Gold Breaks Records in Shanghai as Physical Demand and Futures Markets Align Above LBMA Benchmarks

Gold is now decisively in price discovery mode, with both the Shanghai Gold Exchange (SGE) and Western futures markets reflecting historic highs in price, volume, and investor sentiment. The week’s developments mark another step in what is increasingly shaping up to be a structurally bullish cycle for precious metals. While much of the recent media attention has been on Western futures, the physical gold market in Shanghai has quietly set the pace—with staggering volumes and fresh all-time highs.

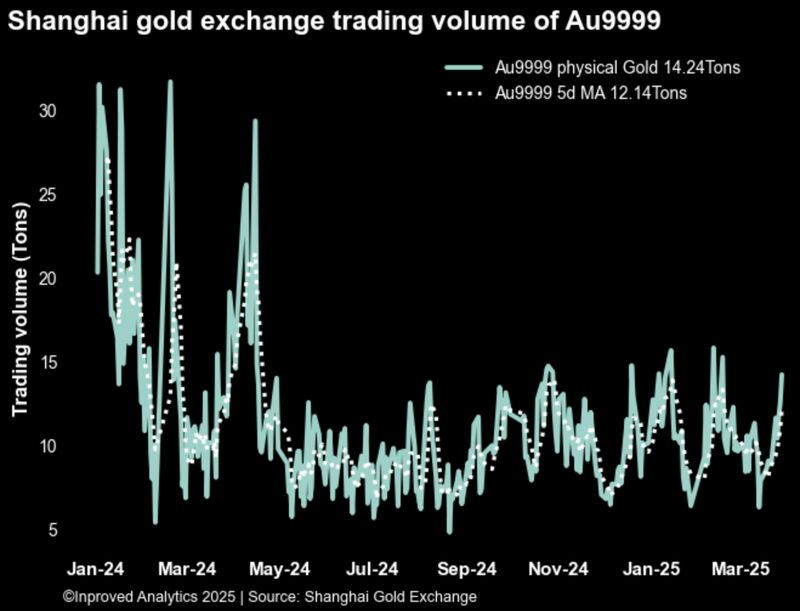

On Friday, AU9999, the physical proxy contract for gold on the Shanghai Gold Exchange (SGE), saw trading volume surge to 14.2 tons, contributing to a five-day trailing average of 12.14 tons, up 37.8% week-on-week. This sharp rise in physical volume is a clear sign of persistent demand in China, where gold remains deeply embedded in household wealth allocation and institutional reserve strategies.

Fueling the excitement, gold traded at a record ¥720/gram, equivalent to $3,082 per ounce—an all-time high in yuan terms. Importantly, this price is now 0.2% above the LBMA spot price, showing a sustained premium in China’s domestic market. While minor on the surface, this divergence reflects the underlying supply-demand tightness in China’s physical market, a dynamic that continues to persist despite global inflows into Western exchanges like COMEX.

Silver and platinum are riding similar tailwinds in Shanghai. Silver traded as high as $36.40/oz, a +5.6% premium over LBMA, while platinum traded at $1,010/oz, +3.3% higher than Western benchmarks. On a trailing basis, gold premiums flattened slightly to $3,029/oz, while silver remained elevated at $35.70/oz (+6%), reinforcing that investor preference in China is rotating not only toward gold but increasingly toward silver and platinum as well.

This consistent premium structure tells a clear story: real, deliverable metal is being bid in the East at levels above London benchmarks—a scenario that historically precedes broader market shifts.

In the U.S., COMEX gold futures (June 2025) are now sitting squarely within their 68.2% retracement band, between $3,026 and $3,082. This zone is widely viewed by technical traders as a high-probability region for either resistance or breakout. With spot gold trading just over $3,080, markets are watching closely for a decisive breach that could open the path to a sustained rally beyond the $3,100 threshold.

The 25-delta risk reversal skew has firmed to 0.4, indicating that call options are beginning to outpace puts in terms of demand—albeit modestly for now. The put wall at $2,700, however, remains the market’s anchor to the downside. It’s a deeply entrenched hedge level, with many institutional portfolios still carrying downside insurance from lower levels, built during the earlier stages of this rally.

The most notable takeaway here is that Western futures are beginning to confirm what physical markets in the East have been suggesting for weeks: gold demand is real, broad-based, and expanding across both speculative and physical channels.

The simultaneous rise in both volume and price on the Shanghai Gold Exchange—paired with the growing premium to LBMA—is not just a quirk of currency or short-term demand. It is emblematic of a larger structural narrative playing out: a revaluation of physical gold in Asia, where central banks and private buyers are increasingly asserting their influence on global pricing.

In contrast, the COMEX remains dominated by leveraged futures and options flows. But that gap may be narrowing. With options skew now tilting bullish and the market trading firmly within the upper retracement range, Western traders are slowly catching up to the signals that Shanghai’s physical markets have been sending: this is not a short-term spike, it’s a momentum shift.

Silver’s relative premium of +6% and platinum’s +3.3% above LBMA in Asia further illustrate the global reach of this rotation into metals. Investors aren’t just interested in “safe-haven” gold—they’re also pricing in tighter physical markets across the entire precious metals complex.

As Hugo Pascal highlights, this convergence of record-high physical gold prices in Shanghai, heavy trading volumes in AU9999, and steadily climbing futures in the U.S. is not accidental—it is a coordinated signal. The East is pulling physical prices higher, while the West is beginning to validate those signals in derivative markets.

With COMEX gold nearing $3,100, Shanghai setting new records, and silver leading on a relative basis, the next phase of this cycle may be one where price discovery moves increasingly from paper speculation to physical demand—and the rest of the world will have to follow.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

Latest articles

Tool and strategies modern teams need to help their companies grow.

Invite users to stay updated with exclusive insights and market trends by subscribing to the newsletter.

InProved Pte. Ltd. (“InProved”, UEN 201602269C). InProved is regulated by the Ministry of Law (“Minlaw”) and holds a Precious Stones and Precious Metals license for dealing in bullion products (PSPM License PS20190001819). For additional legal and privacy related information related to InProved, please visit are terms and conditions.

Our products and services are only available to Accredited Investors. Investing in bullion involves risk, and there is always the potential of losing money. Certain bullion products are not suitable for all investors. The rate of return on investments can vary widely over time, especially for long-term investments. Past performance is no guarantee of future results. Before investing, consider your investment objectives and any fees and expenses that may be charged by InProved and any third-party stakeholders. The content provided herein is for informational purposes only and is not investment or financial advice, tax or legal advice, an offer, solicitation of an offer, or advice to buy or sell or hold bullion products. This material has not been reviewed by the Minlaw.

Statements made are not facts, including statements regarding trends, market conditions and the experience or expertise of the author or quoted individual(s) are based on current expectations, estimates, opinions and/or beliefs. Opinions expressed by other members on InProved should not be viewed as investment recommendations from InProved. Endorsements were provided at the request of InProved. InProved is not affiliated with and does not purport to own or control any third-party content linked herein.

Copyright © 2025 InProved Pte Ltd (UEN 201616594C, PSPM license PS20190001819)