Silver’s Surge into COMEX Vaults: What It Means for the Market

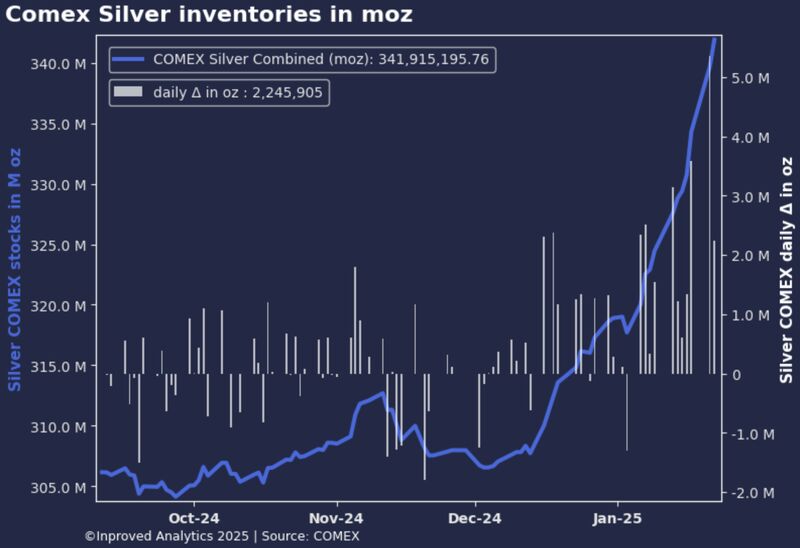

The COMEX vaults have witnessed an extraordinary influx of physical silver, with a daily inflow of 2.2 million ounces pushing total inventories to an impressive 342 million ounces. This isn’t just a routine movement of metal; it’s a development that speaks volumes about the current state of the silver market and its evolving dynamics.

To understand the significance of this event, it’s essential to consider the role of COMEX vaults in the broader silver ecosystem. These vaults serve as a critical link between the physical and futures markets. While futures contracts on the COMEX are primarily financial instruments, they carry the obligation of physical delivery upon expiration. The robust inflows into the vaults suggest that the market is preparing for increased delivery demands, underscoring a growing connection between the paper and physical silver markets.

The timing of these inflows is notable, raising questions about what might be driving such a significant movement of metal. On the one hand, silver’s dual role as an industrial and investment asset has taken center stage in recent months. Economic uncertainty, coupled with inflation concerns, has reignited silver’s appeal as a safe-haven asset. Investors seeking to hedge against currency devaluation and rising prices are showing a clear preference for assets like silver, and the surge in inventories may be an attempt to meet this rising demand.

At the same time, silver’s critical role in the green energy transition cannot be ignored. With governments worldwide ramping up investments in renewable energy, demand for silver in solar panel production and other industrial applications is steadily growing. This long-term trend adds another layer of complexity to the current market dynamics. The recent inflows into COMEX vaults could reflect strategic stockpiling by institutions positioning themselves to meet future industrial demand.

It’s also possible that the inflows are partially driven by improved supply conditions. Mining activity, which faced significant disruptions during the pandemic, has been recovering steadily. Producers may now be delivering their output to COMEX vaults to fulfill contractual obligations or to take advantage of current price levels. However, even with increased supply, the demand side of the equation remains robust, ensuring that silver’s market fundamentals stay strong.

The immediate impact of this influx on silver prices is complex. On the surface, an increase in inventories might suggest a temporary easing of supply constraints, which could stabilize prices in the short term. However, it’s important to recognize that much of the silver being vaulted may already be allocated for delivery or tied to existing contracts. This means that while inventories are growing, the market may not be experiencing a true surplus.

Looking further ahead, the implications for silver remain bullish. The ongoing energy transition, combined with silver’s enduring appeal as a hedge against economic uncertainty, suggests that demand will continue to rise. The recent inflows into COMEX vaults may be a proactive measure to ensure that the market can accommodate these future needs without disruptions.

This massive movement of silver into COMEX vaults is a reflection of a market that is constantly adapting to the demands of an uncertain world. It highlights the growing interconnectedness of physical and paper silver markets and underscores silver’s evolving role as both an industrial commodity and a financial asset. For traders, investors, and industrial players alike, these developments offer a glimpse into the shifting landscape of the silver market and the opportunities it holds for the future.

Latest articles

Tool and strategies modern teams need to help their companies grow.

Invite users to stay updated with exclusive insights and market trends by subscribing to the newsletter.

InProved Pte. Ltd. (“InProved”, UEN 201602269C). InProved is regulated by the Ministry of Law (“Minlaw”) and holds a Precious Stones and Precious Metals license for dealing in bullion products (PSPM License PS20190001819). For additional legal and privacy related information related to InProved, please visit are terms and conditions.

Our products and services are only available to Accredited Investors. Investing in bullion involves risk, and there is always the potential of losing money. Certain bullion products are not suitable for all investors. The rate of return on investments can vary widely over time, especially for long-term investments. Past performance is no guarantee of future results. Before investing, consider your investment objectives and any fees and expenses that may be charged by InProved and any third-party stakeholders. The content provided herein is for informational purposes only and is not investment or financial advice, tax or legal advice, an offer, solicitation of an offer, or advice to buy or sell or hold bullion products. This material has not been reviewed by the Minlaw.

Statements made are not facts, including statements regarding trends, market conditions and the experience or expertise of the author or quoted individual(s) are based on current expectations, estimates, opinions and/or beliefs. Opinions expressed by other members on InProved should not be viewed as investment recommendations from InProved. Endorsements were provided at the request of InProved. InProved is not affiliated with and does not purport to own or control any third-party content linked herein.

Copyright © 2025 InProved Pte Ltd (UEN 201616594C, PSPM license PS20190001819)