| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

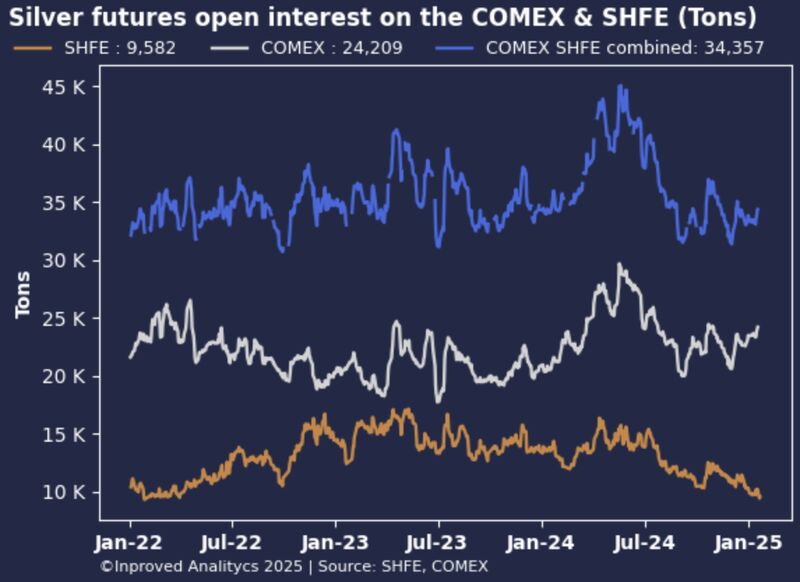

In the global silver market, a curious divergence has emerged. On the COMEX in the United States, open interest in silver futures has been on the rise, reflecting growing investor engagement. Conversely, the Shanghai Futures Exchange (SHFE) in China is experiencing a slump, with open interest lingering near a three-year low. This contrast offers a window into the differing economic landscapes and investor sentiments between the West and China.

In the United States, the COMEX has witnessed a notable uptick in silver futures open interest. This increase is largely attributed to investors seeking safe-haven assets amid global economic uncertainties. The recent re-election of President Donald Trump has introduced policy unpredictability, prompting market participants to hedge against potential volatility. Additionally, the Federal Reserve’s indications of possible interest rate adjustments have influenced investment strategies, making precious metals like silver more attractive.

In stark contrast, the SHFE’s silver futures market is experiencing a downturn in open interest. Several factors contribute to this trend:

The contrasting trends between COMEX and SHFE highlight how local economic conditions and policies can significantly influence market behavior. In the West, the pursuit of safe-haven assets amid political and economic uncertainties has bolstered silver futures activity. Meanwhile, in China, a combination of economic slowdown, regulatory measures, and cautious consumer behavior has led to a contraction in the silver futures market.

This divergence underscores the importance of understanding regional dynamics when analyzing global commodity markets. Investors and analysts must consider how local factors, from economic growth rates to regulatory environments, can impact market participation and sentiment.

As the global economy continues to navigate through uncertainties, the silver market’s split behavior serves as a reminder of the complex interplay between local conditions and global trends.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions