| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

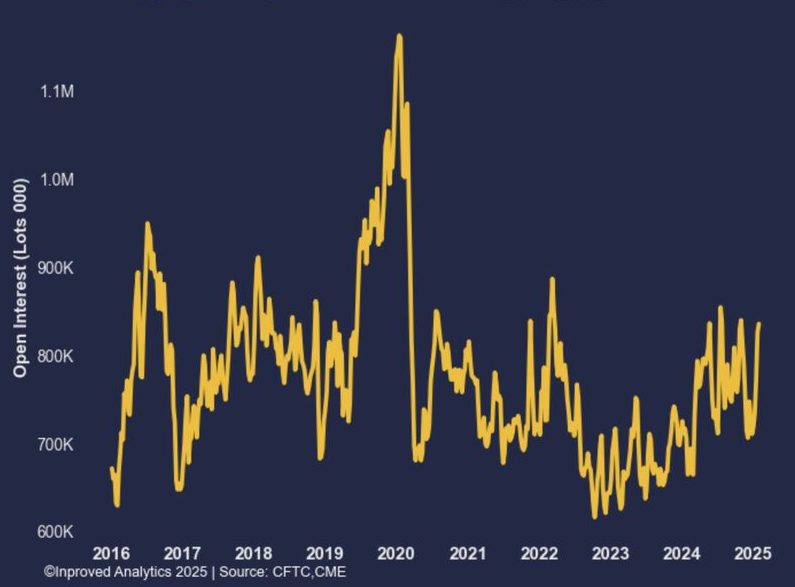

The precious metals market is heating up. Hugo Pascal, Chief Investment Officer at InProved, recently highlighted a significant shift in market dynamics: aggregated open interest across the entire precious metals complex has surged to a three-month high, reaching 836,000 contracts. Year-to-date, open interest has climbed 16.24%, signaling renewed engagement from traders and investors alike.

This uptick in open interest is more than just a statistical move—it reflects growing conviction in the precious metals sector, as market participants position themselves for what lies ahead. A rising open interest typically indicates that new capital is flowing into the market, rather than just existing positions being rolled over. The sustained increase suggests that traders are actively building positions, whether for speculative opportunities, hedging purposes, or long-term strategic investments.

The timing of this surge is no coincidence. Precious metals have been gaining attention amid an increasingly complex macroeconomic landscape. Inflation remains a key concern, with central banks continuing to balance monetary tightening against economic stability. Gold, silver, and other metals often thrive in these conditions, serving as both inflation hedges and safe-haven assets. The renewed interest in precious metals futures suggests that investors are recalibrating their portfolios, bracing for potential economic turbulence ahead.

Beyond the macroeconomic backdrop, the industrial demand for silver and platinum group metals (PGMs) is also playing a role in this surge. Silver, in particular, has seen increased attention due to its critical role in solar panel production and green energy technologies. The global push toward renewable energy has reinforced silver’s dual status as both a monetary metal and an industrial commodity, drawing fresh capital into the market. Meanwhile, platinum and palladium continue to be essential for the automotive sector, with demand fluctuations often influencing futures positioning.

The rise in open interest also suggests a growing speculative appetite. Hedge funds and institutional traders are likely taking positions in anticipation of price volatility, particularly as global uncertainty lingers. The movement in open interest aligns with the idea that traders are preparing for significant market shifts, possibly expecting breakouts in gold and silver prices or volatility-driven opportunities in other precious metals.

With open interest at its highest level in three months and year-to-date growth exceeding 16%, the precious metals market is showing clear signs of growing investor engagement. Whether this trend continues will depend on a range of factors, including central bank policies, economic data releases, and broader shifts in risk sentiment. But one thing is certain—precious metals are back in focus, and the market is paying attention.

Hugo Pascal’s analysis once again highlights the shifting landscape in precious metals, providing key insights into the market’s evolving trends. As traders and investors navigate this environment, the surge in open interest serves as a strong signal that the precious metals complex is gearing up for an active and potentially volatile period ahead.

About Us

Information

Individual Solutions

Commercial Solutions