and bursts of speculative activity, is now flashing signals of renewed investor interest. Hugo Pascal, Chief Investment Officer at InProved, recently pointed to several key developments shaping silver’s landscape—each one carrying weight on its own, but together painting a picture of a market on the move.

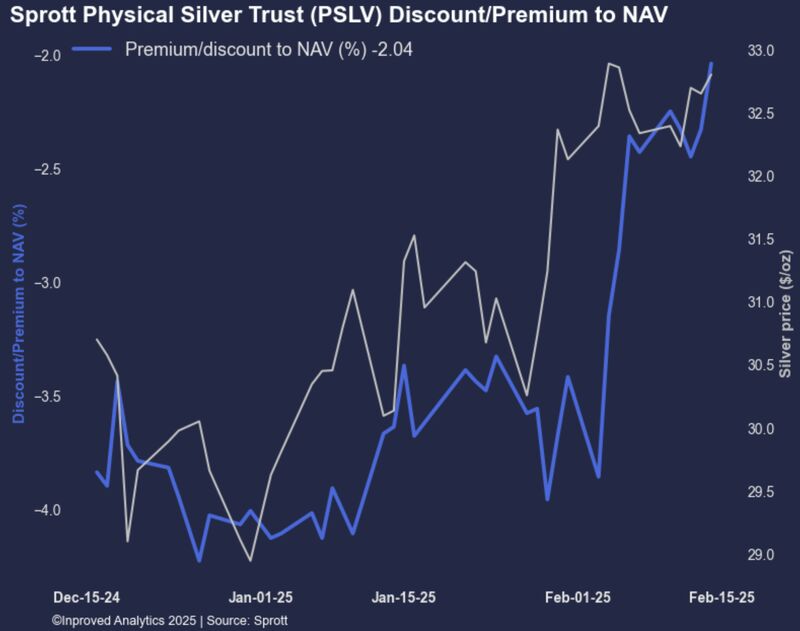

The Sprott Physical Silver Trust (PSLV), a closely watched indicator of physical silver demand, has seen its discount shrink to -2.04% as of February 14, 2025. While still trading below its net asset value, the narrowing of this discount suggests rising interest in physical silver. Investors who had been hesitant to buy PSLV at a steep discount are now stepping in, reflecting a shift in sentiment toward silver as a tangible asset. In previous market cycles, similar moves in PSLV have foreshadowed price rallies, as growing demand for physical silver often precedes larger institutional flows.

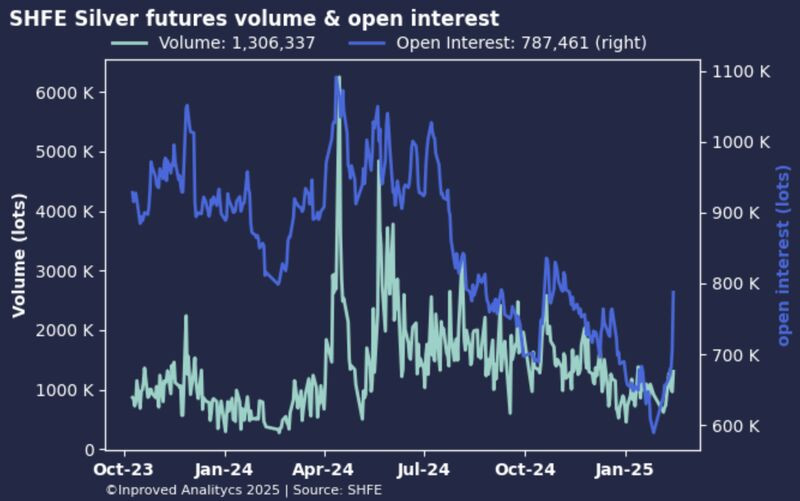

Meanwhile, across the globe, the Shanghai Futures Exchange (SHFE) has just recorded its largest daily increase in silver open interest since November 2023, with contracts surging 11.4% in a single session—equivalent to 1,207 tons. This is significant. The SHFE had been lagging in silver activity for months, weighed down by cautious sentiment in China’s economy. A spike of this magnitude suggests that traders in the world’s largest consumer of silver are positioning for movement. Whether this surge is being driven by industrial hedging, speculative interest, or a deeper belief in silver’s future trajectory, it’s clear that liquidity is returning to the Chinese silver market.

On the COMEX, all eyes are now locked on the $34 level. The March 2025 silver contract is trading within a key technical zone, with its 68.2% retracement range set between $32.14 and $33.32. This is an area where past price action suggests silver could either find resistance or break out into new highs. The 25-delta skew at 2.2 indicates that call options are in stronger demand than puts, reinforcing the idea that traders are betting on higher prices. And then there’s the call wall at $34—a level where option activity is concentrated, creating a psychological and technical barrier. If silver can push through, it could unleash a wave of momentum buying as traders who were waiting on the sidelines jump in.

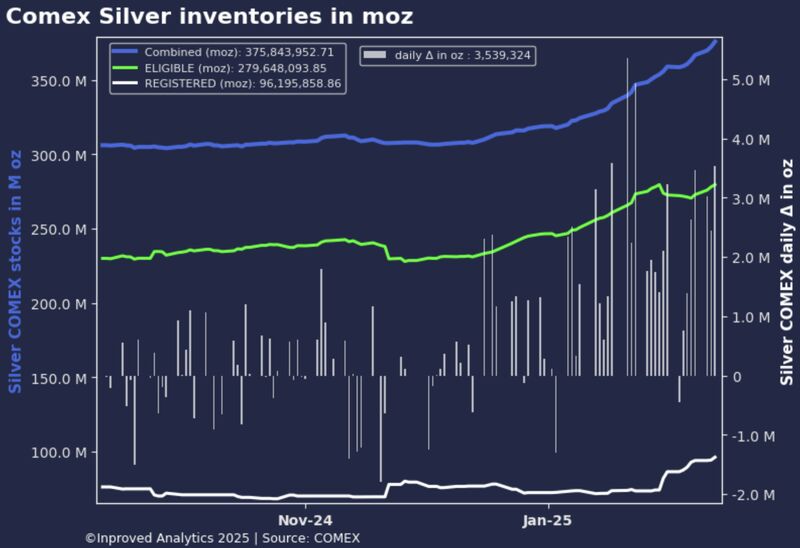

At the same time, silver inventories at COMEX vaults continue to grow, with a fresh inflow of 3.5 million ounces (110 tons), bringing total holdings to 375.9 million ounces. Month-to-date, COMEX has absorbed 16.8 million ounces (524 tons), reflecting strong inflows into the system. The divergence between rising inventories and the bullish sentiment in derivatives markets raises a critical question: is this new silver supply merely repositioning within the market, or is it an effort to meet expected future demand?

Taken together, these developments suggest that silver is entering a decisive phase. The shrinking PSLV discount, the resurgence of open interest on SHFE, the critical technical positioning around $34 on COMEX, and the steady accumulation of vault inventories all point to a market where positioning is shifting rapidly. If silver’s momentum continues to build, it could set the stage for one of the most interesting periods in recent memory.

Hugo Pascal’s analysis highlights a silver market that is no longer content to move in the shadows. With fundamental and technical factors aligning, the weeks ahead could prove pivotal for those watching the metal’s next big move.

About Us

Information

Individual Solutions

Commercial Solutions