A Quiet Prelude to Gold’s Summer Rally: Shanghai Vaults, Weak Trading, and Volatility Setup

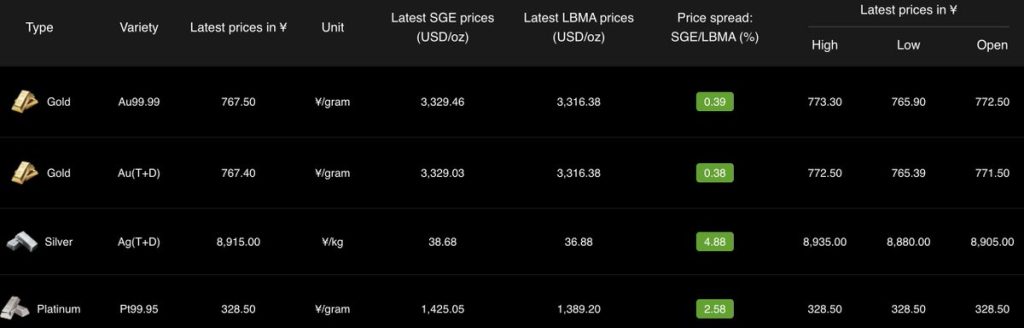

As of July 7, gold is trading at $3,329/oz, representing a 0.4% premium to the LBMA benchmark. This consistent spread, while modest, reveals a firm bid for physical metal globally. Although the premium hasn’t rocketed, its persistence reflects steady demand, especially among Asian buyers. While premiums alone don’t dictate the next move, they contribute to a broader narrative underpinning bullish sentiment.

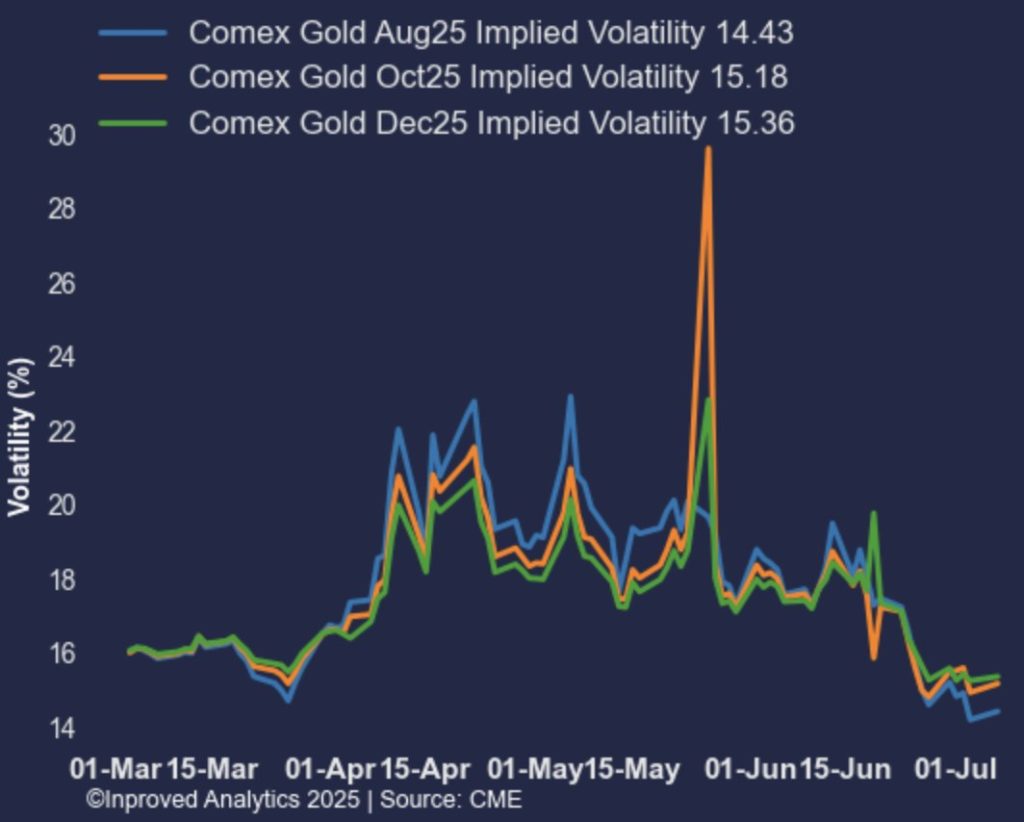

Gold’s at-the-money implied volatility has fallen to a three-month low. In the eyes of savvy market watchers like Hugo Pascal, this isn’t a sign of weakness—rather, it’s a signal. “Low IV just ahead of gold’s seasonal strength window sets the stage for asymmetric upside,” he notes. With this backdrop, buying calls becomes an attractive strategy: capped downside with theoretically unlimited gains if gold reignites upward momentum.

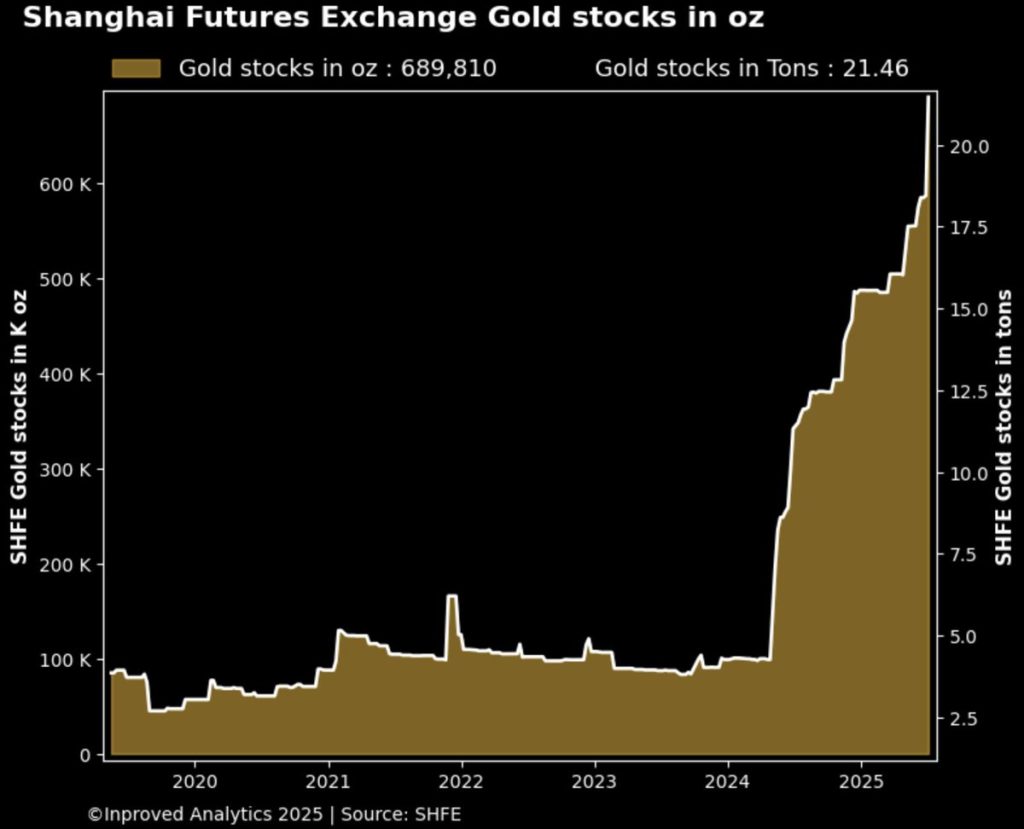

Across the world, Shanghai’s gold vaults recorded a steep 17.7% week-on-week increase, adding 21.5 tonnes (or about 3.2 tonnes/103,000 ounces). In a market where physical metal moves with measured precision, this inflow is significant. According to Pascal, “When vaults in Shanghai surge at this pace, it’s not periodic demand—it’s structural accumulation.” This suggests institutional and retail buyers are quietly positioning ahead of what they expect to be a meaningful price move later in the year.

Interestingly, while vault inflows are at their strongest in months, trading volume in Shanghai’s physical proxy contract (AU9999) has been weak—just 5 tonnes traded on July 3, the lowest since August 2024. Premiums remain at +0.4%, but the low turnover indicates that market participants are holding onto bullion rather than circulating it. Pascal interprets this as “a shift from transactional to contemplative positioning—vaults are going full; hands are now sticky.”

These layered signals—premium strength, vault inflows, low implied volatility, and muted volumes—coalesce around a powerful thesis: a steady accumulation phase before seasonal strength arrives. Summer often sparks inflows into bullion as investors diversify and protect wealth. With volatility subdued, premiums firm, and Asian vaults filling, gold appears primed for a breakout but may need a catalyst—geopolitical news, rate decisions, or macro surprises.

For those looking to act on these trends:

If you’re in Singapore—or anywhere aiming to anchor their assets in gold with precision—InProved offers the tools and rates to execute thoughtfully. Our mobile app provides live LBMA bullion pricing, regional premium tracking, and global vault access, complemented by expert strategies informed by data like this—brought to you by leaders like Hugo Pascal.

Download the InProved app today to tap into institutional pricing, real-time vault insights, and call-option guidance before gold’s seasonal window opens.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

Latest articles

Tool and strategies modern teams need to help their companies grow.

Invite users to stay updated with exclusive insights and market trends by subscribing to the newsletter.

InProved Pte. Ltd. (“InProved”, UEN 201602269C). InProved is regulated by the Ministry of Law (“Minlaw”) and holds a Precious Stones and Precious Metals license for dealing in bullion products (PSPM License PS20190001819). For additional legal and privacy related information related to InProved, please visit are terms and conditions.

Our products and services are only available to Accredited Investors. Investing in bullion involves risk, and there is always the potential of losing money. Certain bullion products are not suitable for all investors. The rate of return on investments can vary widely over time, especially for long-term investments. Past performance is no guarantee of future results. Before investing, consider your investment objectives and any fees and expenses that may be charged by InProved and any third-party stakeholders. The content provided herein is for informational purposes only and is not investment or financial advice, tax or legal advice, an offer, solicitation of an offer, or advice to buy or sell or hold bullion products. This material has not been reviewed by the Minlaw.

Statements made are not facts, including statements regarding trends, market conditions and the experience or expertise of the author or quoted individual(s) are based on current expectations, estimates, opinions and/or beliefs. Opinions expressed by other members on InProved should not be viewed as investment recommendations from InProved. Endorsements were provided at the request of InProved. InProved is not affiliated with and does not purport to own or control any third-party content linked herein.

Copyright © 2025 InProved Pte Ltd (UEN 201616594C, PSPM license PS20190001819)