This Week in Gold: Rising Open Interest, Price Highs, and Speculative Calls

This week, gold captivated the markets with a mix of technical momentum, surging speculative interest, and political intrigue. In his latest analysis, Hugo Pascal, Chief Investment Officer at InProved, highlighted several noteworthy trends that shaped the week for the precious metal. From a surge in open interest on the COMEX to positioning around speculative call options ahead of a major political event, gold’s story this week is as dynamic as the market itself.

Open interest on the COMEX soared to a 9-week high, reaching 552,723 contracts, equivalent to 55.2 million ounces of gold. This represents a remarkable 10.7% increase week-to-date, reflecting growing participation in the gold futures market.

Why does this matter? Rising open interest often signals heightened activity and interest in a market, with traders entering new positions rather than simply closing existing ones. Pascal points out that this uptick in open interest underscores increased speculative appetite, likely driven by a combination of macroeconomic factors and anticipation of future price moves.

Gold prices climbed to a 5-week high, with the February 2025 contract (Feb ’25) settling at $2,750.8/oz. Pascal notes that this rally is backed by a mix of safe-haven demand and technical momentum.

Persistent macroeconomic uncertainty—ranging from inflation concerns to a weaker dollar—has provided a favorable backdrop for gold. The metal’s recent performance signals resilience, with traders seemingly positioning for further upside as it approaches key resistance levels.

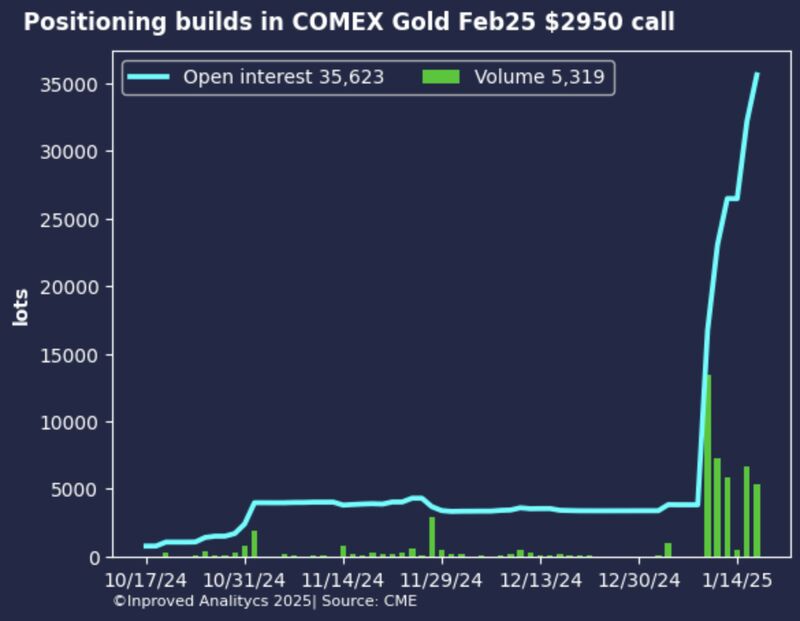

Adding an intriguing twist to this week’s narrative, Pascal highlights speculative activity in gold call options. Traders are positioning around strike prices of $2,925 and $2,950, with these options set to expire in just 11 days—coinciding with the inauguration of Donald Trump as the 47th president of the United States.

Pascal aptly refers to these trades as “lottery tickets.” With profit probabilities below 1%, these options represent high-risk bets that rely on significant price movement in an extremely short timeframe. Such speculative positioning suggests that traders are factoring in the potential for heightened market volatility around this high-profile political event.

This week’s gold activity tells a compelling story of a market preparing for potential shifts:

1. Growing Participation: The surge in open interest indicates a broadening base of market participants, both speculative and hedging-oriented, seeking exposure to gold amid global uncertainty.

2. Bullish Momentum: Gold’s climb to a 5-week high reflects ongoing support from safe-haven demand and favorable technical conditions.

3. Speculative Bets: The call option activity around $2,925 and $2,950 strikes highlights the speculative nature of short-term trading, especially as traders look to capitalize on potential price swings tied to geopolitical and economic events.

As the market eyes the inauguration of President-elect Donald Trump, Pascal’s analysis suggests that volatility could remain elevated in the short term. The positioning in out-of-the-money call options, while highly speculative, underscores the market’s readiness for surprises. Meanwhile, the rise in open interest signals a renewed focus on gold as both a safe haven and a speculative opportunity.

For traders and investors, gold’s activity this week offers key takeaways about market sentiment, positioning, and the interplay of macroeconomic and political forces. As Pascal’s analytics consistently show, the precious metals market remains a fascinating barometer of global uncertainty and investor behavior.

Stay tuned for further insights from Hugo Pascal and the InProved team as we continue to track the dynamic world of gold and precious metals trading.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

Latest articles

Tool and strategies modern teams need to help their companies grow.

Invite users to stay updated with exclusive insights and market trends by subscribing to the newsletter.

InProved Pte. Ltd. (“InProved”, UEN 201602269C). InProved is regulated by the Ministry of Law (“Minlaw”) and holds a Precious Stones and Precious Metals license for dealing in bullion products (PSPM License PS20190001819). For additional legal and privacy related information related to InProved, please visit are terms and conditions.

Our products and services are only available to Accredited Investors. Investing in bullion involves risk, and there is always the potential of losing money. Certain bullion products are not suitable for all investors. The rate of return on investments can vary widely over time, especially for long-term investments. Past performance is no guarantee of future results. Before investing, consider your investment objectives and any fees and expenses that may be charged by InProved and any third-party stakeholders. The content provided herein is for informational purposes only and is not investment or financial advice, tax or legal advice, an offer, solicitation of an offer, or advice to buy or sell or hold bullion products. This material has not been reviewed by the Minlaw.

Statements made are not facts, including statements regarding trends, market conditions and the experience or expertise of the author or quoted individual(s) are based on current expectations, estimates, opinions and/or beliefs. Opinions expressed by other members on InProved should not be viewed as investment recommendations from InProved. Endorsements were provided at the request of InProved. InProved is not affiliated with and does not purport to own or control any third-party content linked herein.

Copyright © 2025 InProved Pte Ltd (UEN 201616594C, PSPM license PS20190001819)