A Golden Resurgence: Shanghai Leads the Charge as Gold Premiums Surge in Trump Tariff Aftershock

Gold fever has returned to the East — and this time, it carries the heat of geopolitics, rising protectionism, and a physical market that refuses to be ignored.

In the wake of former U.S. President Donald Trump’s proposed return to sweeping tariffs, a ripple of reaction has swept across the global commodity markets. According to Hugo Pascal, Chief Investment Officer at InProved and a leading voice in global precious metals strategy, “we’re not just seeing price volatility — we’re watching a structural revaluation of physical gold unfold, led once again by Asia.”

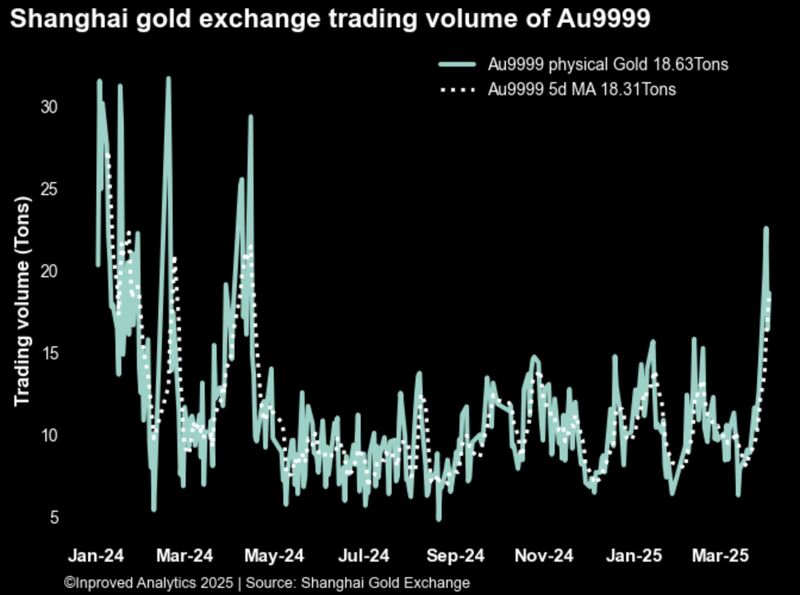

That sentiment is underscored by what’s happening in Shanghai, where physical gold demand has erupted into one of the most intense bursts of trading activity seen in over a year. The AU9999 contract — China’s benchmark physical proxy for gold on the Shanghai Gold Exchange (SGE) — has surged to exceptional levels.

Today, AU9999 posted a remarkable 22.6 tons traded, marking the most active session since April 15, 2024. The 5-day average now stands at 18.3 tons, the highest in a year, while the 21-day rolling average is up to 11.7 tons, the strongest in over four months.

Pascal explains, “This isn’t just speculative action. AU9999 is a delivery-focused contract — these are real ounces, bought by institutions and high-net-worth individuals looking for protection. The scale and frequency of volume show that trust in physical gold is deepening, especially in China.”

The catalyst? Trump’s proposed tariffs and the expectation of renewed economic friction. As seen during his first term, tariffs often lead to currency volatility, rising inflation, and a breakdown in global trade flows. China’s market is responding the same way it did then: by turning to gold.

Shanghai gold is now trading at ¥742/gram, or $3,162/oz, which is 0.6% above the LBMA benchmark — an increasingly significant premium. Meanwhile, silver in Shanghai trades at $35.65/oz, a 6.2% premium, and platinum at $1,016/oz, 3.7% above London pricing. The numbers are starting to echo conditions seen in 2020, when gold premiums widened globally as physical supply chains struggled to match demand.

Pascal adds, “What we’re seeing with these premiums is a clear signal that the East is once again repricing gold on its own terms. When Shanghai outpaces London, it tells you that physical demand is leading paper speculation — not the other way around.”

This is particularly important for vault dynamics. While the LBMA remains relatively stable on paper, ETF allocations are increasing, and whispers of delivery delays are beginning to surface. COMEX, on the other hand, is seeing inflows into its vaults — not withdrawals — indicating that institutions are quietly preparing for physical settlement risks, not just speculative upside.

Pascal believes that these conditions may widen: “If AU9999 continues to see 15–20 tons a day in volume, vault pressures will emerge by summer. Combine that with widening EFP spreads and rising options skews in the West, and you get a market where the physical and futures worlds start pulling in different directions.”

He’s quick to emphasize that this is not merely a flash-in-the-pan moment. “This isn’t just about tariffs — it’s about trust,” he says. “Gold is behaving as a sovereign hedge again. Whether it’s central banks, insurers, or family offices, smart money is watching these volumes and taking action.”

In previous cycles — 2008, 2011, and more recently in 2020 — such structural divergence between East and West markets foreshadowed sustained rallies. Shanghai’s performance, especially in AU9999, has historically acted as an early-warning system for tighter physical markets and higher global spot prices. Now, with both volume and premiums rising in tandem, we may be seeing the early stages of that pattern once more.

Pascal concludes with a clear signal for InProved clients and institutions: “Don’t underestimate regional demand. The East is not just buying — it’s setting the tone. If the West waits to catch up, they’ll be paying higher premiums to get access to the same ounces.”

With Shanghai lighting the fire and Washington fanning the flames with tariff rhetoric, it seems the world’s oldest safe-haven asset is once again reminding investors why it never went out of style. As China leads the gold market higher, the rest of the world may soon have no choice but to follow.

Latest articles

Tool and strategies modern teams need to help their companies grow.

Invite users to stay updated with exclusive insights and market trends by subscribing to the newsletter.

InProved Pte. Ltd. (“InProved”, UEN 201602269C). InProved is regulated by the Ministry of Law (“Minlaw”) and holds a Precious Stones and Precious Metals license for dealing in bullion products (PSPM License PS20190001819). For additional legal and privacy related information related to InProved, please visit are terms and conditions.

Our products and services are only available to Accredited Investors. Investing in bullion involves risk, and there is always the potential of losing money. Certain bullion products are not suitable for all investors. The rate of return on investments can vary widely over time, especially for long-term investments. Past performance is no guarantee of future results. Before investing, consider your investment objectives and any fees and expenses that may be charged by InProved and any third-party stakeholders. The content provided herein is for informational purposes only and is not investment or financial advice, tax or legal advice, an offer, solicitation of an offer, or advice to buy or sell or hold bullion products. This material has not been reviewed by the Minlaw.

Statements made are not facts, including statements regarding trends, market conditions and the experience or expertise of the author or quoted individual(s) are based on current expectations, estimates, opinions and/or beliefs. Opinions expressed by other members on InProved should not be viewed as investment recommendations from InProved. Endorsements were provided at the request of InProved. InProved is not affiliated with and does not purport to own or control any third-party content linked herein.

Copyright © 2025 InProved Pte Ltd (UEN 201616594C, PSPM license PS20190001819)