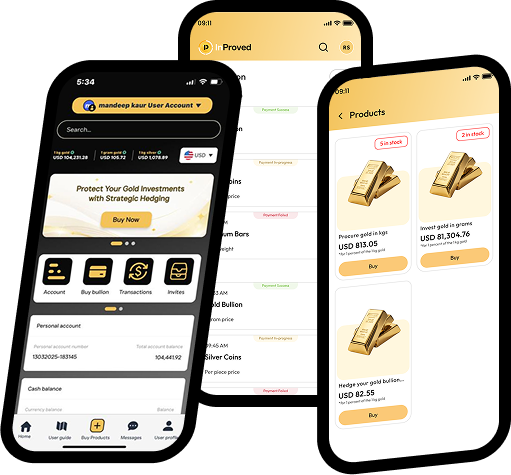

InProved – bullion investing, evolved

InProved is a technology-driven bullion platform designed to maximize price and tax efficiencies for savers and investors. We believe in absolute transparency, direct market access, and real-time pricing, so you never overpay for your gold, silver, or platinum investments. Our mission is to provide institutional-grade pricing and tax advantages to every investor—without the need for expensive brokerage services or middlemen.

InProved vs Singapore

InProved offers lower premiums and transparent pricing for gold & silver in real time

Product

InProved

Other singapore suppliers

Save upto

Action

Gold - 1kg

1kg of 99.99% fine gold, LBMA-approved, stamped with weight, purity & refiner mark.

Buy at %

USD

Premium %

USD

USD

Gold - 100gram

100g of 99.99% pure gold, fully backed under InProved’s bullion savings program.

Buy at %

USD

Premium %

USD

USD

Silver - 1kg

1kg of 99.99% fine silver, LBMA-approved, stamped with weight, purity & refiner mark.

Buy at %

USD

Premium %

USD

USD

Silver - 100oz

1 gram of 99.99% pure silver, fully backed under InProved’s bullion savings program.

Buy at %

USD

Premium %

USD

USD

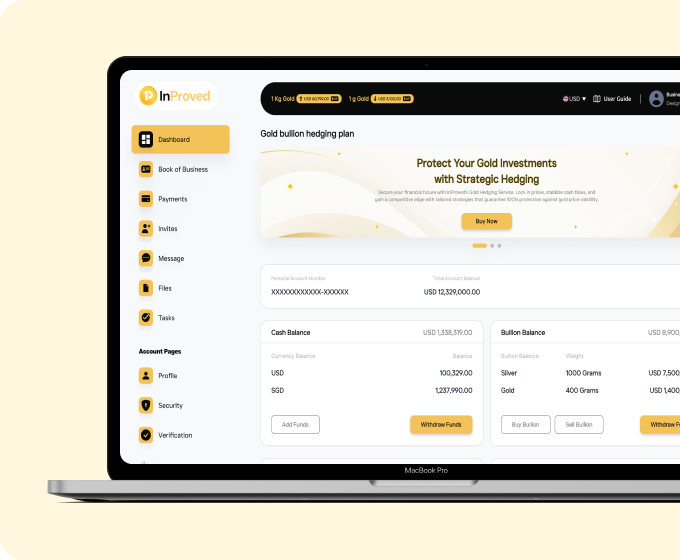

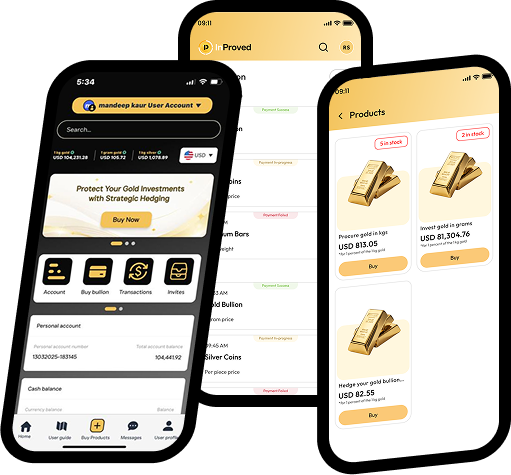

With InProved, you gain access to a diverse range of bullion investment options, all backed by real-time pricing and industry-leading efficiency. Whether you’re buying, saving, or hedging, we provide the best tools to protect and grow your wealth.

Physical Bullion – Buy and store tax-free in Singapore

Bullion Savings Plans – Save in grams, convert to bars anytime

Futures & Options – Hedge price exposure with ease

Family Office Solutions – Build a tax-efficient bullion investment structure

Already holding Physical Gold Bars? Silver Bars? Platinum Bars?

Secure your physical bullion with expert hedging strategies.

Why choose InProved?

Spend smarter, lower your bills, get cashback on everything you buy, and unlock credit to grow your business.

Proprietary real-time data

Track price trends without paying for expensive data terminals.

No need for bloomberg or reuters

Get the same institutional-level insights for free.

Flexible funding options

Fund your investments using cash or crypto.

Real-time price alerts

Get notified instantly when key price points are reached.

Speak to an analyst

Make an appointment with our investment experts for in-depth insights on precious metals price trajectories.

Frequently asked questions

Don’t see your question answered? Get in touch with us!

Why does InProved consistently offer lower premiums than Singapore suppliers?

InProved leverages direct supplier relationships, proprietary pricing algorithms, and tax-efficient structures to pass cost savings directly to users. Unlike traditional bullion dealers who add retail markups, our platform ensures that buyers always get the most competitive prices through:

Additionally, first-time savers can enjoy unbeatable premiums on their first 1kg gold, silver, or platinum bar—something unmatched in the Singapore market.

How does InProved provide institutional-grade pricing to retail investors?

Unlike traditional bullion shops that source through distributors, InProved operates on a direct-market model that prioritizes price efficiency and investor returns:

Because we offer direct access to institutional pricing and reinvest a portion of our trading profits into price optimization, even retail investors can buy at near-wholesale premiums—something no traditional Singapore dealer offers.

Are InProved’s prices updated in real-time, and how do they compare to global benchmarks?

Yes! InProved’s prices are automatically updated in real-time based on:

Every trade you make on InProved.com reflects real-time pricing, ensuring you are never overpaying based on outdated or artificially marked-up prices.

Additionally, our platform compares live premiums from multiple Singapore suppliers, so you can always see how much you’re saving with InProved.

How do I ensure I’m getting the best price when purchasing gold, silver, or platinum?

With InProved’s Price Comparison Tool, you can instantly compare:

Furthermore, InProved users can set price alerts—so you’ll be notified the moment your ideal price is reached.

Why are InProved's tax advantages better than traditional bullion dealers in Singapore?

Singapore is already a tax-friendly jurisdiction for bullion, but InProved takes it further by offering even more efficiencies:

Unlike traditional dealers, who offer only personal ownership options, InProved allows you to structure your holdings for maximum efficiency.

Can I hedge my physical bullion exposure while still benefiting from price efficiencies?

Yes! InProved offers a comprehensive hedging strategy for investors who already own physical bullion but want to:

If you already own physical gold, silver, or platinum, speak to our team about hedging strategies that maintain your exposure while unlocking liquidity.

How does InProved’s pricing structure remain competitive even in volatile markets?

InProved continuously optimizes its pricing model to ensure it outperforms traditional bullion retailers by leveraging data-driven market intelligence and a unique profit pass-back mechanism:

Even in volatile markets, our pricing remains competitive, transparent, and efficient—something no other Singapore supplier can match.

Can't find the answer you're looking for? Please chat to our friendly team.

Get in touch

Capture price & tax efficiency in precious metals investing

Create your free account in under a minute and start building your precious metals portfolio with the best premiums in Singapore

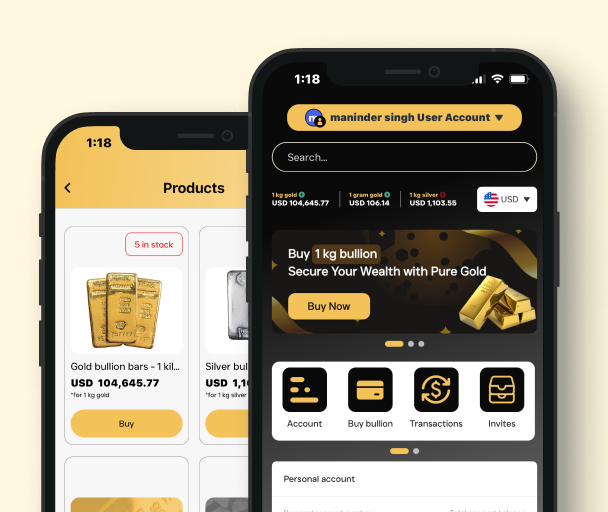

Available now on iOS and Android

Latest articles

Tool and strategies modern teams need to help their companies grow.

Invite users to stay updated with exclusive insights and market trends by subscribing to the newsletter.