Micro Gold and Silver Futures Hit All-Time Highs: What This Means for Precious Metals Trading

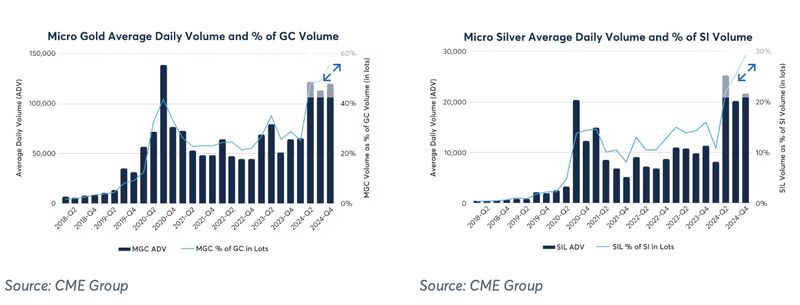

Micro Gold Futures (MGC) and Micro Silver Futures (SIL) reached record-breaking volumes in 2024, with 105,372 and 18,940 contracts traded, respectively. These figures represent year-over-year increases of 61% and 77% compared to 2023. Hugo Pascal, Chief Investment Officer at InProved, recently highlighted this significant milestone in a LinkedIn post, noting the growing popularity of these smaller-sized futures contracts among traders and investors.

In this article, we’ll explore what Micro Gold and Silver Futures are, their importance in the precious metals market, and the implications of these contracts achieving all-time high trading volumes.

Micro Gold (MGC) and Micro Silver (SIL) futures are smaller-sized futures contracts offered by the Chicago Mercantile Exchange (CME). These contracts are designed to make gold and silver futures trading more accessible to a wider range of market participants, including retail investors and smaller institutional players.

Key Features of Micro Futures

Micro futures have transformed the precious metals trading landscape by lowering the entry barrier for market participants. Here’s why they matter:

1. Accessibility:

Smaller contracts enable retail investors and small institutions to participate in futures markets, which were historically dominated by larger players. This democratization of access has increased market liquidity.

2. Hedging Opportunities:

Micro futures provide a cost-effective way for smaller-scale miners, jewelers, and investors to hedge their exposure to fluctuations in gold and silver prices.

3. Speculative Interest:

The affordability of micro contracts has attracted speculative traders seeking to profit from short-term price movements in gold and silver.

4. Portfolio Diversification:

With lower capital requirements, these contracts allow smaller investors to diversify their portfolios with precious metals futures.

The record-breaking trading volumes for MGC and SIL in 2024 highlight several important trends:

1. Increased Participation:

The 61% growth in Micro Gold Futures (MGC) and 77% growth in Micro Silver Futures (SIL) suggest a significant rise in retail and institutional participation. This reflects a growing interest in precious metals as a hedge against economic uncertainty, inflation, and market volatility.

2. Appeal of Precious Metals in a Volatile Market:

Gold and silver prices were strong in 2024 due to persistent inflation concerns, geopolitical instability, and fluctuating monetary policies. Micro futures provided an accessible way for more traders to capitalize on these trends.

3. Liquidity and Market Efficiency:

Higher trading volumes improve market liquidity, reducing spreads and making it easier for participants to enter and exit positions. This creates a more efficient market for price discovery in both gold and silver.

4. Shift Toward Smaller Contracts:

The success of MGC and SIL underscores a broader shift in market preference toward smaller-sized contracts, which provide greater flexibility and scalability for traders with diverse strategies and risk profiles.

The growing popularity of Micro Gold and Silver Futures has far-reaching implications:

1. Strengthened Market Ecosystem:

The increased volume of micro contracts enhances overall market activity, complementing larger futures contracts and ETFs.

2. Impact on Pricing Trends:

The expanded participation base could contribute to more balanced and transparent pricing for gold and silver, as a broader range of market views influences price discovery.

3. Resilience of Precious Metals:

The record-breaking growth of these contracts highlights the enduring appeal of gold and silver as both investment and hedging instruments, even as other asset classes vie for attention.

Hugo Pascal’s LinkedIn post rightly emphasizes the significance of the record highs achieved by Micro Gold and Silver Futures in 2024. These smaller contracts have democratized access to precious metals markets, attracting a diverse range of participants and driving unprecedented trading volumes.

As gold and silver continue to play a critical role in portfolios—whether for hedging, diversification, or speculation—the popularity of micro futures is likely to grow further. For traders and investors looking to navigate the evolving landscape of precious metals, the success of MGC and SIL serves as a testament to the increasing importance of accessible, flexible trading instruments.

To stay informed about market developments in gold, silver, and other commodities, follow Hugo Pascal on LinkedIn and explore InProved’s expert analysis for actionable insights.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

Latest articles

Tool and strategies modern teams need to help their companies grow.

Invite users to stay updated with exclusive insights and market trends by subscribing to the newsletter.

InProved Pte. Ltd. (“InProved”, UEN 201602269C). InProved is regulated by the Ministry of Law (“Minlaw”) and holds a Precious Stones and Precious Metals license for dealing in bullion products (PSPM License PS20190001819). For additional legal and privacy related information related to InProved, please visit are terms and conditions.

Our products and services are only available to Accredited Investors. Investing in bullion involves risk, and there is always the potential of losing money. Certain bullion products are not suitable for all investors. The rate of return on investments can vary widely over time, especially for long-term investments. Past performance is no guarantee of future results. Before investing, consider your investment objectives and any fees and expenses that may be charged by InProved and any third-party stakeholders. The content provided herein is for informational purposes only and is not investment or financial advice, tax or legal advice, an offer, solicitation of an offer, or advice to buy or sell or hold bullion products. This material has not been reviewed by the Minlaw.

Statements made are not facts, including statements regarding trends, market conditions and the experience or expertise of the author or quoted individual(s) are based on current expectations, estimates, opinions and/or beliefs. Opinions expressed by other members on InProved should not be viewed as investment recommendations from InProved. Endorsements were provided at the request of InProved. InProved is not affiliated with and does not purport to own or control any third-party content linked herein.

Copyright © 2025 InProved Pte Ltd (UEN 201616594C, PSPM license PS20190001819)