Silver Slips but Sentiment Holds: COMEX Inventories Swell, Shanghai Closes, and Skew Signals Persist

As the month turns and Shanghai observes a market holiday, the global silver trade enters a brief pause — but the undercurrents of volatility, structural tightness, and institutional hedging remain unmistakably in motion.

On May 2nd, with the Shanghai Gold Exchange (SGE) closed for the day, silver prices pulled back modestly in global markets. Spot XAGUSD dipped 1.6% to $32.10/oz, retreating from the top of its recent range, even as broader momentum indicators continue to suggest underlying strength. For many, this minor setback is less a reversal and more a moment of digestion following an aggressive, speculative April.

According to Hugo Pascal, Chief Investment Officer at InProved, “When Shanghai pauses, the rest of the world tends to recalibrate. But what’s notable is that despite the softer price action today, the structural dynamics in silver — vault flows, option skews, and tight premiums — remain firmly in bullish territory.”

Looking back at the COMEX Silver (Jul’25) daily technicals, traders were watching the following critical Fibonacci retracement bands and options positioning levels over recent sessions:

So where are we now?

On May 2nd, with spot silver at $32.10, prices are sitting just above the lower bound of the updated retracement band, showing that the technical support — while tested — has held for now. The market hasn’t pushed through the upper end ($33.01), but it also hasn’t violated key downside supports. In other words, silver remains in a consolidation phase, range-bound between $32.5 and $34, just as Pascal described last week — but it is still leaning bullish, especially when viewed through the options market.

One of the more important — and often misunderstood — indicators Pascal tracks is the 25-delta risk reversal skew.

In simple terms, this measures the difference in demand between out-of-the-money call options (bets that prices will rise) and out-of-the-money put options (bets on price drops). A positive skew means traders are paying more for calls than puts, signaling that they’re more concerned about missing the upside than protecting against downside.

A skew of +2.7 (April 29) is a very strong bullish indicator — nearly three times the normal “neutral” level.

A skew of +2.1 (April 30) still points to bullish sentiment, albeit with slightly reduced urgency.

“This kind of skew tells you that institutional buyers are looking past short-term dips,” says Pascal. “They’re not exiting positions — they’re just hedging with more precision. The call-side appetite remains elevated.”

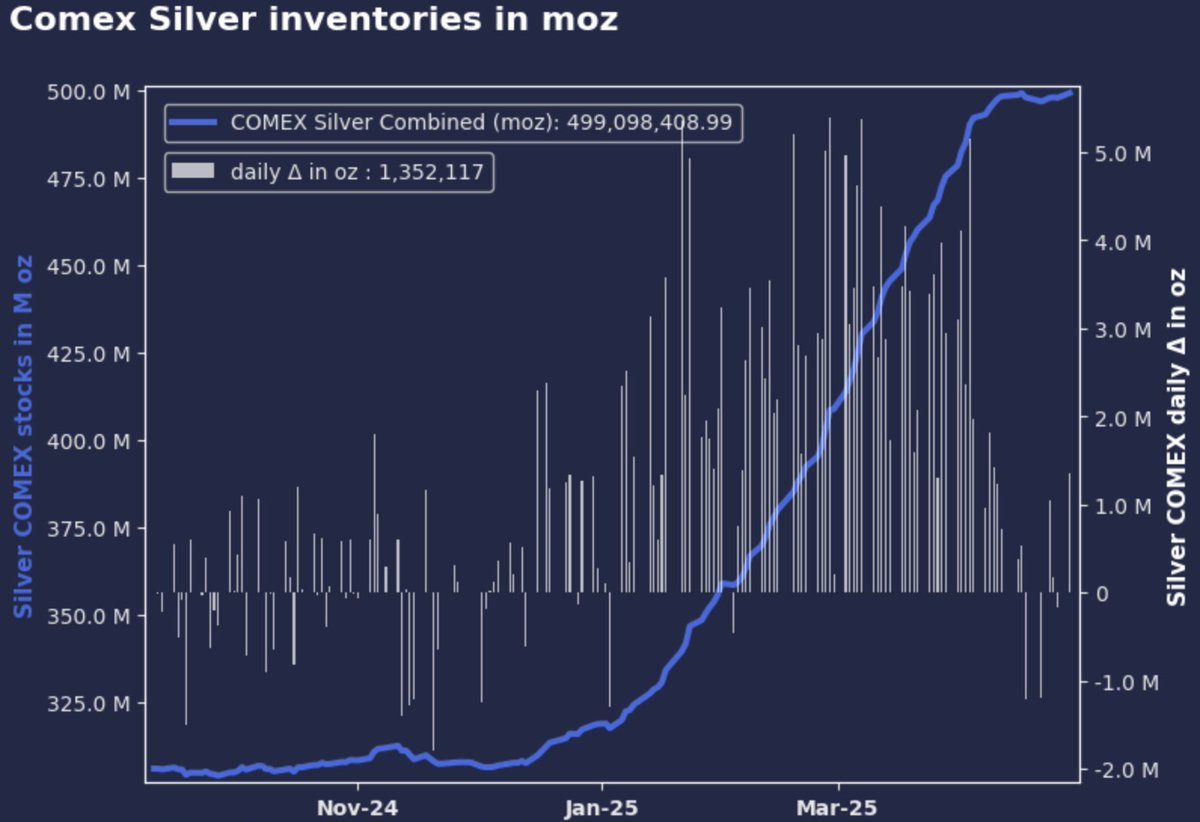

While futures markets flirt with consolidation, physical silver continues to flood into the COMEX vaults — a quiet but critical story in understanding broader positioning.

On Tuesday (April 30), inventories rose by 1.8 million ounces (56 metric tons), bringing total COMEX silver reserves to over 500 million ounces. Crossing this threshold is not just a psychological marker — it reflects deep institutional interest in securing deliverable metal, not just betting on price direction.

Pascal sees this as more than routine replenishment. “This is not just about delivery coverage,” he notes. “It’s a preparation for potential future volatility — whether that’s geopolitical, currency-driven, or tied to industrial demand.”

The movement of silver “back to the COMEX” also suggests a subtle East-to-West rotation of physical metal, potentially as investors in Asia secure profits or reallocate risk ahead of another buying wave post-holiday.

Even with the brief pullback in spot prices, physical premiums remain robust. Silver is still trading at $35.10/oz in Asian benchmarks, roughly 5.95% above LBMA pricing — a clear signal that the demand for real, deliverable silver is strong, and hasn’t yet been eased by the recent inflows in the West.

As Pascal explains, “When silver trades with a 5–6% premium above global benchmarks for weeks at a time, you’re no longer in a soft market. You’re in a tight, nervous, and forward-looking market.”

For bullion dealers, this period demands agility. As price action consolidates while vault inventories rise and premiums remain high, it’s a precarious balance. Dealers should watch for:

Whiplash volatility following the return of Shanghai next week. Asia may quickly try to buy dips and push prices higher again.

Inventory bottlenecks, especially if retail demand remains firm in the West while delivery timelines stretch from Asian suppliers.

Hedging costs, as elevated skew makes downside protection relatively cheap while upside hedging grows more expensive — a cue for savvy inventory managers to protect margins.

Pascal advises dealers to prepare now: “This is the time to quietly restock and re-hedge. If you wait until the next breakout above $34, the premiums will make it punitive.”

For diversified investors, silver remains one of the most misunderstood — and mispriced — assets in the current macro regime. The metal continues to trade with:

Investors who haven’t yet increased their physical allocation — or who rely too heavily on synthetic exposure — should consider increasing tangible holdings now, while spot is stable and premiums haven’t exploded higher again.

“Silver is quietly building its floor,” Pascal says. “And when the ceiling breaks, it won’t be gradual. It will be a scramble.”

Though May 2nd’s Shanghai holiday offered a brief lull, the underlying tension in the silver market remains tightly coiled. The COMEX range has held firm, skew is still favoring upside, and vault flows and premiums both point to a market that’s not done moving.

As Pascal summarizes, “The signal from silver hasn’t changed — only the tempo. The question isn’t whether silver will move. It’s when.”

With fundamentals building quietly behind the scenes, the market’s next phase could be more forceful than the last — and those paying attention to skews, vaults, and premiums will be the ones best prepared to profit from it.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

Latest articles

Tool and strategies modern teams need to help their companies grow.

Invite users to stay updated with exclusive insights and market trends by subscribing to the newsletter.

InProved Pte. Ltd. (“InProved”, UEN 201602269C). InProved is regulated by the Ministry of Law (“Minlaw”) and holds a Precious Stones and Precious Metals license for dealing in bullion products (PSPM License PS20190001819). For additional legal and privacy related information related to InProved, please visit are terms and conditions.

Our products and services are only available to Accredited Investors. Investing in bullion involves risk, and there is always the potential of losing money. Certain bullion products are not suitable for all investors. The rate of return on investments can vary widely over time, especially for long-term investments. Past performance is no guarantee of future results. Before investing, consider your investment objectives and any fees and expenses that may be charged by InProved and any third-party stakeholders. The content provided herein is for informational purposes only and is not investment or financial advice, tax or legal advice, an offer, solicitation of an offer, or advice to buy or sell or hold bullion products. This material has not been reviewed by the Minlaw.

Statements made are not facts, including statements regarding trends, market conditions and the experience or expertise of the author or quoted individual(s) are based on current expectations, estimates, opinions and/or beliefs. Opinions expressed by other members on InProved should not be viewed as investment recommendations from InProved. Endorsements were provided at the request of InProved. InProved is not affiliated with and does not purport to own or control any third-party content linked herein.

Copyright © 2025 InProved Pte Ltd (UEN 201616594C, PSPM license PS20190001819)