| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

Gold is no longer just running — it’s galloping. Across both Eastern and Western markets, a synchronised wave of record-breaking activity is sweeping through the precious metals complex, turning a simmering bull market into a full-blown global rush. As China’s Spring Gold Trading Frenzy 2.0 hits its stride, traders and institutions across continents are reinforcing gold’s status not merely as a safe haven, but as the anchor of a rapidly changing financial order.

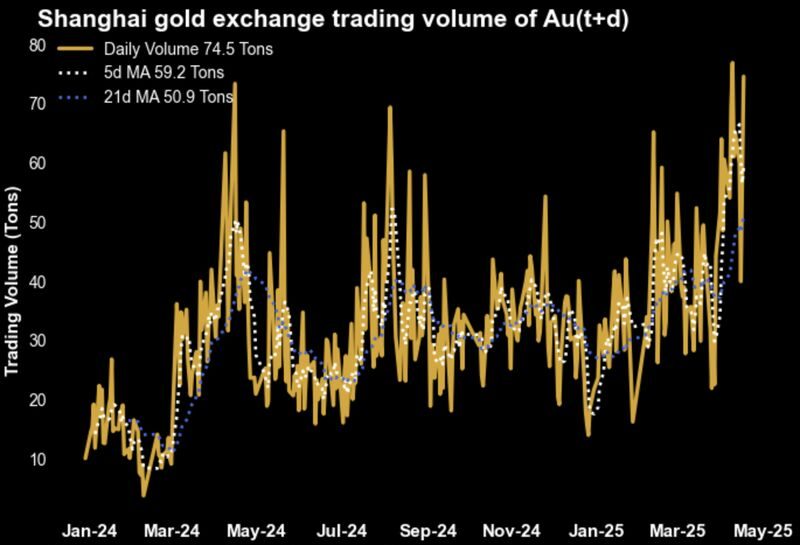

Three days ago, the Shanghai Gold Exchange (SGE) became the epicentre of this accelerating rally. According to data tracked by InProved’s Hugo Pascal, trading volume for the AU9999 contract — China’s primary physical gold proxy — exploded to 27 metric tons, while its highly liquid counterpart, Au(T+D), surged to 74.5 metric tons traded in a single day. These are not speculative flutters — these are multi-billion-dollar flows from institutions and high-net-worth buyers looking for safety, liquidity, and sovereignty in metal.

“This is what coordinated capital movement looks like,” Pascal said. “The Chinese market is confirming what we’re seeing globally — that gold is being re-rated not just as a hedge, but as a strategic asset. And they’re doing it through physical contracts, not just futures.”

The frenzy hasn’t stayed local. In the West, COMEX gold (June 2025) has pierced its previous ceiling, with the call wall migrating higher to $3,500, reflecting escalating demand for upside exposure. The contract now trades within its 68.2% retracement band between $3,295 and $3,397, and call options remain heavily bid, pushing the 25-delta risk reversal skew to 2.2 — one of the highest seen this year.

Meanwhile, gold’s physical market has surged in tandem with its derivatives. On the Shanghai Futures Exchange (SHFE), open interest in gold futures spiked to 420,000 contracts, an 11-month high, as Chinese traders responded to renewed geopolitical stress and ongoing yuan depreciation. The June contract set a new all-time high at ¥781.60/gram, equivalent to $3,324/oz on COMEX terms — a clear signal that Eastern price discovery is now consistently leading the global market.

Pascal points to the political trigger behind this acceleration: Donald Trump’s latest public comments regarding U.S.–China trade tensions and broader macroeconomic uncertainty. “His rhetoric has always pushed precious metals higher,” Pascal noted. “But what’s different now is that the reaction is immediate and led by Asia. Chinese gold buyers aren’t waiting — they’re bidding aggressively into every dip, often pushing spot gold higher before New York even opens.”

That behavior was evident four days ago, when spot gold (XAUUSD) surged to $3,275/oz, or $105,300/kg, during Asian trading hours — well ahead of any Western flows. Notably, this move came directly after Trump’s remarks, and broke above the then-call wall at $3,250, cementing a bullish breakout that has since gathered momentum.

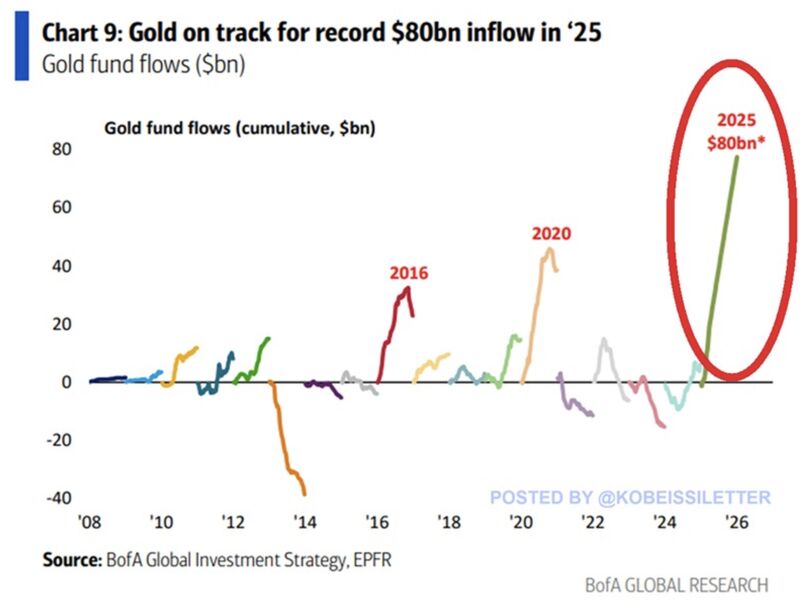

Even more telling is the flood of capital into precious metals investment vehicles. As reported by Bank of America Global Investment Strategy, gold fund inflows in 2025 have smashed all previous records, reaching $80 billion year-to-date — more than double the previous high set during the 2020 pandemic-driven surge. This is not just hot money chasing a headline. This is deep, strategic allocation from global capital pools — including pensions, sovereign wealth, and multi-asset funds — repositioning for long-term protection.

“The scale of inflows is a function of global realignment,” Pascal explained. “You have nations building reserves, institutions responding to currency devaluation risk, and individuals front-running inflation. All of it funnels into the same asset — and right now, that asset is gold.”

Even the broader metals complex is responding. Silver traded as high as $34.80/oz, reflecting a 7.5% premium to the LBMA, while platinum climbed to $998/oz, a 3.7% premium. In Shanghai, gold premiums also widened, with local spot trading at ¥773/gram ($3,284/oz), or +0.8% above LBMA levels. These consistent premiums point to a broader truth: that gold (and its cousins) are becoming physically scarce and politically essential.

Looking ahead, Pascal warns that the current dynamics may only be the beginning. “If call walls keep shifting higher and physical demand remains this robust, we could see a regime change in how gold is priced globally. We’re moving from a dollar-driven framework to a bi-polar one — where Asia sets the tone, and the West follows.”

For clients of InProved, this is a clarion call to action. Whether you’re a central bank, private wealth advisor, or industrial hedger, the message is clear: the world is repricing gold — not just in futures curves, but in vaults, wallets, and policy playbooks.

With trading volumes surging in Shanghai, options exploding on COMEX, fund flows smashing records, and spot prices rewriting history almost daily, we are now deep into a new era of gold — one where physical ownership, timing, and location matter more than ever.

The Spring Gold Frenzy is no longer a trend. It’s the new normal.

About Us

Information

Individual Solutions

Commercial Solutions