Gold Surges Past $3,000 as Swap Dealers Unwind Shorts and Market Momentum Builds

Gold has officially crossed into uncharted territory. For the first time in history, spot gold is trading above $3,000 per ounce, marking a milestone that reflects both strong market fundamentals and shifting investor sentiment. Hugo Pascal, Chief Investment Officer at InProved, has been tracking a crucial trend that may have played a key role in this rally: swap dealers have been aggressively cutting their short exposure over the past five weeks, a move that often signals major shifts in price direction.

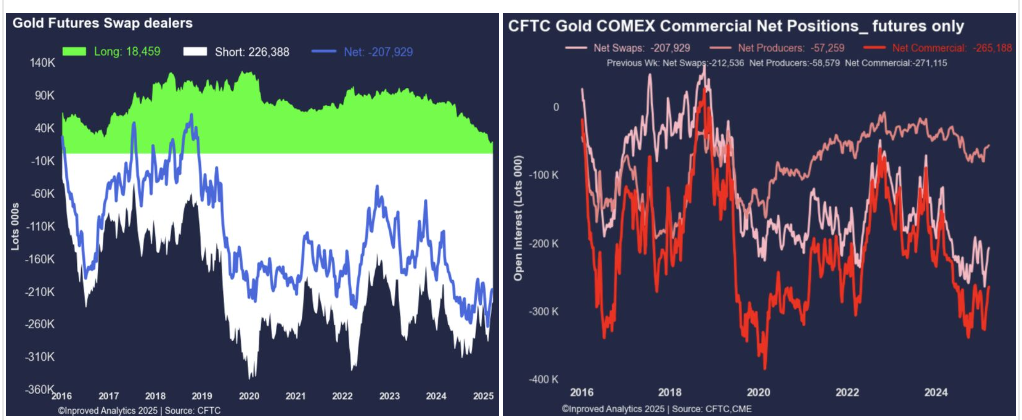

As of this week, swap dealers have trimmed their net-short positions by another 4,600 contracts, bringing their total short exposure down to -207,929 contracts, the lowest level in two months. Over the last five weeks, they have reduced their bearish bets by a massive 5.6 million ounces (-56,800 contracts), an amount equivalent to $16.4 billion at today’s prices. This unwinding of short positions has provided crucial fuel for gold’s momentum, removing a key source of selling pressure just as the market was testing key resistance levels.

Meanwhile, gold remains firm above $2,950, with technical levels suggesting that the next major upside targets are $2,975 and then the psychologically significant $3,000 level. The COMEX April 2025 contract is now trading within a critical technical zone, with the 68.2% retracement range between $2,920 and $2,974. The 25-delta risk reversal skew has shifted from negative (-0.3) to neutral (0.1), indicating that options traders are no longer pricing in downside risk as aggressively as they were just a day ago. Additionally, two key option walls—$2,800 on the downside (put wall) and $3,000 on the upside (call wall)—are creating a well-defined range that will likely determine gold’s next major move.

Swap dealers—large financial institutions that act as intermediaries in the gold futures market—typically maintain significant short positions as part of their hedging activities. When they start aggressively covering these shorts, it often means that they anticipate further price appreciation or that market conditions are making it more expensive to hold large short positions.

The fact that swap dealers have cut their short exposure by $16.4 billion worth of gold contracts in just five weeks suggests that they are either taking profits on previous bearish bets or repositioning for a sustained rally. This level of short covering is reminiscent of previous episodes where major institutional players underestimated gold’s upside potential and were forced to unwind positions as prices kept climbing.

A similar dynamic unfolded in 2020, when gold surged past $2,000 for the first time during the pandemic-driven market chaos. Back then, swap dealers were forced to aggressively unwind short positions, which only fueled further price gains as covering those shorts meant buying back gold contracts at increasingly higher prices. The same pattern appears to be playing out now, as dealers scramble to exit bearish positions in the face of relentless buying pressure.

Gold’s ability to hold above $2,950 suggests that the market remains well-supported, with immediate resistance at $2,975 and a major psychological barrier at $3,000. The 68.2% retracement zone between $2,920 and $2,974 has historically been an area where price action either consolidates or accelerates, making this a crucial moment for traders.

The shifting options landscape also reinforces the idea that gold’s bullish momentum is not slowing down. Just a day ago, the 25-delta risk reversal skew was negative, implying that traders were still hedging against downside risks. Now, with the skew at 0.1, the balance of risk is neutral, indicating that the market has absorbed recent volatility and is positioning for further upside.

The presence of a strong put wall at $2,800 provides an additional layer of support. This means that if gold does experience a pullback, it is likely to find strong buying interest at this level as market makers adjust their hedges and traders step in to defend their positions. On the upside, the call wall at $3,000 represents a significant concentration of options activity. If gold breaks through this level, it could trigger a wave of additional buying from traders who had been waiting on the sidelines for confirmation of the breakout.

Gold’s push above $3,000 is more than just a technical milestone—it’s a reflection of deep structural shifts in the market. Central banks continue to be net buyers of gold, inflation remains a persistent concern, and geopolitical uncertainty is keeping investors on edge. The rapid unwinding of swap dealer shorts suggests that large institutional players are no longer willing to fight the rally, a dynamic that could create even more upward pressure in the weeks ahead.

If history is any guide, once gold establishes itself above a major psychological level like $3,000, it often triggers a wave of fresh buying as traders and institutions adjust their strategies. The next few sessions will be critical in determining whether this move is a temporary breakout or the beginning of a much larger rally.

Hugo Pascal’s analysis highlights a moment of inflection in the gold market. With swap dealers reducing short exposure at a historic pace, technical indicators turning increasingly bullish, and gold now trading in price discovery mode above $3,000, the stage is set for one of the most exciting periods in gold’s history. Whether gold continues to surge higher or pauses for consolidation, the structural forces driving this rally appear far from over.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

Latest articles

Tool and strategies modern teams need to help their companies grow.

Invite users to stay updated with exclusive insights and market trends by subscribing to the newsletter.

InProved Pte. Ltd. (“InProved”, UEN 201602269C). InProved is regulated by the Ministry of Law (“Minlaw”) and holds a Precious Stones and Precious Metals license for dealing in bullion products (PSPM License PS20190001819). For additional legal and privacy related information related to InProved, please visit are terms and conditions.

Our products and services are only available to Accredited Investors. Investing in bullion involves risk, and there is always the potential of losing money. Certain bullion products are not suitable for all investors. The rate of return on investments can vary widely over time, especially for long-term investments. Past performance is no guarantee of future results. Before investing, consider your investment objectives and any fees and expenses that may be charged by InProved and any third-party stakeholders. The content provided herein is for informational purposes only and is not investment or financial advice, tax or legal advice, an offer, solicitation of an offer, or advice to buy or sell or hold bullion products. This material has not been reviewed by the Minlaw.

Statements made are not facts, including statements regarding trends, market conditions and the experience or expertise of the author or quoted individual(s) are based on current expectations, estimates, opinions and/or beliefs. Opinions expressed by other members on InProved should not be viewed as investment recommendations from InProved. Endorsements were provided at the request of InProved. InProved is not affiliated with and does not purport to own or control any third-party content linked herein.

Copyright © 2026 InProved Pte Ltd (UEN 201616594C, PSPM license PS20190001819)