After months of steady ascent and speculative exuberance, gold is taking a breather — and the shift has not gone unnoticed.

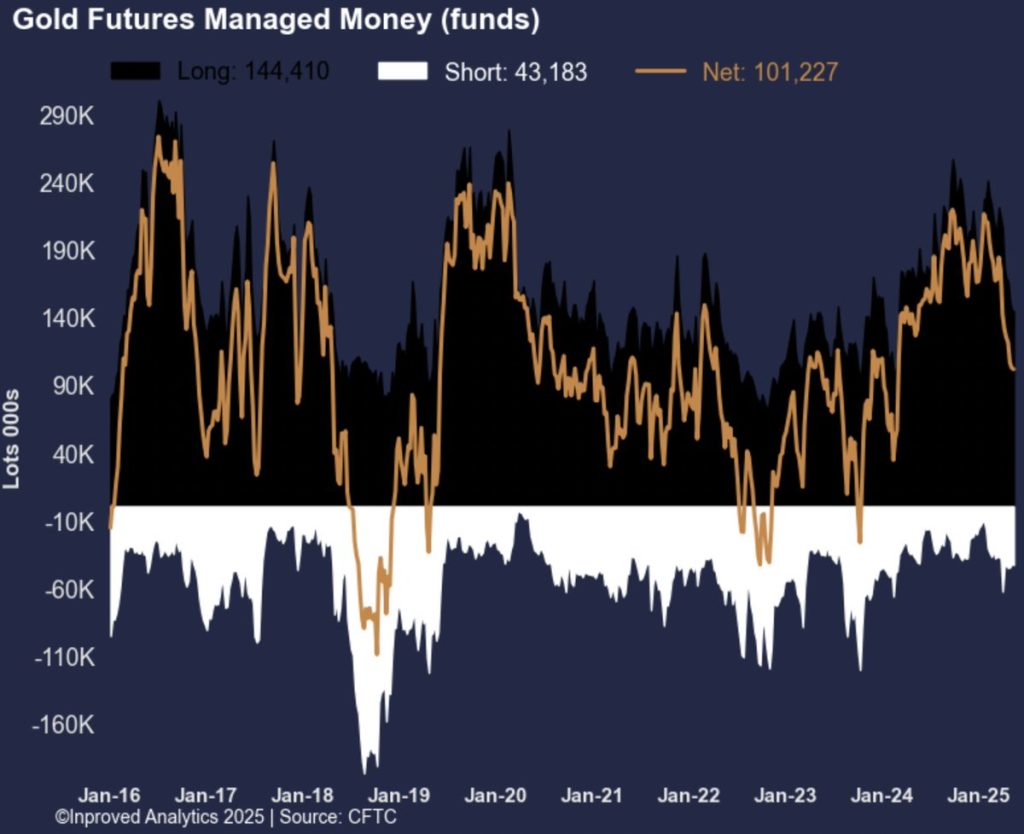

As of mid-May, speculative net long positions in gold have been reduced for eight consecutive weeks, falling to just 101,227 contracts, the lowest level in 15 months. Year-to-date, those net long positions have declined by 43%, equivalent to 7.6 million ounces. Yet despite the clear pullback in positioning, gold is still up 21% year-to-date — a divergence that points to deeper complexity under the surface of the metal’s price action.

According to Hugo Pascal, CIO of InProved, “This isn’t a collapse in conviction — it’s a repricing of risk. Speculators are stepping back, not because gold has failed them, but because volatility is receding, and the market is recalibrating ahead of key economic triggers.”

The recent softening in gold began in earnest in the second week of May, coinciding with mounting anticipation around the latest U.S. CPI report. Inflation surprises have consistently been one of the dominant catalysts for gold in 2024 and 2025 — and markets are clearly bracing for a new data pivot.

On May 13, COMEX gold futures (June 2025) traded within a key Fibonacci zone, with dual retracement ranges posted at:

These bands represented technical support and resistance thresholds, where large speculative orders tend to cluster. As prices slipped toward the lower edge of these ranges, eyes turned to $3,212 — a level Hugo Pascal warned could trigger further selling if breached.

By May 14, that risk was realized. Spot gold fell to ¥738/gram, or $3,182/oz, still holding +0.9% over LBMA, but below critical support — creating a technical breakdown signal for short-term traders. With implied volatility falling, options protection also became cheaper, suggesting less fear of abrupt upside moves and more positioning for potential chop or downside.

One of the defining features of this pullback has been the calm in volatility despite large swings in price. Gold just logged its 15th trading session in 2025 with a daily swing exceeding $100 per ounce — a stunning stat, but one that is now being met with a volatility curve that’s cooling, not heating.

Pascal interprets this as a maturing bull market, rather than a dying one. “This kind of reversion in implied vol, despite wide ranges, tells me the market is becoming more professional. The fast money is rotating out, while longer-term flows — central bank buying, sovereign allocations, insurance mandates — are still quietly accumulating.”

Options sentiment has also flattened. The 25-delta risk reversal skew, which measures the relative cost of bullish calls versus bearish puts, moved into negative territory at -0.1 — suggesting more demand for downside protection in the very short term.

That shift aligns with the build-up of put wall defenses, now clearly defined at $3,200 and $3,000 for the June 2025 contract. These levels represent areas where significant open interest in puts would likely accelerate hedging flows if breached — adding weight to selling pressure.

There are three main drivers behind the recent gold retracement:

1. CPI Anxiety: As CPI data loomed, traders dialed back long exposure to avoid being whipsawed by an inflation surprise — either dovish or hawkish.

2. Volatility Normalization: With volatility cooling across broader macro assets — including Treasuries, FX, and oil — precious metals naturally saw a fade in fast-money participation.

3. Profit-Taking After a Strong Run: With gold up 21% YTD and speculative positioning having been elevated since March, many funds have simply locked in profits ahead of Q2 rebalancing.

Pascal notes: “This isn’t capitulation. This is caution. And when you pair caution with structural strength, the result is usually a healthy consolidation, not a reversal.”

While short-term sentiment is bruised, the underlying fundamentals for gold remain robust:

Pascal emphasizes that the current floor is psychological and structural — hovering between $3,150 and $3,200. If macro data, especially CPI, doesn’t surprise to the downside, traders may see this zone as a re-entry point rather than a breakdown area.

The pullback in gold may appear steep on a chart, especially with speculators stepping aside and volatility cooling. But this is not a market in retreat — it’s a market catching its breath.

As Hugo Pascal puts it: “Markets don’t go up in a straight line — especially ones that have climbed 21% in four months. The important question is: who’s stepping back, and who’s still buying? And the answer, right now, is telling: the fast money is fading, but the deep pockets are still there.”

For long-term investors, this may be a moment of reflection — and opportunity. The bull market isn’t over. It’s just shedding some speculative weight before its next run.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

Latest articles

Tool and strategies modern teams need to help their companies grow.

Invite users to stay updated with exclusive insights and market trends by subscribing to the newsletter.

InProved Pte. Ltd. (“InProved”, UEN 201602269C). InProved is regulated by the Ministry of Law (“Minlaw”) and holds a Precious Stones and Precious Metals license for dealing in bullion products (PSPM License PS20190001819). For additional legal and privacy related information related to InProved, please visit are terms and conditions.

Our products and services are only available to Accredited Investors. Investing in bullion involves risk, and there is always the potential of losing money. Certain bullion products are not suitable for all investors. The rate of return on investments can vary widely over time, especially for long-term investments. Past performance is no guarantee of future results. Before investing, consider your investment objectives and any fees and expenses that may be charged by InProved and any third-party stakeholders. The content provided herein is for informational purposes only and is not investment or financial advice, tax or legal advice, an offer, solicitation of an offer, or advice to buy or sell or hold bullion products. This material has not been reviewed by the Minlaw.

Statements made are not facts, including statements regarding trends, market conditions and the experience or expertise of the author or quoted individual(s) are based on current expectations, estimates, opinions and/or beliefs. Opinions expressed by other members on InProved should not be viewed as investment recommendations from InProved. Endorsements were provided at the request of InProved. InProved is not affiliated with and does not purport to own or control any third-party content linked herein.

Copyright © 2025 InProved Pte Ltd (UEN 201616594C, PSPM license PS20190001819)