| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

In the ever-fluctuating landscape of precious metals, gold stands as a resilient beacon of value. Despite a recent negative weekly close, with prices at $2,347.2 down by 2.76%, the underlying bullish sentiment remains robust. Understanding the intricacies behind this seemingly contradictory movement and preparing for potential volatility ahead, particularly with the Federal Reserve on tap for Wednesday, is crucial for investors seeking to capitalize on the gold market’s potential.

The recent dip in gold prices is normal and healthy, it’s part of precious metals DNA influenced by various factors such as economic indicators, geopolitical tensions, and market sentiment. However, it’s essential to look beyond the immediate downturn and analyze broader trends to gain a clearer perspective on the market’s direction.

After a sharp decline at the beginning of last week, Gold quickly bounced off its put wall (highest negative gamma) around $2300/$2310 signaling resilience from the buyers, defending a short-term support level. This resilience suggests that underlying factors supporting the bullish outlook for gold remain intact.

Additionally, understanding the significance of daily key levels, such as the +/-1 standard deviation expected move ($2,325/$2,369 for April 29th ), the $2,280 put wall, and the call wall at $2,400 acting like a resistance, provides valuable insight into potential price movements and areas of support and resistance.

With the Federal Reserve scheduled on Wednesday, the gold market is likely to experience an increase in volatility. As we expect Powell to make a Hawkish pivot, traders should be prepared to brace for significant volatility in the gold market and keep an eye on important levels such as put wall and gamma levels.

Investors should approach this period of heightened volatility with caution and a strategic mindset. While volatility presents opportunities for profit, it also carries increased risks. Implementing risk management strategies, such as zero cost collar, can help mitigate potential losses during turbulent market conditions.

Despite short-term fluctuations and potential volatility, the long-term outlook for gold remains bullish. Several fundamental factors support this optimistic view, including ongoing economic uncertainty, inflationary pressures, geopolitical instability and China loading up on the yellow metal while reducing their dependance on US treasury ( fell to $775 billion in February, a drop of $22.7 billion from a month earlier).

Investors with a long-term perspective should focus on the underlying fundamentals driving the demand for gold rather than short-term price movements. By maintaining a disciplined investment approach and focusing on the intrinsic value of gold as a portfolio diversifier and wealth preservation tool, investors can navigate market volatility with confidence.

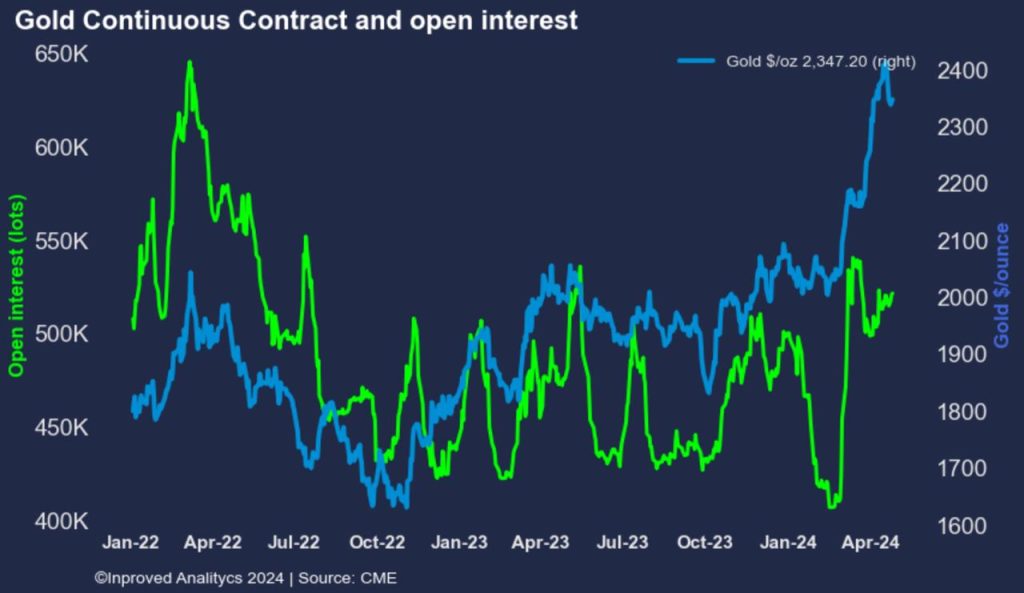

Speculators on the SHFE have reduced their long bets since Monday’s 15 frenzy (2.99 X OI) but volume remains elevated at 0.89 times open interest, while historical average is about 0.62

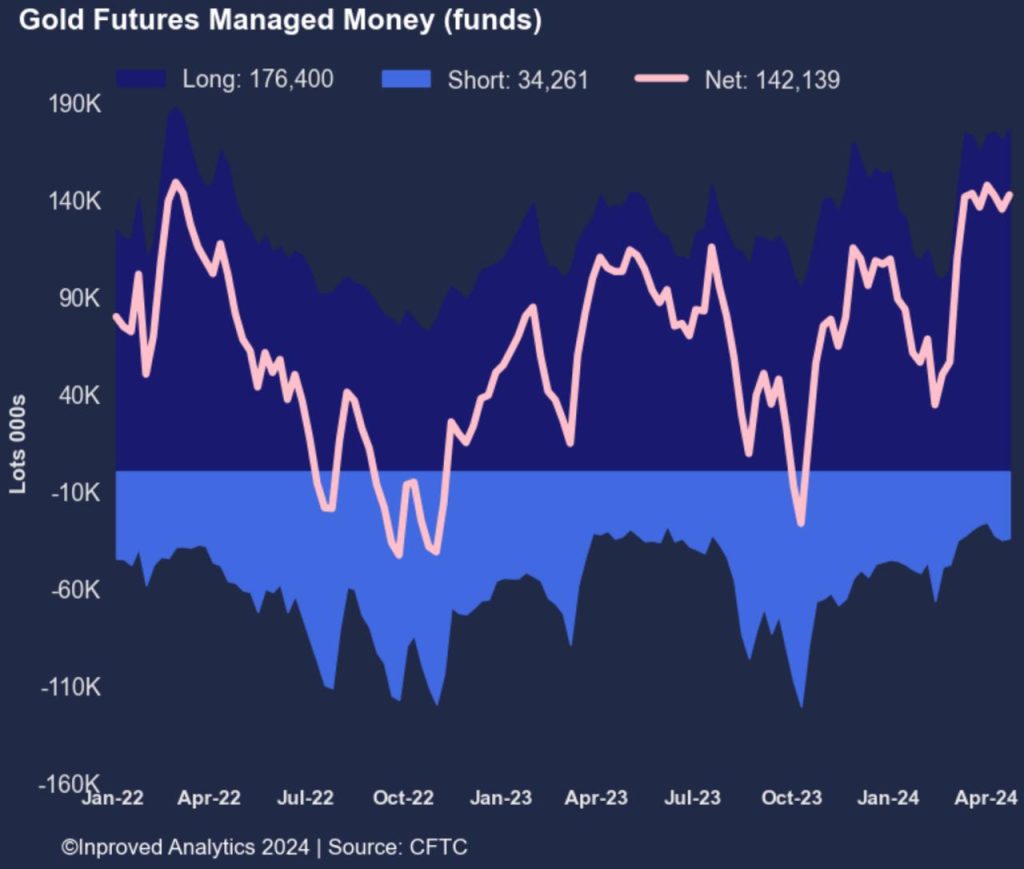

From feb 13 to April 23 speculative funds have increased their net long length by 335 tonnes, highlighting the strength of this rally

Looking ahead, the sustainability of gold prices above $2,250 an ounce depends on a complex interplay of factors. While the current drivers may support high prices in the short term, any significant economic recovery shift in monetary policy could affect gold’s appeal. Investor behavior will also play a critical role. If gold continues to provide strong returns, and prices can stabilize around this level without a “severe” correction it will likely attract more investment, supporting higher prices.

In conclusion, while recent fluctuations in gold prices is nothing but healthy , the underlying bullish outlook for the precious metal remains intact. Understanding the dynamics driving short-term movements, preparing for potential volatility ahead, and maintaining a long-term perspective are essential for navigating the gold market successfully. By staying informed, exercising caution, and focusing on the fundamentals, investors can capitalize on the opportunities presented by gold’s enduring appeal in the global financial landscape. For more in-depth articles and data, take a look at our latest gold updates page.

About Us

Information

Individual Solutions

Commercial Solutions