Gold Cools but Sentiment Holds: Shanghai Volumes Dip, COMEX Levels Test Support, and Options Traders Stay Bullish

As markets digest a sharp pullback in spot gold prices and a slowdown in Chinese physical demand, investors are beginning to wonder: is this the long-awaited cooling of the 2025 gold rally — or just another pause before the next leg higher?

On May 2nd, spot gold (XAUUSD) fell 1.75% to $3,232/oz, marking one of its steepest single-day declines in recent weeks. While some might interpret this as a sign of exhaustion in the rally, the underlying data from futures, physical premiums, and options markets tells a more nuanced story — one that echoes the brief pullback seen in spring 2024, but with some key differences that may suggest a firmer floor this time around.

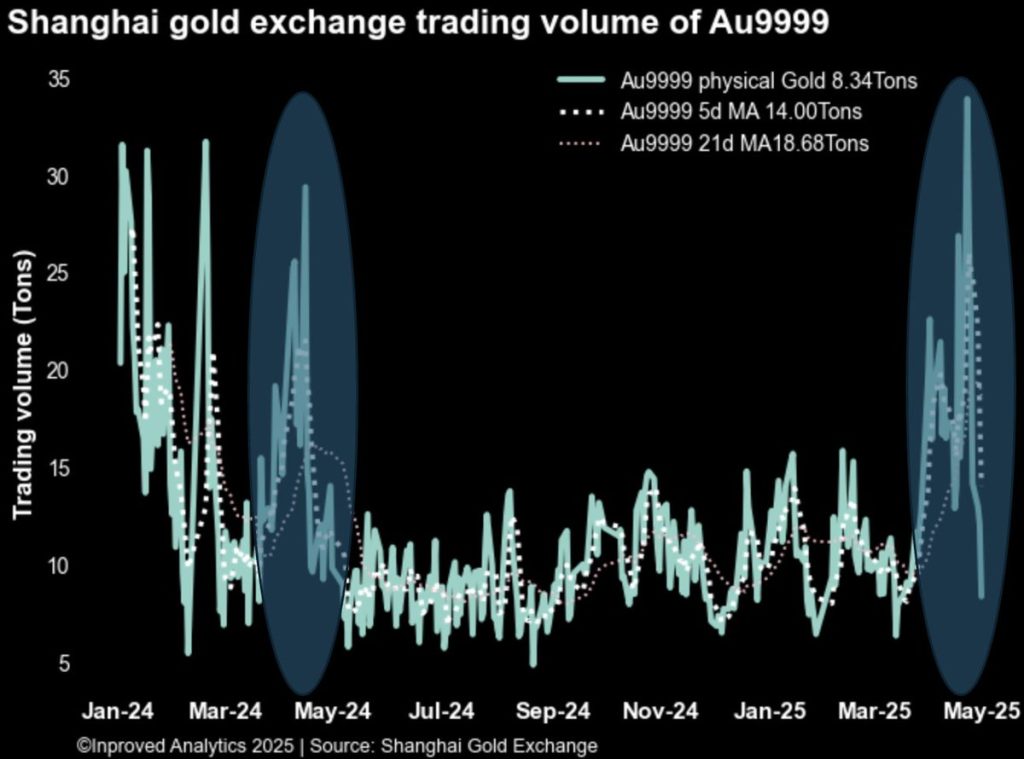

Perhaps the most immediate sign of a cooling market was the sharp drop in physical demand from China. The AU9999 contract — China’s main physical gold proxy on the Shanghai Gold Exchange (SGE) — registered its weakest trading session in six weeks, with only 8.35 tons traded, a staggering 40% below its 5-day moving average.

According to Hugo Pascal, Chief Investment Officer at InProved, this shouldn’t yet be seen as a reversal in demand but rather a momentary breath. “AU9999 has been trading at an extremely elevated pace for weeks,” Pascal notes. “When you’re running that hot, it’s natural for volume to thin once pricing starts to show softness. But the underlying structural bid in China remains strong.”

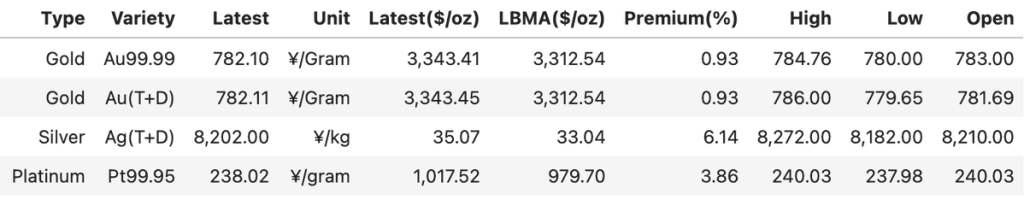

Importantly, despite lower volumes, physical premiums remained resilient. Gold in China was still trading at ¥782/gram ($3,343/oz), holding 0.93% above LBMA benchmarks, and climbing back to ¥789/gram ($3,368/oz) later in the session, 1.13% above London. This continued premium indicates that the soft spot price hasn’t dislodged the real physical demand — buyers are still willing to pay up for gold settled locally, especially amid persistent yuan depreciation and trade tensions.

Turning to the U.S. futures markets, COMEX gold (June 2025) has entered a key technical zone. On May 2nd, gold pulled back directly into its 68.2% retracement band, which ranges from $3,304 to $3,392. With spot prices dipping to $3,232, that zone was violated intraday, but importantly, futures did not break down through the lower band with conviction. That suggests support is still broadly intact — especially if buyers return quickly in the next session.

Pascal points out that these Fibonacci retracement zones, often drawn from the most recent swing lows to highs, help institutional traders identify high-probability bounce areas. “When prices pull into a 68.2% retracement and hold, it’s usually a healthy correction,” he explains. “If they break through with volume, then you’re in a deeper sell-off. Right now, this looks more like digestion.”

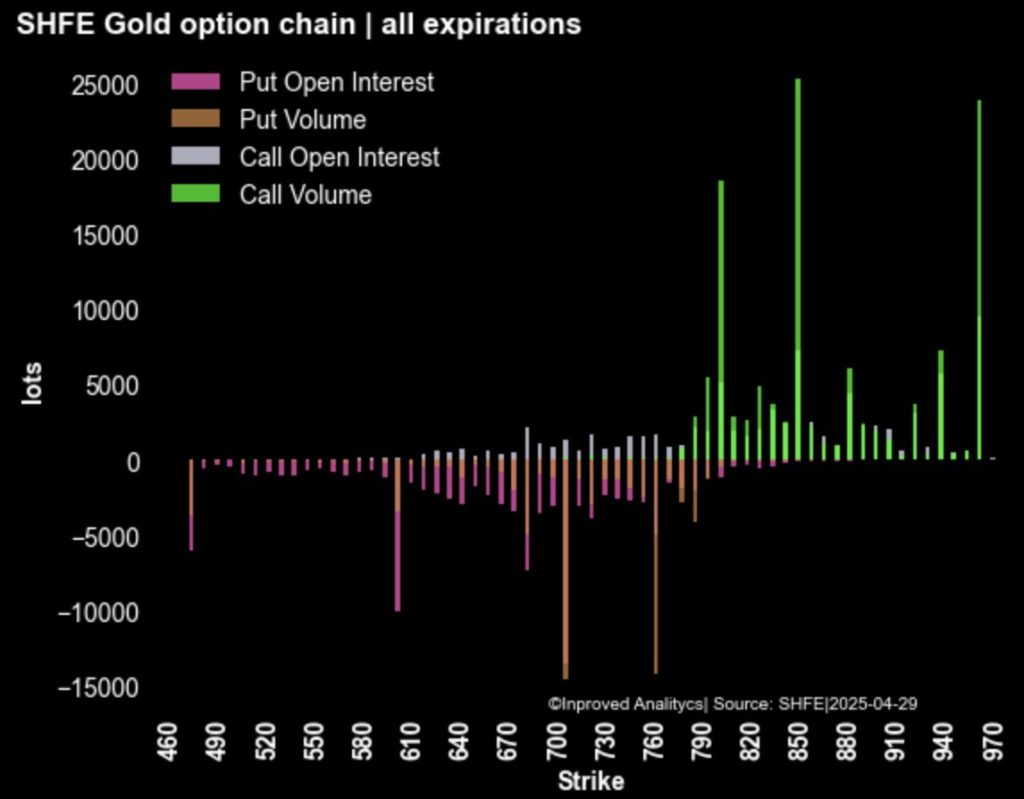

In options markets, the 25-delta risk reversal skew remains at +1.0, signaling that call options continue to be more expensive than puts. But what does that mean?

The risk reversal (or RR) skew measures the difference in implied volatility between bullish call options and bearish put options. A positive skew means that investors are paying more to bet on upside than downside — a clear signal of bullish sentiment. A skew of +1.0 is modest but meaningful, and its consistency over the past several sessions reflects continued conviction.

On the Shanghai Futures Exchange (SHFE), that conviction is even clearer. Today’s most actively traded gold call options were struck at ¥848 and ¥960/gram, equivalent to $3,630 and $4,110/oz in COMEX terms — both significantly above current spot.

Meanwhile, the put/call volume ratio sits at 0.58, meaning that for every 100 puts traded, 172 calls are being exchanged — again, a strong bullish indicator that the smart money continues to bet on higher prices.

Pascal adds, “This is classic sentiment divergence. Spot is weak, but options flows are aggressive. That usually means traders are viewing this dip as a buying opportunity, not a trend change.”

While gold took a breather, silver and platinum have continued to show strength, a sign that the broader precious metals complex is still underpinned by demand.

Silver is holding at $35.10/oz, a +6.15% premium over LBMA, signaling persistent tightness in the physical market.

Platinum trades at $1,017/oz, or +3.86% over London benchmarks, continuing its catch-up move as industrial hedgers return.

This resilience, especially in silver, offers a form of confirmation for gold bulls. Pascal notes that, “When silver holds firm and premiums stay elevated while gold dips, it suggests that the pullback is more about positioning than fundamentals.”

For bullion dealers, this is a time to act — not react. The pullback in gold should be used strategically to restock, especially while physical premiums remain stable and before the next options-led rally resumes.

Pascal suggests adjusting inventory thresholds upward to avoid being caught short in another breakout. “Retail buyers are watching dips now with more urgency. Dealers who can fill orders quickly will dominate this cycle,” he says.

Dynamic pricing models should also be tuned more frequently. With Shanghai premiums holding firm and COMEX retracement bands defining action, real-time adjustment is key to protecting margins and staying competitive.

For diversified investors, today’s dip is not a warning — it’s a window. The fact that gold has corrected into a major support zone without a fundamental trigger (e.g. disinflation, dovish Fed rhetoric) suggests this may be a technical reset, not a macro reversal.

Allocators should consider using this opportunity to layer into physical positions, particularly in allocated storage accounts, while watching the options skew as a sentiment gauge. A rise back to a 2.0+ RR skew would confirm renewed momentum.

Silver and platinum should also remain on the radar. Silver’s persistent premium above LBMA indicates a real supply-side squeeze, and platinum’s resilience shows that the broader precious metals bid hasn’t disappeared.

Today’s weaker trading volume in Shanghai and pullback in gold pricing may feel like déjà vu to those who remember Spring 2024’s consolidation, but there’s a critical difference now: the foundation beneath the market is stronger.

Options markets are pointing up, premiums remain elevated, and key technical levels — while tested — have not broken.

As Hugo Pascal concludes:

“This isn’t the end of the rally. This is the market catching its breath before the next sprint.”

The message for those watching? Stay calm, stay positioned — and when the spot price breathes, watch what the options market is shouting. Right now, it’s still whispering one word: higher.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

Latest articles

Tool and strategies modern teams need to help their companies grow.

Invite users to stay updated with exclusive insights and market trends by subscribing to the newsletter.

InProved Pte. Ltd. (“InProved”, UEN 201602269C). InProved is regulated by the Ministry of Law (“Minlaw”) and holds a Precious Stones and Precious Metals license for dealing in bullion products (PSPM License PS20190001819). For additional legal and privacy related information related to InProved, please visit are terms and conditions.

Our products and services are only available to Accredited Investors. Investing in bullion involves risk, and there is always the potential of losing money. Certain bullion products are not suitable for all investors. The rate of return on investments can vary widely over time, especially for long-term investments. Past performance is no guarantee of future results. Before investing, consider your investment objectives and any fees and expenses that may be charged by InProved and any third-party stakeholders. The content provided herein is for informational purposes only and is not investment or financial advice, tax or legal advice, an offer, solicitation of an offer, or advice to buy or sell or hold bullion products. This material has not been reviewed by the Minlaw.

Statements made are not facts, including statements regarding trends, market conditions and the experience or expertise of the author or quoted individual(s) are based on current expectations, estimates, opinions and/or beliefs. Opinions expressed by other members on InProved should not be viewed as investment recommendations from InProved. Endorsements were provided at the request of InProved. InProved is not affiliated with and does not purport to own or control any third-party content linked herein.

Copyright © 2025 InProved Pte Ltd (UEN 201616594C, PSPM license PS20190001819)