Invest confidently in real gold and silver, stored securely with Brink’s Singapore.

Invest confidently in real gold and silver, stored securely with Brink’s Singapore.

At InProved, we help investors grow and protect wealth through tax-efficient gold and silver investments. Partnering with Brink’s Singapore, we provide secure, reliable storage for high-quality bullion, making investing simple and accessible. Our mission is to offer a trusted platform for diversifying portfolios and maximizing long-term value in a world-class facility.

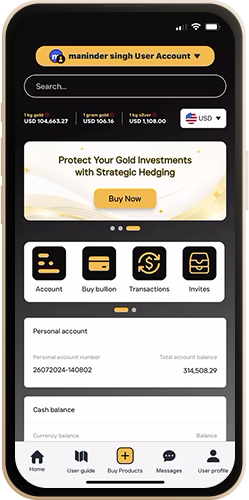

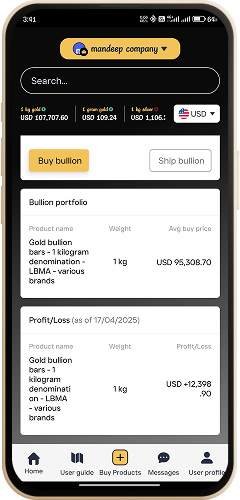

Your bullion platform

Our bullion platform offers a seamless and secure way to buy, store, and manage precious metals with complete peace of mind. Backed by trusted partners and regulated by authorities, the platform ensures real-time pricing, fully insured storage, and transparent ownership — empowering investors to confidently grow and protect their wealth anytime, anywhere.

Better Investment, Tax-Free

Investing in tax-free bullion is a smart way to grow and protect your wealth. It offers long-term value, shields against inflation, and helps you save more by avoiding unnecessary taxes. Let your money work smarter, not harder.

Access to storage and refineries

Your access pass to world-class storage and trusted refineries

It’s not what you earn, but what you save

Transform your wealth with tax-free benefits and efficient investment structures

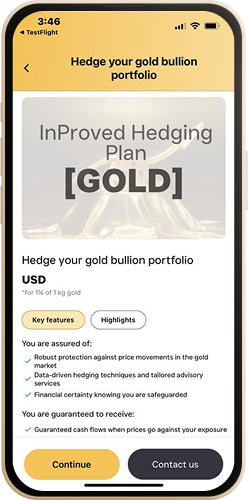

Hedge smart, preserve value

Protect your portfolio – hedge your wealth with InProved.

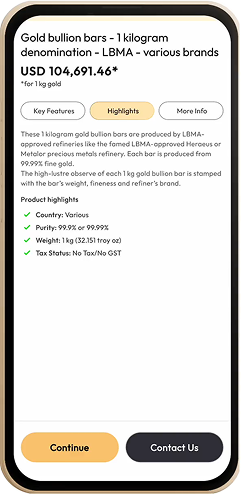

We supply from these refineries

.png)

.png)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.png)

.png)

.png)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.png)

InProved platform is designed to facilitate not only secure bullion investment but also the development and growth of individual and collaborative bullion ventures, offering a comprehensive solution for investors and entrepreneurs seeking to build lasting value in the precious metals industry.

Contact usOur trusted partners

Insightful articles and updates on the latest trends in bullion investment.

What people say about us.

"I started small with InProved’s savings plan and now hold over 500g of gold. It’s simple, secure, and reassuring."

Educator from Serangoon

"As a crypto investor, InProved gave me a way to balance my portfolio with physical assets. The app is clean and powerful."

Startup Founder in Tanjong Pagar

"Buying and storing silver through InProved was surprisingly easy. Knowing it’s in Singapore with Brink’s gives me peace of mind."

Retiree from Bedok

Invite users to stay updated with exclusive insights and market trends by subscribing to the newsletter.