| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

The Chinese gold market is once again on fire, and this time, the intensity feels both familiar and historic. As trading volumes soar across the Shanghai Gold Exchange (SGE) and the Shanghai Futures Exchange (SHFE), a clear narrative is emerging: China is not just buying gold — it is actively reshaping how gold is priced, traded, and positioned as a tool of economic self-determination.

For the second time in just over a year, what analysts are calling the “Spring Gold Trading Frenzy 2.0” appears to be unfolding. Volumes, open interest, and premiums are all surging in tandem — a phenomenon that, according to Hugo Pascal, CIO at InProved, signals more than seasonal demand. “We’re not just seeing holiday accumulation or jewelry buying,” Pascal explains. “This is institutional capital deploying into gold at scale, at a moment of rising geopolitical and monetary tension. China is clearly reinforcing gold’s role as a reserve and hedge — but crucially, on its own terms.”

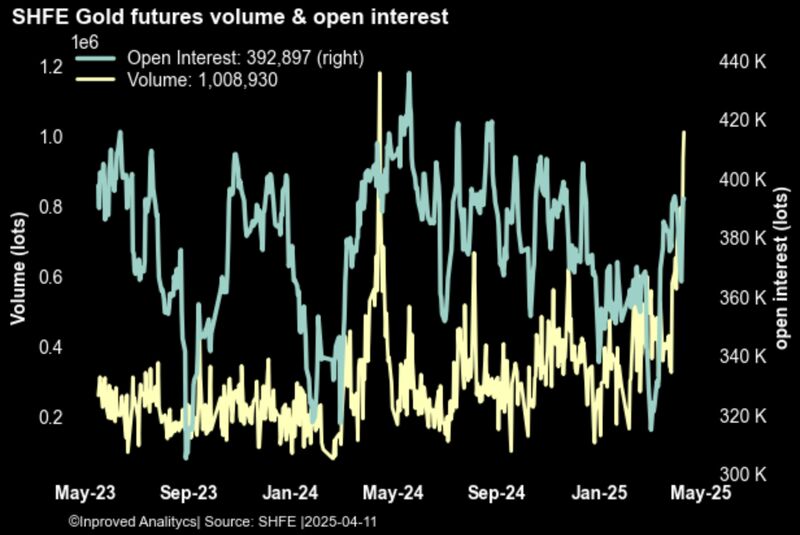

The figures support the momentum. On the Shanghai Futures Exchange (SHFE), trading volume in gold just hit a one-year high, with over 1 million contracts exchanged in a single session. Open interest remains elevated at 393,000 contracts, a four-month high that suggests bullish conviction is not fleeting.

More striking is the explosion in gold options positioning. Over the past two weeks, open interest in gold options on SHFE has grown by 51%, reaching 136,000 contracts. Of that, call options — bets on rising prices — have surged by 79%, while put interest has climbed by 33%, pulling the put/call volume ratio down to 0.65, a clear sign of bullish dominance. Options markets in China are not typically speculative noise; they are often used by larger institutions to hedge or amplify strategic positioning.

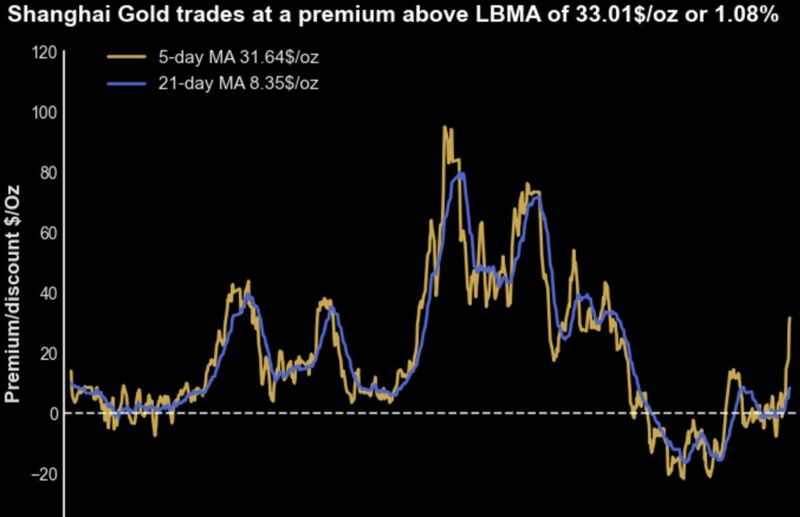

But perhaps the most telling signal comes from the premium itself. The 5-day average Shanghai gold premium has climbed to $31.60/oz, an 11-month high, with spot premiums closing at $33/oz, roughly +1.1% above the LBMA benchmark. These are not minor pricing differentials — they represent a genuine decoupling of Chinese and Western gold valuation, driven by local demand, a weakening yuan, and fears around U.S. trade policy.

As Pascal notes, “The premium isn’t just about shipping or logistics anymore. It’s become a geopolitical indicator — a signal that Chinese buyers are willing to pay more for gold sourced or settled in Shanghai than in London. That tells us where pricing power is shifting.”

Much of this shift is being driven by two powerful tailwinds: the specter of renewed tariffs under a second Trump administration, and the downward pressure on the yuan as capital seeks hard-asset protection. Both factors are incentivizing domestic Chinese investors — from institutions to high-net-worth families — to accelerate their exposure to gold, even if that means paying a premium to international spot prices.

Meanwhile, Western gold benchmarks are trying to keep pace. COMEX Gold (June 2025) is currently trading within its 68.2% retracement zone, between $3,045 and $3,112, and the spot price hit a new all-time high this morning at $3,213/oz, or ¥103,300 per kilogram in yuan terms. The 25-delta risk reversal skew has risen to 1.0, suggesting options traders in the U.S. are also leaning more heavily into bullish structures. The put wall at $2,840 — a crucial support zone — may soon shift upward, particularly if gold continues to hold above the $3,100 level. With LBMA prices now higher than they were just 2–3 days ago, and spot trading above the upper retracement band, the technical structure is clearly tightening in the direction of the bulls.

Pascal believes we are approaching a moment of pricing inflection. “The fact that COMEX is catching up to Shanghai’s premium, not the other way around, shows where the momentum is coming from,” he says. “If the put wall lifts — and we think it might in the next few sessions — it’s because the market is adjusting to a new base level for gold, one where the East sets the floor.”

Adding further complexity is the volatility in Exchange for Physical (EFP) spreads, which are now bouncing around $21.40 per ounce. The wide spread is a symptom of growing divergence between paper and physical markets — especially when Asian demand puts stress on Western supply and pricing parity. While EFPs typically normalize over time, persistent volatility here is another marker of a system under stress from real-world, not just financial, flows.

InProved continues to monitor both sides of the market. For Pascal, this is not just a regional phenomenon, but a signal of deeper structural change. “China is decoupling from the U.S. economically, and it’s using gold as one of its anchors,” he notes. “The trading behavior we’re seeing in Shanghai is a reflection of that strategy. It’s no longer about following global pricing — it’s about defining it.”

With volumes at a one-year high, options markets skewing bullish, and spot prices now leading benchmarks by over 1%, the message from China is clear: gold isn’t just a hedge anymore — it’s a statement of sovereignty. And in this market, that carries more weight than ever.

About Us

Information

Individual Solutions

Commercial Solutions