| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

In the ever-volatile world of precious metals, silver is proving once again that it is anything but quiet. As geopolitical headlines and speculative positioning collide, the market is responding with a clear signal: physical demand is intensifying, institutional flows are building, and investors are leaning heavily into upside risk — especially ahead of a potential second Trump presidency.

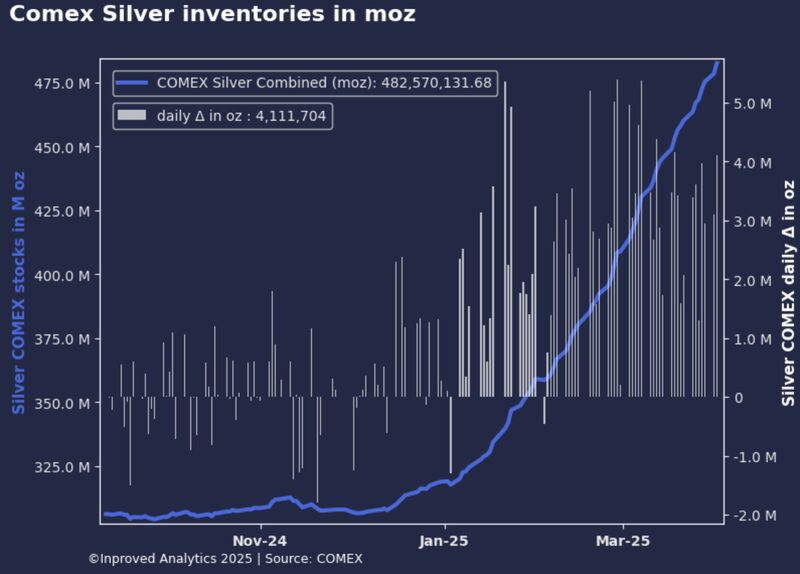

On Tuesday — Day 40 in the lead-up to the May COMEX delivery window — silver inventories at COMEX vaults surged by 4.1 million ounces, or 128 metric tons, pushing total holdings to a record 482.6 million ounces. According to Hugo Pascal, Chief Investment Officer at InProved and one of the industry’s leading interpreters of the precious metals ecosystem, this kind of vault behavior is both anticipatory and reactionary. “We’re seeing a real alignment of institutional readiness and macro uncertainty,” Pascal says. “The market is preparing for physical delivery risk and pricing volatility — not just trading it.”

The numbers on the screen support his view. Silver is now trading at $35.65 per ounce, representing a 6.2% premium over the LBMA benchmark. This kind of pricing divergence typically only occurs when physical delivery expectations tighten, or when local supply is being absorbed faster than it can be replenished. That may well be the case today, especially as market participants brace for the ripple effects of Donald Trump’s aggressive policy posture. His re-election campaign is already shaking global supply chain assumptions and injecting a level of uncertainty that historically pushes investors toward tangible hedges — and silver, with its dual industrial and monetary roles, fits the bill.

One key indicator of how this tension is translating into market behavior lies in the Exchange for Physical (EFP) spread, which now sits at $0.78/oz for May 2025 versus spot (XAGUSD). EFP spreads are widening as arbitrage between paper and physical markets grows more expensive — a sign of physical tightness or premium volatility. This is not dissimilar to what happened in early 2020, when supply chain disruptions and demand spikes forced market participants to pay premiums well above futures prices just to secure physical silver.

But the clearest signal of where the market believes silver is heading lies in the options space. Short-term demand for upside calls has surged, with the 25-delta risk reversal skew for May 2025 contracts now at 3.0, and 3.4 for July 2025 — one of the most bullish configurations seen this year. Traders are aggressively pricing in upside volatility, paying a premium for calls relative to puts, and anchoring their downside hedging around the $32 “put wall”. This level is now a critical support in the derivatives market — a kind of insurance floor where hedging demand is most concentrated.

Pascal highlights that this setup reflects more than just trader sentiment. “The skew tells you that institutions are not just positioned for higher silver prices — they’re willing to pay for it. That’s a fundamental difference from passive allocation,” he notes. “This is targeted, strategic deployment of capital based on real-world risk.”

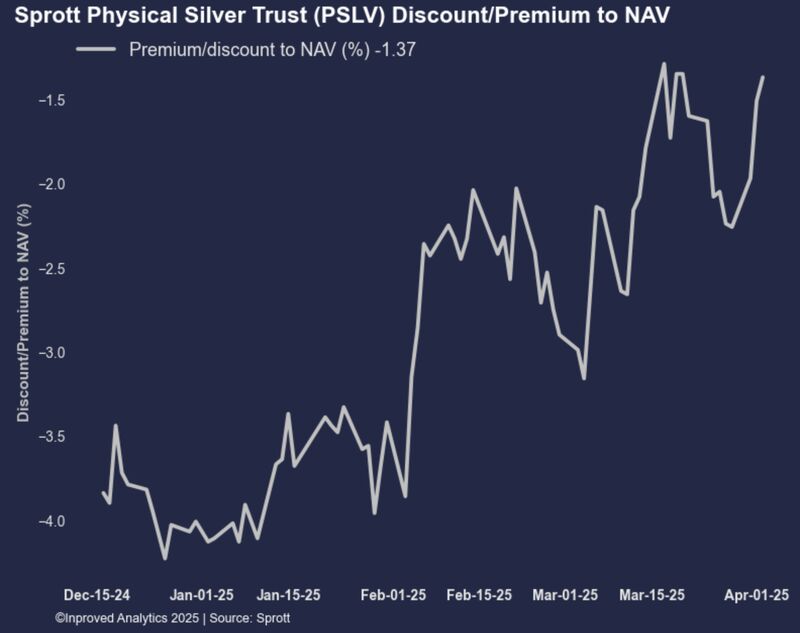

And those risks are very real. Trade tensions, particularly from the U.S. side, could compress industrial margins and incentivize resource stockpiling — something that historically benefits metals like silver, which is essential to everything from solar panels to electronics. China’s vault inventories are already thinning, while speculative positioning on the SHFE is reaching new highs. In the West, the Sprott Physical Silver Trust (PSLV), a barometer of physical silver investor appetite, continues to trade at a discount of -1.4% — narrower than recent months, and another hint that investor confidence in silver’s long-term trajectory is firming.

What we’re seeing is not merely a tactical adjustment. The structural backdrop is shifting. Silver is becoming more difficult to source at spot benchmarks, futures are being used for preemptive hedging, and option markets are skewing hard toward calls — all while physical vaults continue to swell in preparation for what may be a turbulent second quarter.

Pascal believes that this convergence of positioning and policy risk could produce a critical inflection point. “The premiums, the vault flows, the skew — they’re all aligning. If Trump’s trade agenda gains more traction, or if inflation fears re-escalate, silver will likely be one of the first assets to break out of its current range and reprice higher.”

In other words, silver isn’t waiting for the news to confirm it. The market is already acting.

And for InProved clients, the takeaway is clear: physical silver demand is tightening, options markets are signaling directional conviction, and the political calendar is quickly becoming the most important chart on the wall. Whether for industrial producers, long-term investors, or hedged portfolios, the opportunity — and risk — in silver is rising.

About Us

Information

Individual Solutions

Commercial Solutions