Why SGE?

Get more out of your precious metals investments by tracking SGE’s impact on global price trajectories. Compare SGE premiums to LBMA benchmark to make informed decisions.

Updated as of .

Type

Variety

Latest prices in ¥

Unit

Latest SGE prices (USD/oz)

Latest LBMA prices (USD/oz)

Price spread: SGE/LBMA (%)

Latest prices in ¥

High

Low

Open

Disclaimer: Chinese premiums won’t be accurate outside shanghai trading market hours (9:00 AM - 3:00 PM UTC+8). Neither Inproved nor any of its third party providers shall have any responsibility to maintain the data and services made available on this Web site.

Gain confidence in precious metals price trajectories

By understanding how SGE and LBMA prices interact, you can anticipate price movements and optimize your bullion investments.

1

1Spot divergent pricing early

SGE premiums can indicate global supply and demand trends before they appear in LBMA markets

2

2Anticipate market movements

Use SGE price shifts to predict trends in LBMA h real-time global price dynamics.

3

3Better hedging & investment decisions

Align your bullion savings or investment plans witKey benefits of understanding SGE vs LBMA

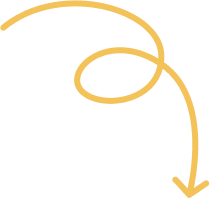

Why choose InProved?

Spend smarter, lower your bills, get cashback on everything you buy, and unlock credit to grow your business.

Proprietary real-time data

Gain access to exclusive SGE vs LBMA price analysis.

No need for expensive terminals

Get institutional-level data without paying thousands for bloomberg or reuters access.

Flexible funding

Invest using cash or crypto to access the bullion market with ease.

Real-time notifications

Set key price alerts to receive updates on your phone when critical price points are reached.

Personalized investment consultations

Make an appointment with our analysts to get expert insights on SGE vs LBMA trajectories.

Already holding physical gold bars? Silver bars? Platinum bars?

Speak to InProved about hedging these exposures and gain tax-free returns at the same time.

Talk to an expertEverything you need to know about the about SGE vs LBMA

Why does SGE often trade at a premium compared to LBMA?

SGE (Shanghai Gold Exchange) frequently trades at a premium over LBMA (London Bullion Market Association) due to:

However, during certain market conditions, SGE may trade at a discount when local liquidity tightens or demand weakens.

How can SGE premiums signal future price trends in global markets?

Investors who track SGE premiums can anticipate shifts in LBMA and COMEX gold prices.

What factors drive the difference between SGE and LBMA bullion prices?

Several key factors create price differences between SGE and LBMA:

By monitoring these factors, investors can identify arbitrage opportunities and make informed investment decisions.

Can I use SGE data to optimize my bullion savings plan?

Absolutely! SGE data provides early indicators of market trends that can enhance your savings strategy:

By integrating SGE insights into your bullion savings plan, you gain a strategic advantage.

How does China’s demand influence SGE premiums over LBMA?

China is the world’s largest gold consumer and second-largest producer, meaning:

If China buys aggressively, SGE premiums surge, often signaling higher LBMA prices ahead.

Is SGE vs LBMA arbitrage possible for individual investors?

Arbitrage opportunities exist, but access is limited for most retail investors:

Although direct arbitrage is challenging, tracking SGE helps investors position their bullion holdings strategically.

Does SGE pricing affect gold-backed ETFs and bullion derivatives?

Yes! SGE pricing can influence global bullion-backed ETFs & derivatives in several ways:

By tracking SGE price shifts, ETF investors can anticipate movements in global bullion-backed assets.

Can't find the answer you're looking for? Please chat to our friendly team.

Get in touch

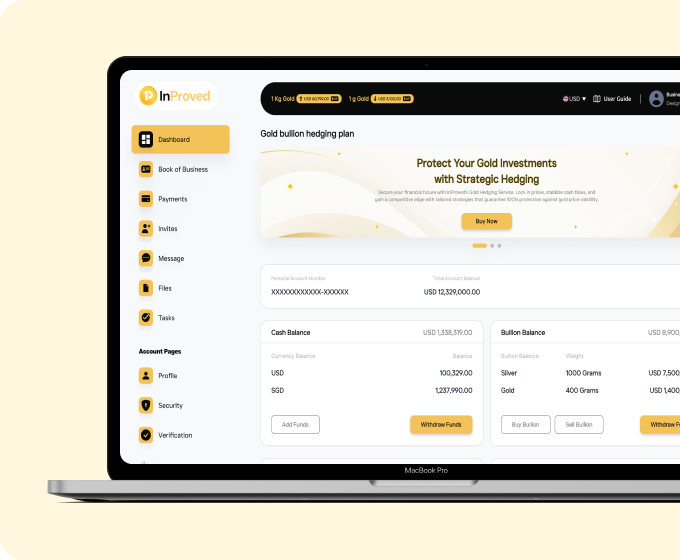

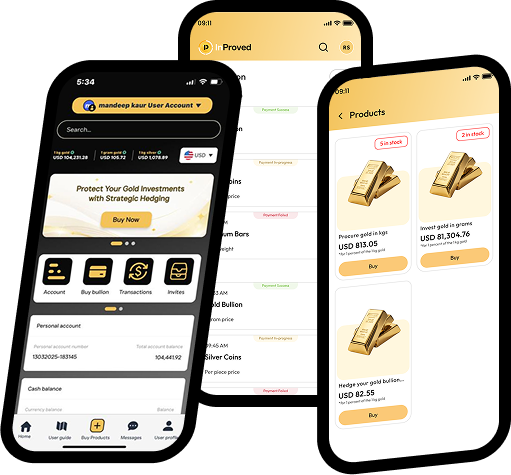

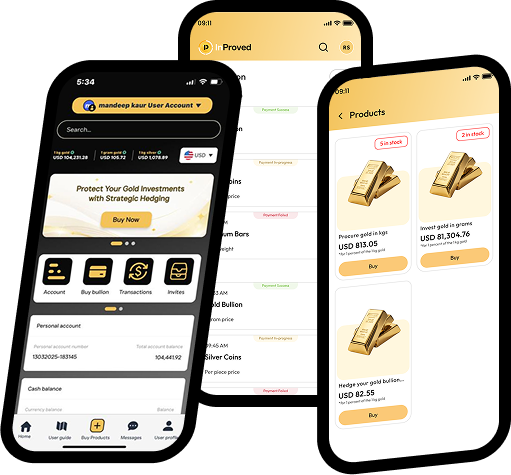

Do you want to master SGE precious metals prices?

Create your free account in under a minute and start a new way of gaining confidence in your precious metals portfolio.

Available now on iOS and Android

Latest articles

Tool and strategies modern teams need to help their companies grow.

Invite users to stay updated with exclusive insights and market trends by subscribing to the newsletter.