| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

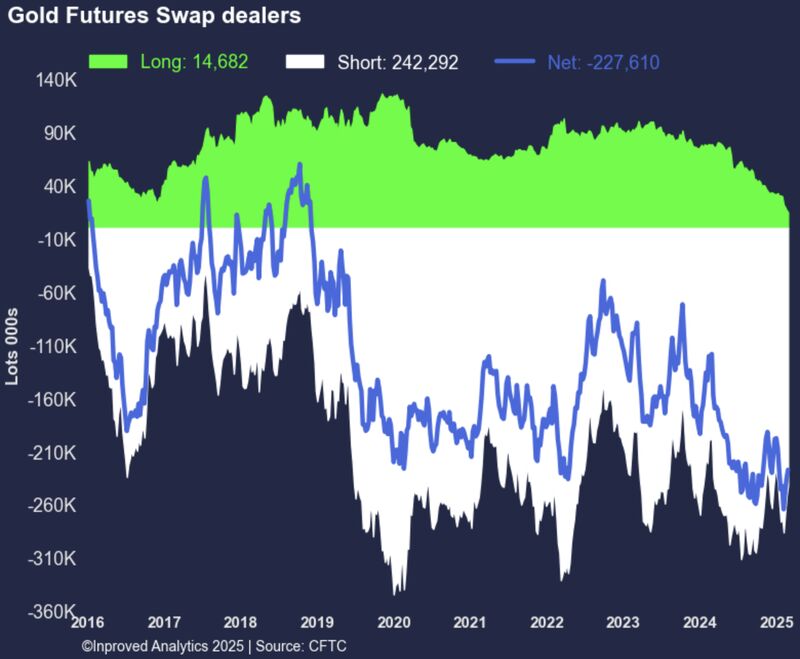

The gold market has seen a significant shift in positioning over the past few weeks, as swap dealers have begun unwinding their historically high short exposure. Hugo Pascal, Chief Investment Officer at InProved, has been closely tracking these developments, noting that swap dealers have now trimmed their net-short positions by 8,000 contracts, bringing their total short exposure down to -227,610 contracts—its lowest level in six weeks. Over the past three weeks, they have reduced their short exposure by 3.7 million ounces (-37,100 contracts), a move equivalent to $10.7 billion at current prices.

This reduction in short positioning is more than just a number on a trading report—it represents a critical shift in market sentiment that could have major implications for gold’s near-term trajectory. Historically, when swap dealers aggressively unwind short positions, it can signal an inflection point in the market, where bearish pressure eases, opening the door for further price gains.

At the same time, technical levels on COMEX’s April 2025 contract are coming into play. Gold is now trading within the key 68.2% retracement range of $2,902 to $2,959, a zone that often acts as a pivot for price action. The 25 delta risk reversal (skew) sits at just 0.1, suggesting a balanced market, where neither bullish nor bearish options traders are showing strong conviction. Meanwhile, the put wall at $2,805 indicates that a significant amount of downside protection is in place, meaning this level is likely to act as a strong support zone in case of a pullback.

Swap dealers are large financial institutions—typically investment banks or hedge funds—that facilitate liquidity in the gold futures market. They play a key role in the ecosystem by hedging client positions, providing market-making services, and sometimes taking speculative bets of their own.

When swap dealers hold large short positions, it often means they are providing liquidity to investors who are long on gold—such as hedge funds, central banks, or institutional asset managers. Conversely, when they reduce their short exposure, it suggests either that they are buying back contracts to lock in profits or that their outlook on gold has shifted.

The fact that swap dealers have reduced their short exposure by 3.7 million ounces in just three weeks is a sign that bearish bets are being unwound. Whether this is simply profit-taking or a broader shift in sentiment remains to be seen, but history suggests that when large institutions begin covering shorts at this pace, it often precedes a period of price appreciation.

The 68.2% retracement level—derived from Fibonacci analysis—is one of the most widely watched technical indicators in trading. It represents a key point where previous price moves often stall or reverse. Gold’s current range of $2,902 to $2,959 on the April 2025 contract suggests that the market is at a crossroads: if gold can break above the upper boundary, it may trigger momentum buying, while a failure to hold this zone could lead to a short-term pullback.

This level is particularly important in light of the ongoing short covering by swap dealers. If these institutions continue to reduce their bearish exposure while gold is testing a major technical zone, it could set the stage for a breakout to higher levels.

Similar episodes of aggressive short covering have played out in the past, often leading to substantial price movements.

The common theme in these scenarios is that when swap dealers start aggressively reducing their short exposure, it often coincides with a broader shift in sentiment—one that tends to favor higher gold prices.

With swap dealers unwinding their short positions at the fastest pace in weeks and gold trading within a key retracement zone, the near-term outlook suggests that the path of least resistance may be higher. If gold can break decisively above $2,959, it could set off a new wave of buying, potentially challenging higher resistance levels in the coming weeks.

On the downside, the put wall at $2,805 provides a critical support level. This means that if gold does experience a pullback, it is likely to find strong buying interest at this level, as traders who previously hedged their downside risk may start unwinding those positions.

The combination of short covering, technical positioning, and macroeconomic uncertainty makes this a pivotal moment for gold. With inflation still a concern, central banks continuing to buy, and institutional players adjusting their exposure, all signs point to gold remaining a focal point for investors in the weeks ahead.

Hugo Pascal’s analysis highlights how market structure changes can provide early clues to major price moves. Whether gold follows the historical script and rallies further remains to be seen, but if past episodes are any guide, the unwinding of swap dealer shorts could be signaling that gold is gearing up for its next leg higher.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions