| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

Gold fever is no longer creeping — it is surging at a historic, almost violent pace, and China is leading the charge. As global investors scramble to position themselves amidst renewed trade war fears, surging tariffs, and shifting global monetary dynamics, trading activity, pricing, and positioning are undergoing seismic shifts across both futures and physical markets.

Over the past week, China’s gold market has exploded into a frenzy not seen since the early pandemic years. As Hugo Pascal, CIO at InProved, describes it, “This is the re-emergence of gold not just as a hedge, but as a geopolitical weapon, a financial firewall, and a statement of independence by the East. What we’re seeing now isn’t just trading — it’s a realignment of gold’s place in global finance.”

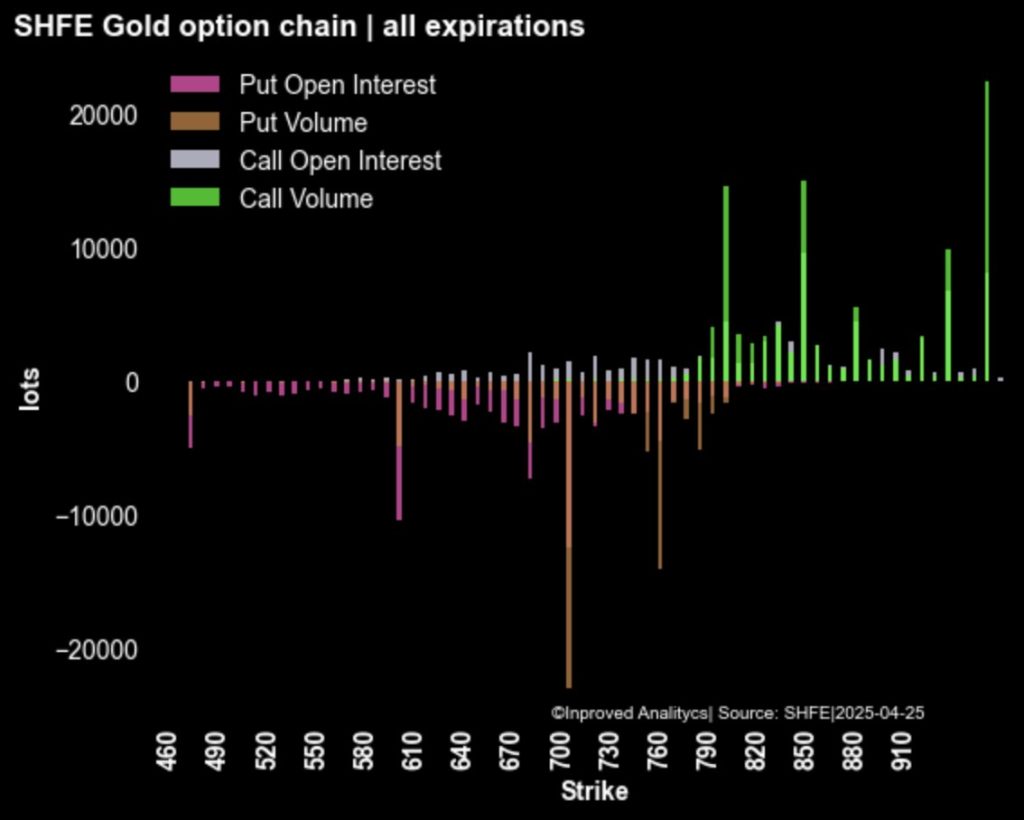

On April 25, the most actively traded gold futures option on the Shanghai Futures Exchange (SHFE) shifted dramatically higher. The leading call option is now at ¥960/gram, which, when translated into global terms, equals an astonishing $4,100 per ounce on COMEX. This represents the market’s growing expectation — or at least its hedging fear — that gold could leap dramatically above today’s spot prices in a relatively short time.

Meanwhile, the most active put option strike remains much more conservative at ¥704/gram, or $3,000/oz equivalent, showing that downside protection is still priced, but nowhere near as aggressively as upside risk is being chased.

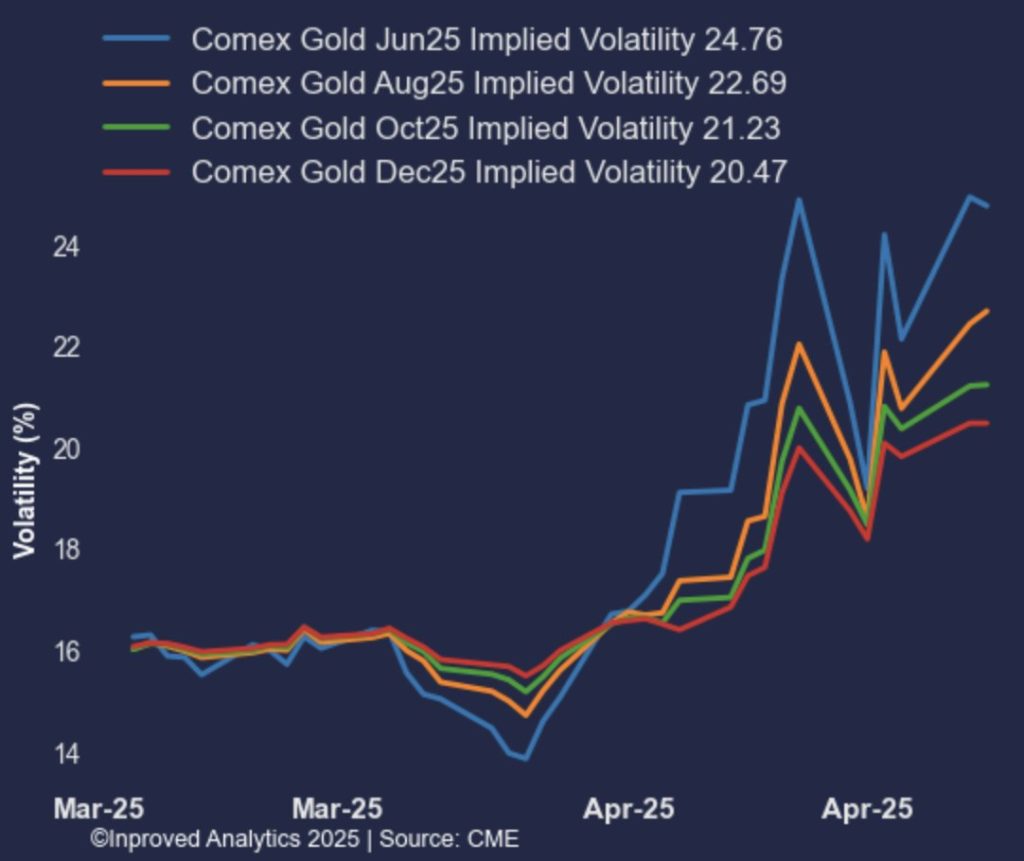

On the COMEX side, June 2025 gold is now trading within a tight 68.2% retracement zone between $3,301 and $3,396, with the 25-delta risk reversal skew holding at +1, suggesting a modest but firm bias toward call buying. The put wall remains at $3,000, a psychological and options-based support that traders are defending, but the energy is clearly being directed toward upside breakouts.

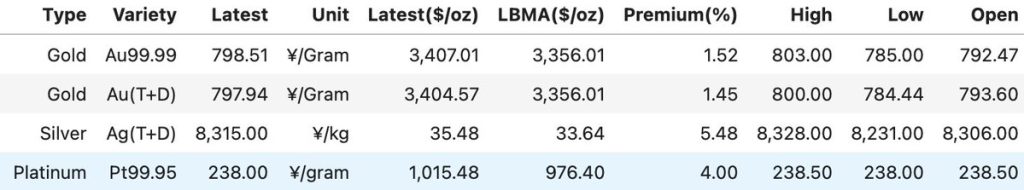

The fever is not confined to the futures arena. Physical premiums in China have continued to rip higher across consecutive sessions:

Today (April 25), gold is trading at ¥798/gram ($3,404/oz), a 1.45% premium over LBMA benchmarks.

In the previous three sessions, premiums have ranged from +1.3% to +1.4% — a consistent and steady premium that points to organic, not speculative, demand.

Meanwhile, silver is trading at $35.5/oz, a 5.5% premium, and platinum at $1,015.5/oz, 4% above LBMA — reflecting broader precious metals strength.

Pascal notes that these premiums are not an anomaly. “Premiums this consistent, across multiple metals, and across several trading days, show sustained real-world demand,” he says. “It’s not just futures traders betting on gold — it’s physical buyers voting with their money.”

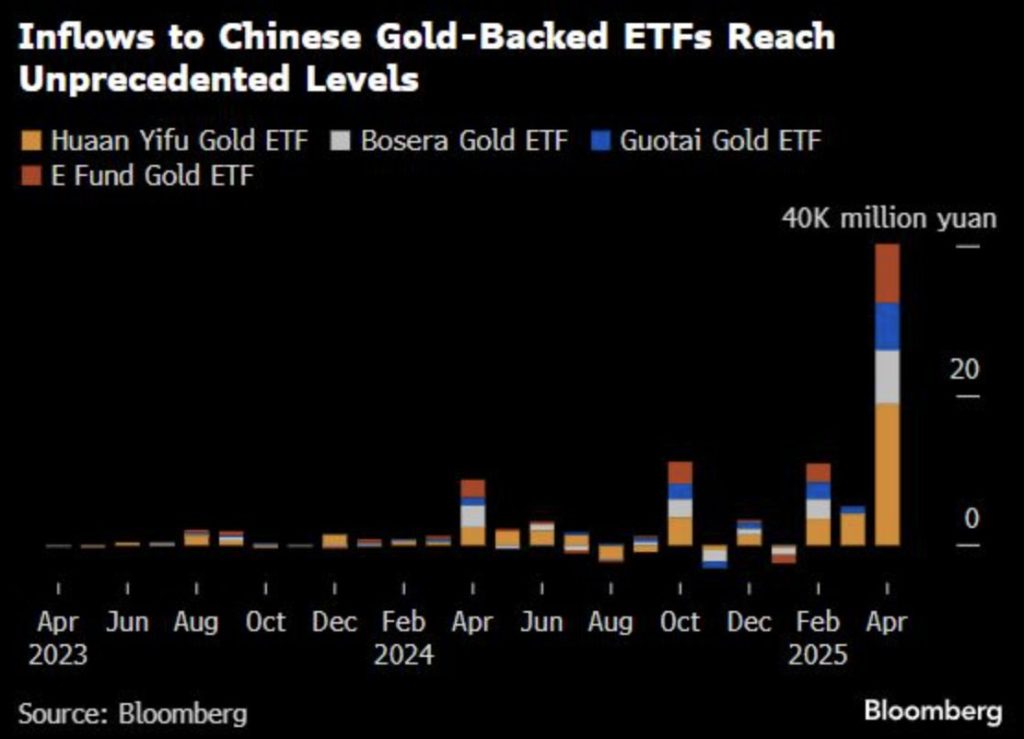

Exchange-Traded Fund (ETF) flows are confirming this, with inflows into Chinese gold ETFs hitting unprecedented levels. According to data sourced by Pascal and confirmed by the latest Bank of America report, gold fund inflows globally have already smashed the previous record set in 2020, with $80 billion flowing into precious metals funds in 2025 alone.

On the Shanghai Gold Exchange (SGE), the benchmark Au(T+D) rolling gold contract saw a massive 124.5 tons traded on April 22 — the highest since the COVID-19 liquidity panic. At the same time, the Shanghai Futures Exchange (SHFE) logged 1.2 million gold contracts traded — a six-year high, surpassing even the explosive sessions of April 2024.

Notably, on that same day, the June 2025 contract hit a new all-time high of ¥836.30/gram, equivalent to $3,555/oz COMEX equivalent, again reflecting that spot trading in Asia is now driving global price action, not merely reacting to it.

Pascal explains, “When Shanghai volumes lead, and Shanghai prices pull London and New York higher, you know the market’s power center has shifted. The East is now defining the risk narrative for precious metals.”

For bullion dealers, the current environment demands a complete reevaluation of inventory, pricing, and hedging strategies.

First, dealers should be prepared for rising acquisition costs. Premiums in China tend to leak into global markets with a lag of a few weeks. Maintaining higher-than-usual inventory buffers, especially for investment-grade bars and coins, will help cushion against sudden wholesale price increases and shipment delays.

Second, pricing models must adjust to incorporate premium volatility, not just spot movements. A flat “spot plus X%” model is likely to underperform. Dynamic repricing every 24 to 48 hours based on both Shanghai premiums and COMEX futures volatility would better align with real market risks.

Lastly, dealers must brace for sourcing challenges. As Pascal warns, “The real squeeze will come not from spot prices, but from the inability to replenish inventory at anywhere near previous costs.”

For diversified investors and institutional allocators, gold’s rise is no longer just about inflation or interest rates — it’s about global realignment.

Allocators must start treating precious metals as core strategic holdings, not just tactical hedges. Larger gold allocations — potentially rising from traditional 5% portfolio slices toward 10–15% — will be necessary to match the structural revaluation now underway.

Moreover, diversified holders should expand beyond traditional Western storage hubs. Allocating a portion of physical holdings into Asia, or diversifying between LBMA and Shanghai-approved custodians, can provide a critical layer of jurisdictional and liquidity security as global financial fragmentation continues.

Finally, exposure to silver and platinum must also rise. As gold premiums lead, these cousin metals tend to experience lagged but amplified secondary rallies. With silver trading +5.5% above LBMA and platinum +4% higher, the stage is set for a broader precious metals supercycle.

As Hugo Pascal concludes, “What we are witnessing now is not merely a market reaction — it’s a global recalibration of gold’s role in finance. And this recalibration is being priced in real time, led by Asia, accelerated by politics, and confirmed by every new ton that trades hands in Shanghai.”

Gold is no longer just insurance — it’s becoming infrastructure. And for those watching the vaults, the futures, and the flows, it is clear: The gold rush of 2025 is not the endgame — it’s only the beginning.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions