| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

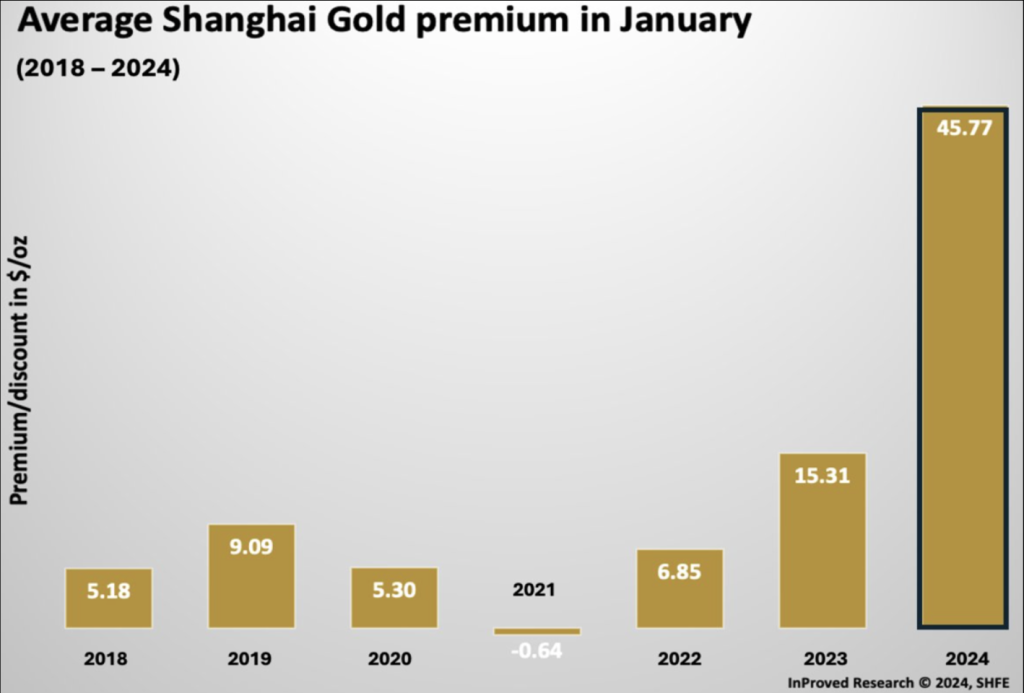

The physical proxy on the Shanghai Gold Exchange (SGE), premium was elevated. Below we list down the key indicators and what this means for the Chinese gold demand:

About Us

Information

Individual Solutions

Commercial Solutions